Working from home? What you need to know about ATO’s new rules on deductions

Taxpayers claiming work from home (WFH) expenses at tax time face big changes this year as Australia moves away from pandemic policies.

The way remote work tax deductions are claimed is changing this year, the ATO has revealed. Photo: Getty

A COVID-era “shortcut” that simplified tax returns by allowing workers to lump all remote work costs into one 80 cent an hour rate has been axed.

Instead, the Australian Taxation Office (ATO) last month unveiled a revised “fixed rate method” allowing WFH expenses (like bills and stationary) to be included in a 67 cent hourly rate – up from 52 cents.

Unlike the shortcut, however, depreciation of office equipment will now need to be calculated separately and workers will also be required to keep real-time records of their WFH hours in daily dairies or timesheets.

ATO assistant commissioner Tim Loh said people who don’t have real-time records yet for this year can get away with using a four-week summary of hours until February 28, under a transition arrangement.

But from March 1, the ATO will require more precise records, he said.

“You need to work out the number of hours you worked from home and multiply that by 67 cents,” Loh said about the revised method.

Another change is that a dedicated home office is no longer required to use the fixed-rate method. An existing “actual costs” method is also still available for workers who prefer to calculate their returns in more detail.

Work from home tax changes

Loh said the remote work tax changes shouldn’t be too onerous for most people, particularly those who were already keeping good records of hours they worked from home during COVID.

He said people who work remotely two-days per week on a full-time schedule could expect to get a deduction of around $500 if claiming running costs like phone, internet and energy bills under the changes.

The fixed-rate method can be used to lump together expenses such as:

- Energy, phone and internet bills.

- Office consumables such as stationery and printer ink.

But unlike the COVID-era shortcut, workers will now need to calculate depreciation on their home office equipment and claim it separately.

These claims can include the following types of home office costs:

- Decline in the value of assets used while working from home, such as computers and office furniture.

- Costs for repairing and maintaining these home office assets.

- Costs associated with cleaning a “dedicated home office”.

“The best thing I would suggest is to check out the ATO website. We have calculators that can help you work out the depreciation of those assets,” Loh said.

Those who used the shortcut during COVID can only claim depreciation on home office equipment for the 2022-23 year.

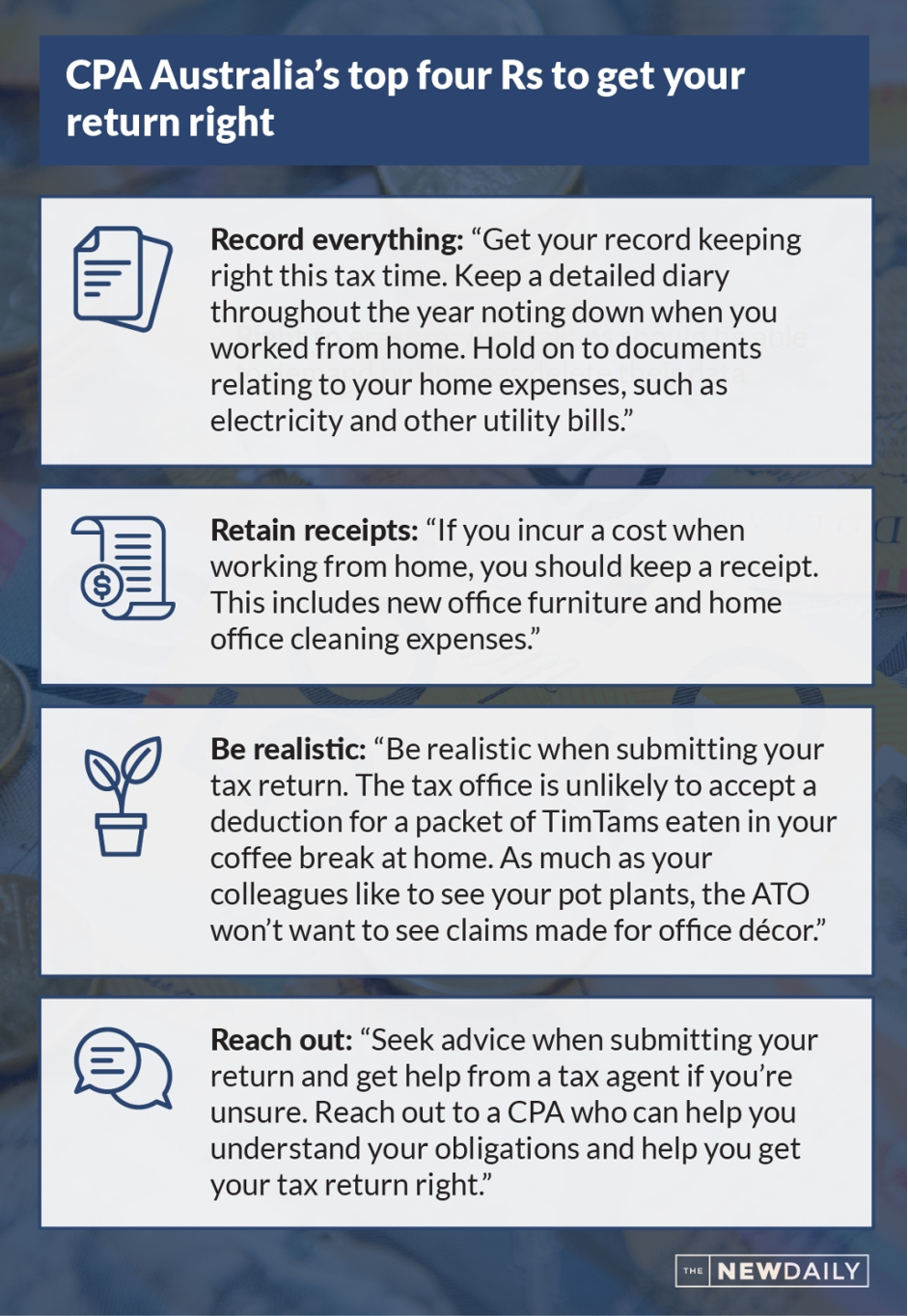

Record keeping is vital

Loh said the most important thing workers can do to prepare for these tax time changes is to keep solid records of the hours they work from home each day and any expenses they incur.

The ATO will this year be asking workers who are claiming expenses like their phone, electricity or internet costs to provide at least one bill they received during 2022-23, Loh said.

“We’re all about records, no records equals no deduction. It’s really important [that] people have that,” he said.

Loh said that taxpayers can keep a record of their remote work hours digitally too, and that employers can help with providing records of work from home rosters, if needed.

BDO Tax Partner, Tim Sandow warned that if people want to keep claiming the working from home deductions, they really need to be on top of their record-keeping and keep it in a form that can be presented to the ATO if they ever ask.

“The good news is there is no set format that the record of hours worked at home must take. The records can be timesheets, rosters, logs of time spent accessing an employer or business system or a diary”, he said.

“The bad news is you need to keep the records for every day you work from home from March onwards.

“Unfortunately, a four-week representative diary won’t cut it anymore – the ATO is making you work a bit harder if you want to claim the deduction.”

Loh said that taxpayers can keep a record of their remote work hours digitally too, and that employers can help with providing records of work from home rosters, if needed.

This story was adapted from a story in our sister publication The New Daily.