The state of fintech in Australia

Beaumont Capital Markets’ International Fintech Review 2022/23 finds that Australia is a global leader and has plenty of opportunity to expand its expertise and products throughout Asia.

Photo: Jonas Leupe

The Australian chapter of the review, by BDO’s Global Leader of Fintech, Tim Aman, states that Australia’s financial services industry has traditionally been characterised as secure and effectively managed due to the strong regulatory environment resulting in banks with strong capital positions and a robust asset management industry led by industry and retail superannuation funds.

In recent times, Australia has expanded its position in the global financial services ecosystem as a leader in the fintech sector.

Currently ranked sixth in the world for fintech, based on the Global Fintech Index, and second in Asia-Pacific, Australia attracts talent and innovators from around the world, as well as investment both domestically and internationally.

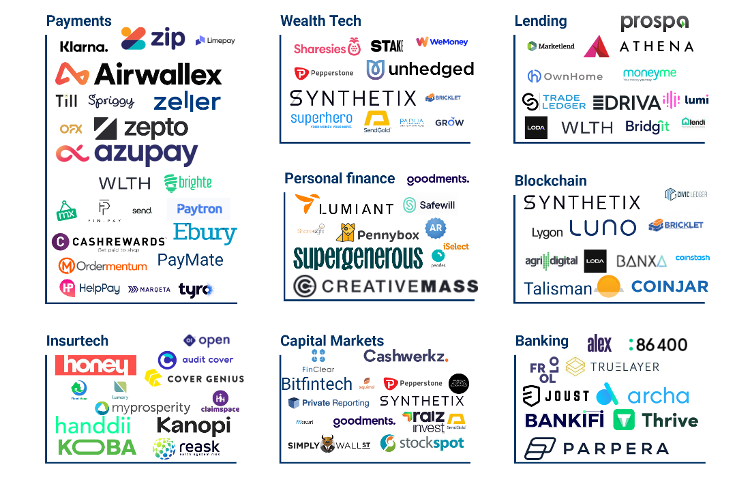

CBInsights Market map of Australia’s top performing fintechs by sector. November 2022.

There is ample opportunity for growth and innovation in the already booming Australian fintech space but as trust and widespread adoption continues to grow in fintech products, there are several challenges on the horizon that need to be addressed for the industry to continue to flourish.

The continued growth and success of Australia’s fintech sector heavily rely on the domain expertise in the domestic market and the global growth pathway.

The Tech Council of Australia defines domain expertise as the availability of research, talent, adjacent industry expertise or the presence of large domestic or global customers or companies. The global growth pathway refers to the ease with which a fintech can scale globally.

It will require the continued investment of capital and regulatory reform from both the public and private sectors, to develop the fintech sector at a pace that satisfies Australia’s consumers and their ever-increasing digital needs.

Business growth opportunities in Australia

Australia’s fintech industry has seen a five-fold increase in the number of fintech companies in the past five years (currently over 800 fintechs across the country), with the industry now worth more than US$4 billion (AU$5.87 billion).

Further, Australia’s global share of GDP is 1.6 per cent, but 2.3 per cent of the world’s tech unicorns have been founded in Australia.

This growth has been driven by strong levels of private funding, namely in venture capital (VC), as well as other sources of global and local investment. Australia’s VCs invest more in PayTech and diversified fintech relative to global VC funding allocations.

Global investors are particularly attracted to Australia’s lending tech market, which attracts 2.2 per cent of Australia’s VC funding as a share of global VC funding. This is followed by PayTech (1.2 per cent), diversified fintech (0.9 per cent), blockchain & crypto (0.5 per cent) and InsurTech (0.5 per cent).

New areas of innovation, such as embedded finance, are also emerging rapidly in the Australian market. Non-financial institutions will continue to capitalise on the opportunities that embedded finance provides when driving growth, increased user engagement and loyalty, and additional revenue streams. The embedded finance industry is expected to record a CAGR of 29.4 per cent during 2022-2029 and represents a largely untapped area at present.

It remains relatively uncertain whether the more mainstream areas of fintech, such as crypto and blockchain, will sustain their levels of growth and adoption. As of April 2022, 28.8 per cent of Australians (or 7.4 million Australians) own crypto. Between 2020 and 2021, cryptocurrency adoption was reported to have jumped 56 per cent.

