If you have transferred money electronically, you may have felt anxious while entering the fifteen or so digits of your recipient’s bank details. And perhaps, rightly so.

According to bzTrack managing director Richard Barry, “disturbingly large amounts of payments go missing in Australia, because people have to type in the account and BSB details – and they don’t always get them right”.

For South Australia’s 143,000 small businesses, misdirected payments and, more commonly, late payments are serious impediments to staying afloat and can suck up valuable time and effort when rectifying them.

Barry is on a mission to ensure on-time payments are the norm for every tradie, sole trader and small business, especially those in the B2C (business-to-customer) sector.

“Small businesses are there to provide services that they are very good at,” said Barry. “What they’re not necessarily good at is managing their cash flow and managing their supply chain.”

Barry said on average SMEs would have 43% more working capital if they never had to wait for payments.

His company bzTrack provides a platform that integrates with accounting software, such as MYOB, QuickBooks and Xero, which has almost half the market in Australia. Information is automatically transferred between bzTrack and the other software, providing real-time updates for accountants.

As well as making it impossible for customers to misdirect payments, there is the option to offer invoice discounting, customisable by timeframe, individual customers and groups.

“Typical accountancy software will manage your invoices, but it doesn’t help you get paid,” said Barry.

“Where bzTrack steps in is by providing not only the payment mechanisms for you to get paid, but also the incentives to your buyers to pay early without you needing to have those conversations directly with them.”

Personal experience is behind Barry’s enthusiasm for the integrated credit check facility for tradies and SMEs supplying products or services to registered companies.

“I’ve been caught out myself before,” he explained. “You spend ages negotiating with the customer only to find out that they are terrible at paying their bills, if they pay them at all.

“Had I known in the past, that their credit score was that bad, I would never have done business with them in the first place.”

For tradies and SMEs supplying goods and services to companies, there is an integrated facility to purchase a credit report – something that may come in handy with the tougher financial outlook ahead.

“One is a full comprehensive document that can be anywhere between 30 and 60 pages long, and the other is a simple credit scoring, which gives you historical credit scoring for a number of years.

“What it tells you essentially is, does this person pay their bill or not?”

He said that at under $50, the comprehensive report offered peace of mind before embarking on a project of any value.

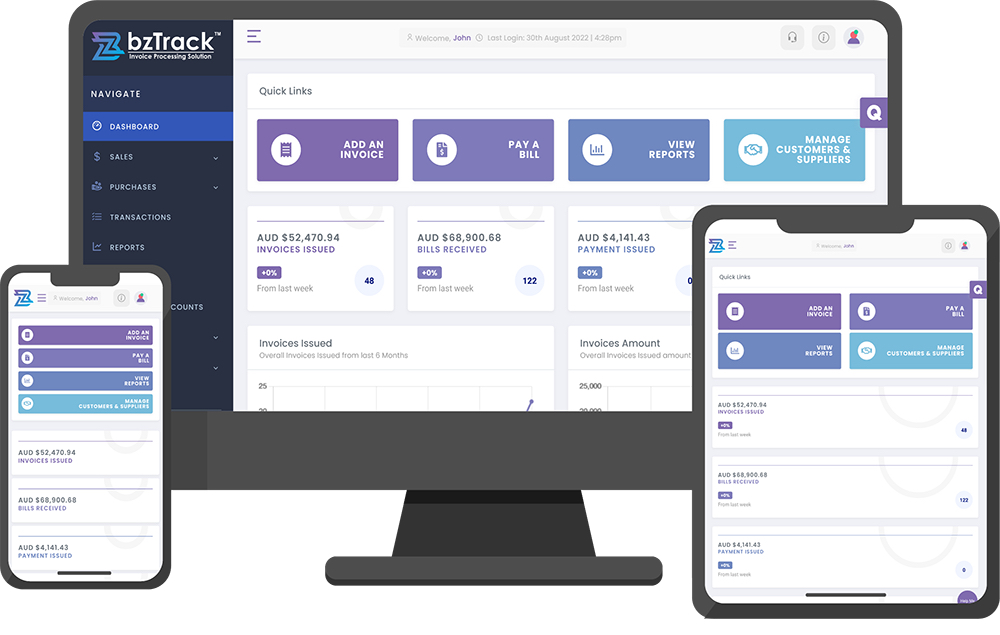

bzTrack is a single sign-on platform, enabling users to generate invoices in the platform or import them from their accounting software, track transactions and make payments to suppliers – all in one place. Device agnostic, it can be accessed via smartphones, tablets, laptops and desktop computers.

bzTrack also offers peace of mind to customers by ensuring their payments go as intended to the company’s bank account and not to another individual’s account. Payments can be made via credit card or direct from bank accounts using PayID, BPay and Apple Pay.

The cost for the service is not a subscription, it is free to join and operates on a user pays basis. The bzTrack account holder is charged $1 per transaction, with the option to pay this cost or pass it on to the customer.

Of passing on the cost to the customer, Barry said, “A lot of people are used to these charges now, but I think it does depend on your customer base and the services you provide.

“We believe that’s not our decision to make. It’s up to you as a business as to what you want to do.”

He is keen to see an end to slow and misdirected payments.

“Australia, and especially South Australia, is a nation of business owners and tradies. With bzTrack B2C, businesses who deal with day-to-day customers – whether that’s builders, caterers, sports clubs, florists and more – can now get paid quickly on the spot.

“Go to bztrack.com and sign up. It’s free to join and you only pay if you use it.”