Adelaide CBD is a magnet for corporate tenants

The Adelaide office market is witnessing a notable trend as tenants increasingly switch from fringe locations, such as Greenhill Road and Fullarton Road, in favour of the more vibrant CBD. JLL managing director and head of capital markets SA, Ben Parkinson explains the move.

Photo: Liam Jenkins/InDaily

In a post-COVID world where flexibility and enhanced amenities are paramount, tenants including RAA, AGL, Nova Systems, KBR, Fivecast and Perks Business services have inked deals opting for the convenience and amenity of the Central Business District (CBD).

This shift not only benefits the ever-flexible workforce, but also highlights the importance for CBD office building owners of attracting the right tenants and providing modern, fitted-out spaces for long-term capital value preservation and growth.

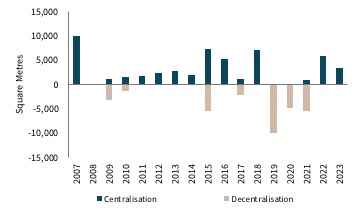

It is interesting to observe the reversal of tenant mobility into the CBD below.

The call for flexibility

In the wake of the pandemic, tenants now prioritise workplace flexibility more than ever. In some instances, traditional long-term leases are giving way to flexible arrangements that align with evolving business needs.

Unlike fringe locations, the CBD provides various short-term options that allow tenants to easily adapt their office space to accommodate fluctuations in demand and support growth plans. This flexibility fosters optimal resource utilisation while accommodating the changing nature of work.

Embracing amenities and retail convenience

Beyond flexibility, tenants also prioritise access to amenities and retail convenience that enhance the overall workplace experience. Fringe locations often struggle to provide an enticing array of amenities, primarily limited to basic food offerings. In contrast, the CBD offers a diverse range of amenities and retail experiences.

Tenants can conveniently access grocery shopping, a wide array of dining options and renowned restaurant precincts, such as Rundle Street, Gouger Street and Hutt Street. Crucially, the CBD houses essential services, including retail shopping, banking facilities, pharmacies and other convenience-based retail.

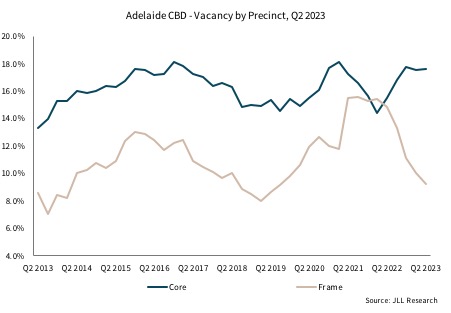

This is a key factor in the contrast between Core (16.2%) and Frame (11.1%) CBD vacancy rates as shown below.

Attracting the right tenants for building owners

The influx of tenants into the CBD highlights the need for office building owners to adapt and attract suitable tenants. To preserve and grow the capital values of their assets, building owners must offer modern, fitted-out spaces that meet evolving tenant expectations. The introduction of flex spaces, speculative suite fit outs, state-of-the-art technology and collaborative work environments can significantly enhance their appeal. Building owners can position themselves as leaders in the CBD market by recognising the value of amenities and retail convenience, and fostering a sense of community within their properties.

The net carbon zero targets of corporate tenants and their attraction cannot be underestimated by investors moving forward.

Preserving and growing capital values

By attracting the right tenants and providing modern, fitted-out spaces, office building owners in the CBD can safeguard and increase the capital values of their assets. The continuous demand for quality office space in the CBD ensures rental growth and fosters long-term stability.

Additionally, offering amenities and services that enhance the tenant experience, including on-site fitness centres, communal areas and secure parking facilities, establishes properties as valuable and sought-after assets, both in terms of financial returns and tenant retention.

What does the future hold for the fringe?

This is not solely a South Australian phenomenon as we are also seeing some similar trends in other non-CBD locations such as St Kilda Road in Melbourne. In St Kilda Road there have been several acquisitions by developers looking to reposition assets either for commercial or residential conversion.

Those choosing to reposition the office assets in these locations need to keep pace with the CBD and ensure that tenant amenity, end of trip facilities and wellness investments are state of the art together with investment in fitted out space ready for occupation.

And for the CBD?

The ongoing migration of tenants from fringe locations to the Adelaide CBD is a testament to the changing demands of the modern workforce and business landscape. The CBD’s offerings of flexibility, abundant amenities, retail convenience, networking opportunities and a thriving social scene cater to these evolving needs.

Office building owners in the CBD must recognise this trend and invest in modern, fitted-out spaces to attract and retain the right tenants, preserving and growing the capital values of their assets.

As the CBD continues to evolve as a dynamic hub of business activity, embracing this transformation is critical.

For over 200 years, JLL has helped clients buy, build, occupy, manage and invest in a variety of commercial, industrial, hotel, residential and retail properties. Driven by our purpose to shape the future of real estate for a better world, we help our clients, people and communities SEE A BRIGHTER WAY SM. Learn more at jll.com