Property report finds South Australia a stable growth market

A report by BDO and Land Services SA has found the South Australian property market is incredibly stable, with consistent capital growth over the past decade.

The newly released SA Property Landscape report found that the property types that experienced the strongest growth over the decade to the 2018 financial year were residential properties and commercial offices, which both peaked at 8.2 per cent in 2010-11, and grew by 5.9 per cent and 4 per cent respectively last financial year.

Co-author Brenton Pike from Land Services SA said the report shows that South Australia is a very stable marketplace compared with other Australian states and territories.

“From a South Australian perspective we are very steady in the marketplace compared to some other jurisdictions,” Pike said.

“It’s a pretty trusted and stable place to invest, because historically we don’t have the volatility of some of the Eastern states.

“If you compare this report to some of the other indices available from a national perspective, South Australia is fairing very well in maintaining capital value compared to other jurisdictions.”

The report was compiled by BDO, one of Australia’s largest accounting and advisory practices, using transactional data from Land Services SA to provides insights into the property market in South Australia.

Matthew Laming, BDO Business Services Partner, said there are on average 35,000 property transactions each year in the state, figures that are buoyed by strong rates of construction, with 25 per cent of housing stock built since 2010.

“What we are seeing is there has been subdivision activity driving the average (of new builds) up,” Laming said.

“It does stem back to which areas we are looking at… there are certain areas when the age of property is a lot higher.”

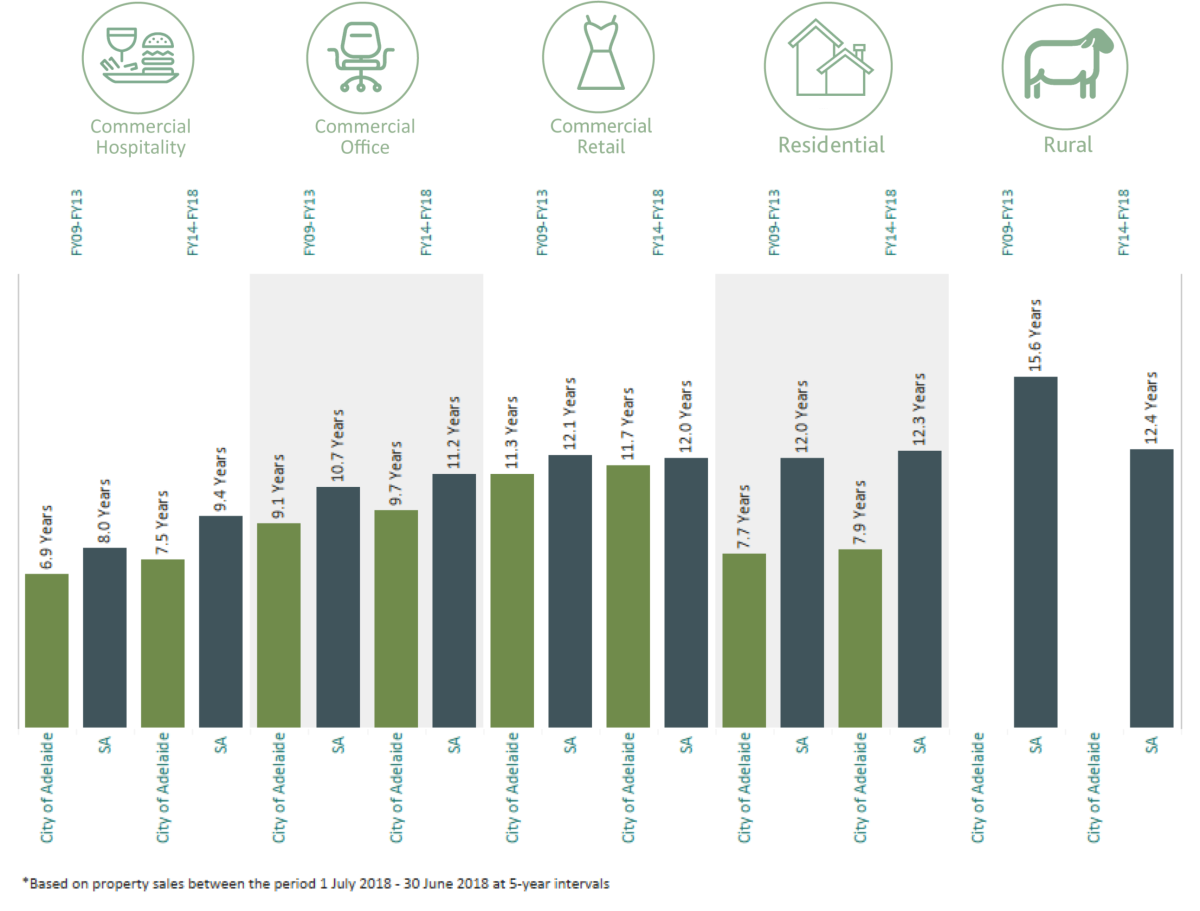

South Australians also hang on to their properties for much longer than commonly thought, with the report revealing an average holding period for residential property of 12.3 years.

“We were somewhat surprised by that,” Laming said.

“The rhetoric we’ve always heard in the industry is that properties turn over every seven or eight years. That holding (of property) definitely does provide stability.”

Source: SA Property Landscape report

Laming said the report has the potential to deliver enormous value in terms of informing business decisions in the property and finance sectors.

“It’s data that hasn’t been presented to the marketplace before in this format,” he said.

“We’ve presented data across multiple aspects – transactions, mortgages, characteristics of property – all in one report. It’s going to be powerful information to help businesses make decisions going forward.”

Pike said the report’s potential to inform lenders and improve their efficiency was also valuable.

“I think the insights around mortgage saturation are very valuable”, he said.

“If you were a brand… is there more or less saturation in an area where you have a branch, compared to an area where you may not have a branch? Insights like that haven’t been out there before and can really influence business decisions.”

This article is sponsored by BDO Adelaide.