The CFO’s changing landscape

If you’re a successful Chief Financial Officer today, you already know what it takes to do the job. But new research from BDO and the Association of Chartered Certified Accountants suggests that the role is changing and the insights they have gathered are relevant to any executive role.

The functions carried out by the Chief Financial Officers (CFO) of tomorrow may be quite different as, increasingly, the role is morphing into that of the Chief Value Officer, or CVO.

To explore this change, BDO and ACCA have drawn on the perspectives of nearly 100 finance leaders from across the globe, representing a wide variety of organisations from large global corporates to start-up businesses. The finance leaders included not-for-profit and public sector organisations as well as publicly listed and private equity backed entities.

The subsequent research findings, detailed in the report entitled “Chief Value Officer — The Important Evolution of the CFO” have clear implications for the CFO’s role, and anyone else occupying the C suite.

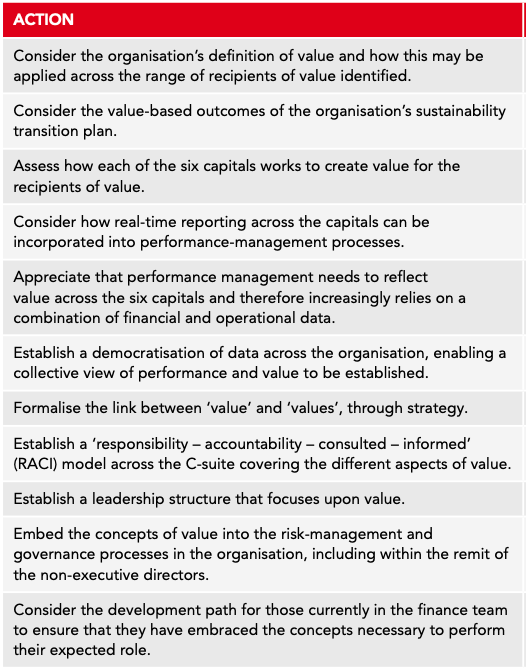

Some actions that leaders of organisations may take to embed value-based concepts in their management and to develop their finance teams appropriately.

The need for a CFO’s level-headed analysis and reporting skills remains key in an increasingly uncertain world. In recent years, corporate boards have had to deal with threats as diverse as a global pandemic, a supply chain collapse and geopolitical uncertainty in Europe and Asia, making data-driven insights vital for company success.

The research shows that CFOs are increasingly being tasked with responsibilities that go beyond financial reporting and shows how companies are now looking to CFOs for strategy and reporting across a range of non-financial business drivers, including environmental, social and corporate governance (ESG) performance.

“Value in the past was very straightforward,” said one UK-based CFO interviewed for the research. “It was ‘show me the money’, and it was real money… that you could count with your hands.”

But today, they said, “We also have other values…. What is the value of ESG?”

This trend is thrusting CFOs into the corporate limelight and changing perceptions of the role, says the research.

Historically, “The more enlightened individual, perhaps one who has interacted with the CFO in an organisation, may well see them as the keeper of the purse strings and often … the person who says that the organisation cannot afford to undertake the suggestion made,” says the report.

Now, though, “the role of finance is definitely transforming towards more business support [and] business value add – rather than just finance retrospective reporting,” a Middle East CFO said.

Shifting landscape

BDO and the ACCA have been monitoring this gradual shift from CFO to CVO, noting the broader range of business needs that finance leaders are having to respond to.

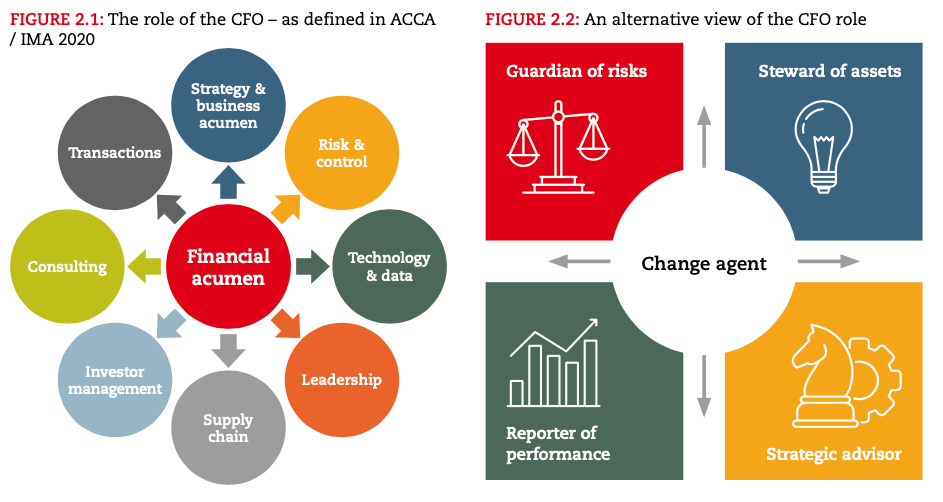

As well as financial acumen, which remains core to the CFO/CVO function, finance heads are increasingly required to have broader skills including leadership, consulting, transactions, supply chain, business strategy, investor management, risk and control, technology, and data.

