Stored value: SA’s defensive real estate assets are in demand

Despite a lack of transactions, Adelaide’s retail, medical and industrial markets are holding up strongly relative to interstate and more good news awaits, says JLL managing director and head of capital markets SA, Ben Parkinson.

A comparison of the state’s commercial property sectors has shown how retail, medical and industrial have performed strongly in a post-pandemic and rising interest rate environment.

The industrial, medical and retail markets are seen as defensive asset classes for different but complementary reasons.

The industrial market has benefited enormously from changing consumption habits, such as the rapid adoption of online retail and the COVID-19 driven change of retail inventory management. These, in turn, are directly benefitting the logistics and transport sector as the market sectors moved from just-in-time to just-in-case.

While inventory holdings have moderated for most retailers and wholesalers, the longer-term investor attractiveness of the industrial sector persists. The delivery of goods to consumers within increasingly quicker timeframes continues to underpin occupier demand for modern warehouses. Industrial space in locations in proximity to high density residential areas or with strong road connectivity to residential populations will be of even more importance in the future as same-day product delivery evolves from an added extra to a consumer expectation. Industrial locations with these efficiency benefits will attract strong demand from developers and investors alike.

JLL managing director SA Ben Parkinson says new investors are attracted by the growth in local yields

At the same time, neighbourhood shopping centres were strong performers during COVID as non-discretionary spending thrived through the pandemic. This has continued in the face of rising interest rates that have clipped consumers’ discretionary spending, as rising mortgage costs limited household budgets to core spending.

To further reinforce the positives of the retail and industrial sectors, rising construction costs have meant many assets are now below replacement value, further underpinning returns and a reluctance to dispose of assets.

Further adding to the growth in the industrial sector is the lack of available zoned, ‘development ready’ industrial and employment land. This has had a significant positive impact on land rates that have increased in some sectors by as much as 30% over the last 12 months. With increased land cost and construction cost also comes the increase in economic rent for new construction, benefitting the existing industrial stock and premiums being paid for assets with shorter lease expiry profiles.

In the industrial sector, despite rising interest rates that have put pressure on values in the office markets in particular, rising rents have offset a slight drop in yields as demand from tenants continues to underpin values through rising rents.

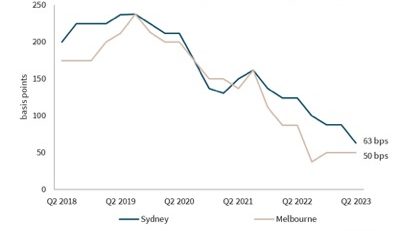

The demand for quality assets has had a positive effect on the Adelaide retail and industrial markets as new investors continue to invest here and the yield differential between South Australia and the eastern states continues to diminish.

Prime Industrial Midpoint Yield Basis Point Spread – Adelaide vs Sydney and Melbourne. Source: JLL Research

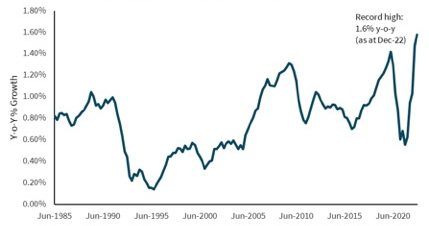

Right now, year-on-year population growth in South Australia is at an all-time high, reaching 1.6% year-on-year to December 2022. While overseas migration is predominantly driving this population growth rate, SA is also attracting more interstate migration.

Over the COVID-19 period to now (from June 2020), net interstate migration into SA has been positive for nine out of the 11 quarters. Our future population growth outlook looks positive too.

With emerging employment sectors like defence, aerospace, technology, health and creative industries requiring a significant volume of highly skilled labour, it’s expected that these will be key contributors to growth as well. Additionally, these sectors will also support the retention of our young university graduates who previously looked to the eastern seaboard for job opportunities.

South Australia: Rolling Annual Population Growth. Source: ABS, JLL Research

With population growth comes consumption. With consumption comes the requirement for more warehouse space to store and distribute these consumer goods, and more retail businesses to service these consumers.

These warehouses need to be developed. These new neighbourhood centres need to be built as the anchor for new communities. The commercial investment universe in Adelaide will expand on the back of this development growth, attracting even more capital to our city.

For over 200 years, JLL has helped clients buy, build, occupy, manage and invest in a variety of commercial, industrial, hotel, residential and retail properties. Driven by our purpose to shape the future of real estate for a better world, we help our clients, people and communities SEE A BRIGHTER WAY SM. Learn more at jll.com