South Australian hydrogen plan sinks

Plans to produce hydrogen in the Cooper Basin for up to 50 years, strongly encouraged by the State Government, have stumbled badly for lack of finance.

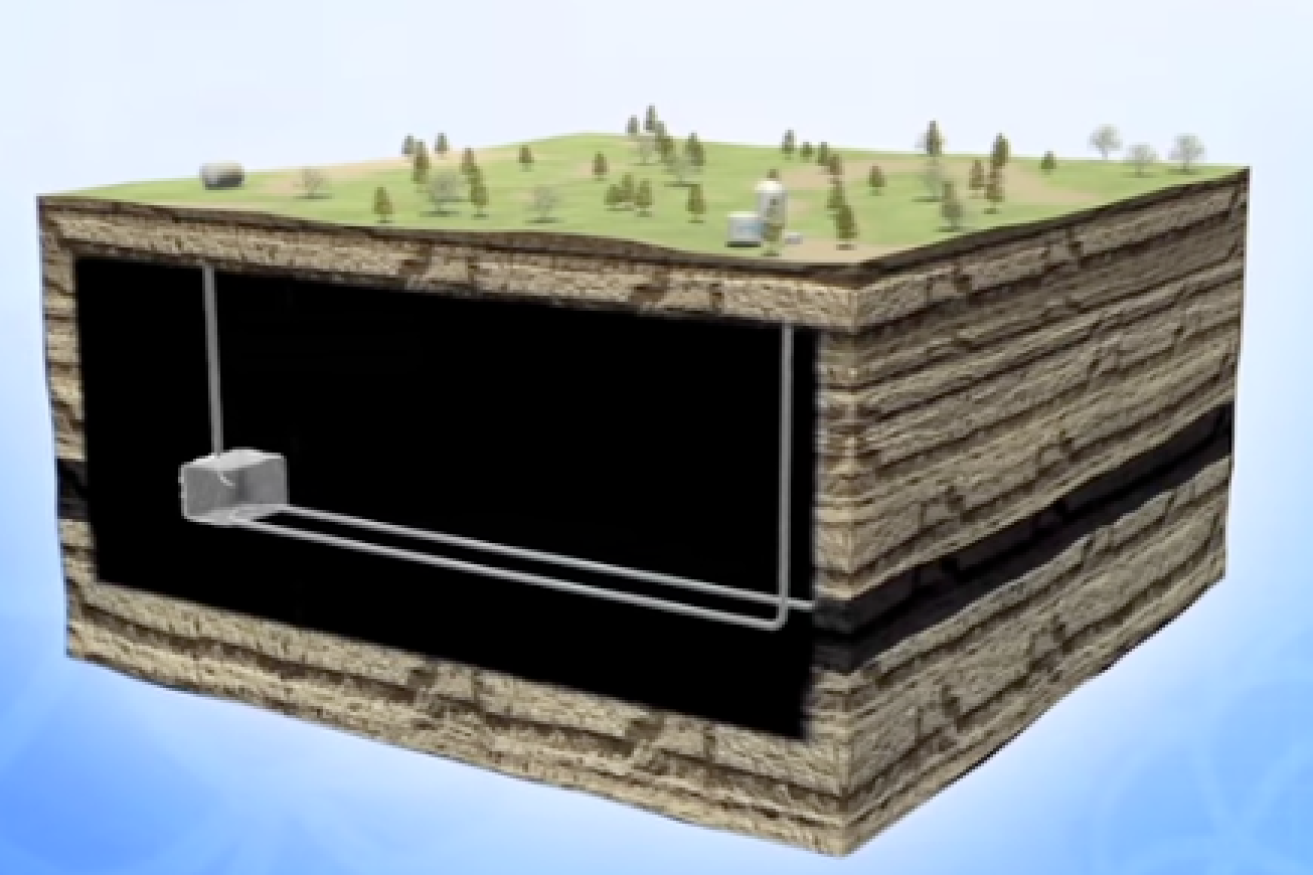

A still shot from a Carbon Energy Ltd video demonstrating their hydrogen extraction technology.