However, with recent cyber security attacks gaining mass notoriety in the media, Australians are taking a more cautious approach currently as it pertains to digital assets.

The report continues with insights into how Australia’s payment revolution is notable, particularly with PayTech giants like Afterpay and Airwallex originating in Australia, how the Australian government has placed increasing emphasis on developing the fintech sector, and how the introduction of new regulatory conditions support entrepreneurship and increase non-traditional finance. (Read the full report here)

The economic climate, challenges facing the industry and outlook for fintech are then discussed.

The report finds that Australia is not exempt from the concerns of a potential global recession and that the Australian Securities Exchange (ASX) saw a significant decline in the pipeline of initial public offerings across FY22 with just 15 floats registered with the ASX at the end of June 2022 (for a total raise of AU$121 million) compared to the 43 proposed listings a year earlier (for a total amount of AU$1.25 billion).

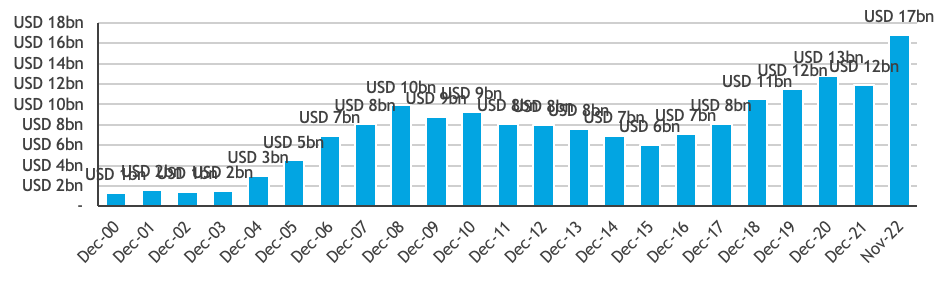

Dry powder in the private capital markets remains at an all-time high with US$ 17bn available in Australia.

Dry powder levels in Australasia. Source: Preqin, BDO analysis.

Challenges with the labour market

The broader technology sector is the seventh largest employment sector in Australia with 1 in 16 Australians working in a technology role. These jobs offer highly competitive remuneration with a weekly pay that is 64 per cent higher than the economy-wide average but it is still challenging to meet the employment needs of the sector with an estimated shortage of 286,000 technology workers across Australia.

The government has provided a goal of adding a million people in tech-related jobs to the economy by 2025 which it will drive through the attracting, recruiting and re-skilling of Australians from non-technology sectors. However, this likely will not suffice, and there will need to be a significant immigration push to attract international talent.

The five key barriers within Australia to attracting tech talent growth have been identified as:

- A lack of awareness about what tech jobs exist, or how to get into them.

- Training products and pathways into tech jobs have not kept pace with industry needs.

- Women, older Australians, and regional Australians are under-represented.

- There is only a small talent pool of people with the skills and experience needed to work in experienced technical roles, and those roles have boomed.

- Australia lacks coordinated effort, analysis and planning for the tech workforce.

As Australia’s fintech sector and the broader technology sector continues to mature, there needs to be continued investment and focus on developing the local labour market at risk of losing locally based high growth ventures and companies to foreign markets.

Australia’s Fintech Outlook

Over the next 12 months, it is expected that there will be a consolidation in the market across fintech subsectors that are saturated due to the current economic headwinds. Increased uptake in open banking will lead to increased competition, and the next generation of locally grown Australian fintechs will arise from the innovative ecosystem.

The market is ripe for the emergence of green fintechs, especially in the WealthTech space over the next 12-24 months as the race for customer acquisition continues.

Local fintechs will also continue to expand into the Asia market, given the demographics and vast opportunities available in the region. Whilst Asia, New Zealand, USA and the UK are well-trodden paths for global expansion, there are existing opportunities in the unbanked areas of Latin America and Africa that should not be neglected.

Further, as the government puts more focus on tax incentives and regulatory updates, Australia will also attract more international fintechs and talent.

The outlook in Australia remains buoyant for the foreseeable future.

BDO in Australia wrote this chapter of the international review. Read the full report here.