Adaptive reuse or adaptive repurpose: What future for Adelaide’s ageing CBD office stock?

Often talked about, but rarely executed, is adaptive reuse really the best solution for the city’s old office buildings? Or should we pursue adaptive repurpose? JLL managing director and head of capital markets SA, Ben Parkinson, brings some data to the discussion.

The recent narrative around adaptive reuse, rather than repurposing, claims to be the clear solution for Adelaide’s ageing office stock, particularly during an ongoing housing crisis.

The challenge lies in transforming these commercial spaces into vibrant living quarters, such as short-stay accommodation, permanent residences, build-to-rent (BTR) or student accommodation.

Revising these buildings requires understanding and meeting the distinct needs of living accommodations, which differ significantly from commercial offices both in terms of tenants and legal requirements.

JLL managing director SA Ben Parkinson believes repurposing can offer better outcomes

Still, adaptive reuse appears to mitigate many commercial challenges.

As newer commercial towers attract the higher profile tenants in the market, owners of older properties face the risk of obsolescence, rendering their assets less relevant and attractive.

This situation results in smaller private tenants, lower rental incomes, high capital expenses, and ultimately, diminishing property values.

So, what benefits could repurposing offer instead?

The journey down the ‘net carbon zero’ pathway seems like an obvious step to future-proof assets.

Not only can updated buildings secure improved incomes, but they can also insulate themselves against the pending Scope 1 and Scope 2 corporate requirements to achieve Net Zero goals largely due by 2030.

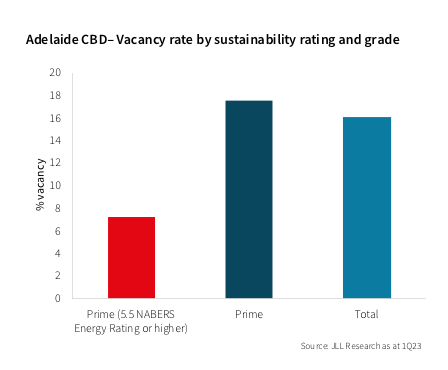

The preference for quality workplaces has led to tighter vacancy rates in buildings with a 5.5-star NABERS rating or higher (7.9%), compared to the broader Adelaide CBD with a vacancy rate of 16.0%.

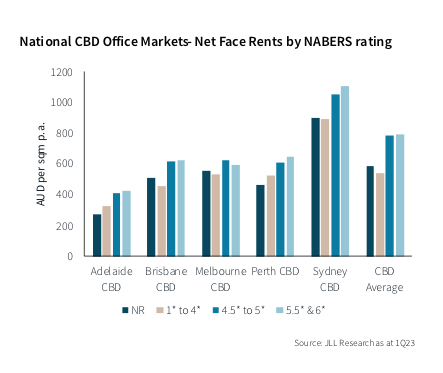

This trend is consistent nationwide, revealing a significant rental gap of over 20% when comparing higher NABERS-rated properties to the general market.

Despite being home to Australia’s second-oldest office stock – around 57 per cent of buildings in Adelaide are at least 40 years old – many of these older-generation buildings can still compete in the CBD office market.

However, to remain competitive, these older buildings will increasingly need to offer attractive rates, quality fit-outs and modern upgrades.

Several Adelaide office buildings have already successfully refocused their efforts on the smaller occupier market by investing in speculative fit-out office suites and adopting ESG principles, including reduced energy consumption.

Pelligra’s 89 Pirie Street and Maras Group’s 74 Pirie Street are good examples of adaptive reuse, with both enjoying low vacancy numbers.

Other assets, such as 45 Pirie Street and the Quintessential Equity-owned 100 King William and 30 Pirie Street, are in the queue for similar upgrades.

Opportunities abound for buildings in the Grenfell and Waymouth precincts to revitalise their office spaces and capitalise on shared amenities, like easy access to public transport, entertainment and shopping.

A building’s ‘precinct’ plays a crucial role in its future success, as it helps attract and retain an in-office workforce in a flexible working environment.

Key elements of adaptive reuse include better connectivity and use of cafés in the ground floor plane, improved staff amenities like end-of-trip and wellness facilities, and flexible office spaces that accommodate companies’ changing needs via co-working facilities.

Buildings that embrace these elements stand to benefit from increased rentals, with leasing incentives integrated into the fit-out costs.

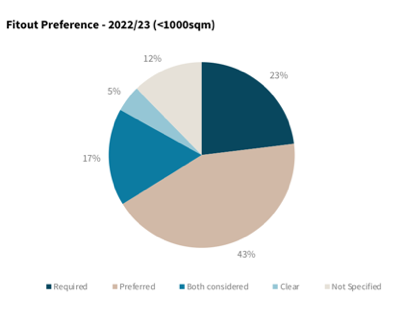

The robustness of construction in many older Adelaide CBD buildings makes them ideal for installing turn-key spec suites, which smaller tenants clearly prefer.

In fact, over 83% of all occupier inquiries for space below 1,000 sqm in 2022/23 preferred an existing fit-out.

JLL Research has found that quality refurbishments and spec suites can boost rental income by as much as 19% in the CBD, as shown in the following building examples.

| Address | Size | Rent uplift % |

| Grenfell Street | 200-350sqm | 15-19% |

| Gawler Place | 170-500sqm | 12-16% |

| Grenfell Street | 220- 270sqm | 13-17% |

While some continue to tout adaptive reuse as a solution to the Adelaide CBD landscape, currently, it is unlikely be an affordable housing ‘silver bullet’ and increase the number of dwellings in the CBD.

Without significant intervention or tax incentives from the Government to encourage proactive developers, it is improbable that the CBD will undergo widespread redevelopment through build-to-rent or traditional apartment projects aiming to resolve the housing crisis.

For over 200 years, JLL has helped clients buy, build, occupy, manage and invest in a variety of commercial, industrial, hotel, residential and retail properties. Driven by our purpose to shape the future of real estate for a better world, we help our clients, people and communities SEE A BRIGHTER WAY SM. Learn more at jll.com