The company behind the proposal, Carbon Energy Ltd, has been forced into voluntary administration, following its failure to raise $1.5 million in funding through a share purchase plan.

The company’s shares were immediately suspended indefinitely on the stock exchange following yesterday’s announcement.

Jarrod Villani and Robert Hutson of KordaMentha have been appointed administrators.

Carbon Energy’s CEO, Bryan O’Donnell, told InDaily: “ I do absolutely believe there is a case for deep coal to produce hydrogen in the Cooper Basin.

“Businesses with other priorities are beginning to think that maybe I am right.

“The SA government absolutely thinks it is a good idea.”

“State government financial support is likely to be worthwhile, but not material – about a million dollars or so. It would not be make-or-break for the project.

“At this stage, the SA government say they don’t want to back single horses, but they do want to facilitate the process.

“We have identified tenements in the Cooper and we have the ability to buy them when we want to do it. We have gone far enough in the negotiations.

“I have no doubt that in 10 years’ time the production of hydrogen from coal will be quite significant, with CO2 capture and storage.”

Carbon Energy, now a Chinese-controlled company using “Keyseam” technology based on CSIRO research, was seeking just $1.5 million.

Most of the money was earmarked for the Cooper Basin hydrogen project. Some was to finance technical services and support for proposed underground coal gasification in South Africa, including a possible partnership with a private South African company. Discussions on this are continuing.

The company’s key plan was – and still is – to gasify coal underground, at least 1500 metres below the surface, to produce up to 68.6 per cent hydrogen.

Carbon dioxide produced in the process would either be sequestered in old oil wells or liquified and sold to conventional oil and gas companies for use in boosting production from existing wells.

The company had hoped to begin exploration drilling in the second and third quarters of next year. The aim was to begin commercial production as early as 2020, scaling up to full-scale commercial production in 2030. In theory, the coal in the basin could produce up to 20 million tonnes of hydrogen a year for more than 50 years.

O’Donnell had hoped that the share purchase plan would broaden the shareholder base and bring in some significant long-term investors, but the Chinese interests, who control 80 per cent of the company, did not support it.

There was also very little support from shareholders holding the remaining 20 per cent. The offer, of up to $15,000 worth of shares at eight cents each, was extended three times, but raised less than $281,000.

Those who did subscribe are now being given their money back.

“If things work out according to my plan, one thing in the future will be a SPP that will be successful,” O’Donnell said.

“But when 80 per cent of the company is owned by Chinese investors it is difficult.”

O’Donnell, who has a background in major projects in the oil and gas industry, was brought into the company in January with the aim of turning it around.

“CNX is just a little tiny company but it can contribute to the environmental wellbeing of the world,” he said.

“I have a pretty strong belief that the massive consumption of petrocarbons and the emissions of CO2 is. … putting the environment in a very precarious position.

“We have to do something about it.”

He said that although major gas companies such as Woodside were committed to sequestering their carbon dioxide, little was actually being done because it was a direct hit to their profits. He did not think that that would change until there was a price on carbon.

Carbon Energy operated a UCG trial using Keyseam at Bloodwood in Queensland from 2010 until 2016, when the Queensland Government banned all UCG in response to the environmental disaster caused by Linc Energy’s coal-to-diesel operation near Chinchilla.

UCG remains a highly controversial technology with numerous trials around the world having been abandoned for technical or environmental reasons.

Carbon Energy, however, maintains that its keyseam system produced a more consistent quality and composition of syngas than traditional UCG, and can be adjusted to produce commercial quantities of hydrogen at competitive prices.

The keyseam technology was developed in conjunction with the CSIRO, which still owns just under half a per cent of the company. That stake was recently worth around $27,000, but may now be worthless.

The Queensland ban on UCG almost pushed Carbon Energy to the wall, until it was rescued by Chinese investors hoping to use its technology in Chinese coalfields. It is understood, however, that the initial Chinese proposals have since run into difficulty, with a joint venture partner pulling out.

– Adelaide Independent Reporter

Disclaimer: The author owns shares in Carbon Energy.