“The rise of the CVO exemplifies how modern business success is about so much more than financial performance,” says Carly Bleathman, who leads the Finance Function Advisory for Business Services and Outsourcing at BDO in the United Kingdom.

“Today’s stakeholders recognize that a whole range of factors, from supply chain resilience to environmental performance, can undermine the value of a business. The CVO is expected to provide insight into the risks and opportunities inherent in all these areas.”

More and more, says the CVO report, “the CFO role is a voice for the organisation, building upon the inherent trust in, and ethical perspective of, the role.”

Agents of change

A complementary view is that future CFOs will be change agents, drawing on data-driven insights to help organisations achieve their strategic aims.

The report says: “The CFO is the reporter of performance in its broadest sense of both financial and operational performance and, in this role, provides information to others … enabling them to form considered opinions on the relative strengths and opportunities for the organisation.”

Clearly, this is a very different brief to that handed to the CFOs of yesteryear – and requires a different set of skills.

Nick Fox, Business Services Partner at BDO in Australia, facilitated the Australian round-table in Sydney and said a very clear theme was the additional value coming from the CFO role, beyond managing the financials of a company.

“Successful and sustainable businesses increasingly need to combine economic, environmental and social equity, and the best CFOs of today have expertise in all three areas. From our discussions there was agreement that a successful CFO today is more of a Chief Value Officer, adopting a growth mindset,” Fox said.

“It is an evolution from someone who traditionally would maintain the financials of the business, to someone who is driving a range of performance-based decisions, and leading a company’s environmental and social strategy and initiatives. This led to a discussion about the future – is there a need for a new role of Chief Value Officer or is this something that today’s top CFOs are already fulfilling?”

Fox said it was clear from the research that CFOs are increasingly adopting a value-centric approach in their work, and this represents an evolution towards encompassing the chief value officer role within a more traditionally financially focused remit.

“There are many leading CFOs already taking on this broader Chief Value Officer role, embracing and driving the sustainability agenda and developing their companies for a positive future,” Fox said.

“What this suggests for the development path for aspiring CFOs is that getting an increasingly broad range of experience, which embraces both formal and informal learning activities, specifically through working in different business units beyond finance, is important.

“There is opportunity here for professional bodies and practices to provide this type of learning and development, custom-made for this new breed of CFO.”

For those aspiring to become CFOs, “the challenges are greater than in the past,” the report says.

“The gap in the pathway between a more junior role and the CFO role may now be harder to bridge than it was,” it says, although “bridging that gap is worthwhile. The CFO role is one that offers tremendous satisfaction and reward.”

A key implication of the research is that CFOs and CVOs will need to increasingly rely on specialist skills that may only be available on an advisory or outsourced basis.

Assembling all the reporting and analysis skills that a CVO needs might be hard to do in-house, but fortunately, there are expert advisers that can deliver the services required. As CFOs move from finance to value, adviser relationships are vital.

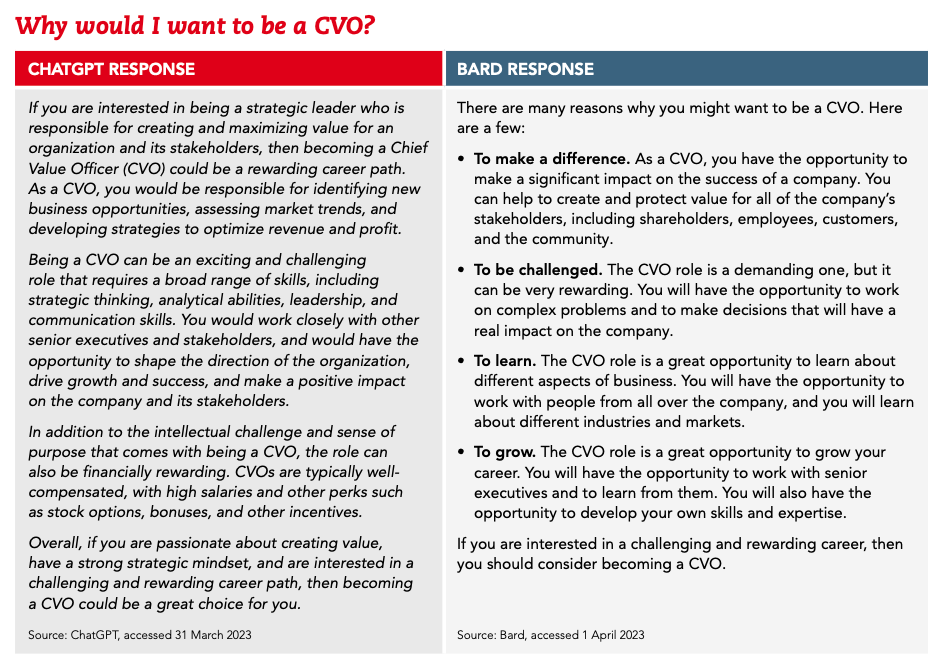

The role of a Chief Value Officer (CVO) is one that is increasingly used in the context of the broader reporting that organisations are now undertaking. Is the CVO role an extension of the CFO role or is it unique? What constitutes value anyway?