SA’s economic outlook a mixed picture

UPDATED | South Australia’s economic outlook for 2018 is for continued growth but an economic study warns that a fall in farm production could offset gains “to a significant extent”.

The newly-opened O-Bahn tunnel: public infrastructure investment has helped the South Australian economy to grow. Photo: Tony Lewis/InDaily

The final economic briefing report for 2017 by the University of Adelaide’s South Australian Centre for Economic Studies (SACES) predicts a slowing in growth after an improved showing in 2016-17.

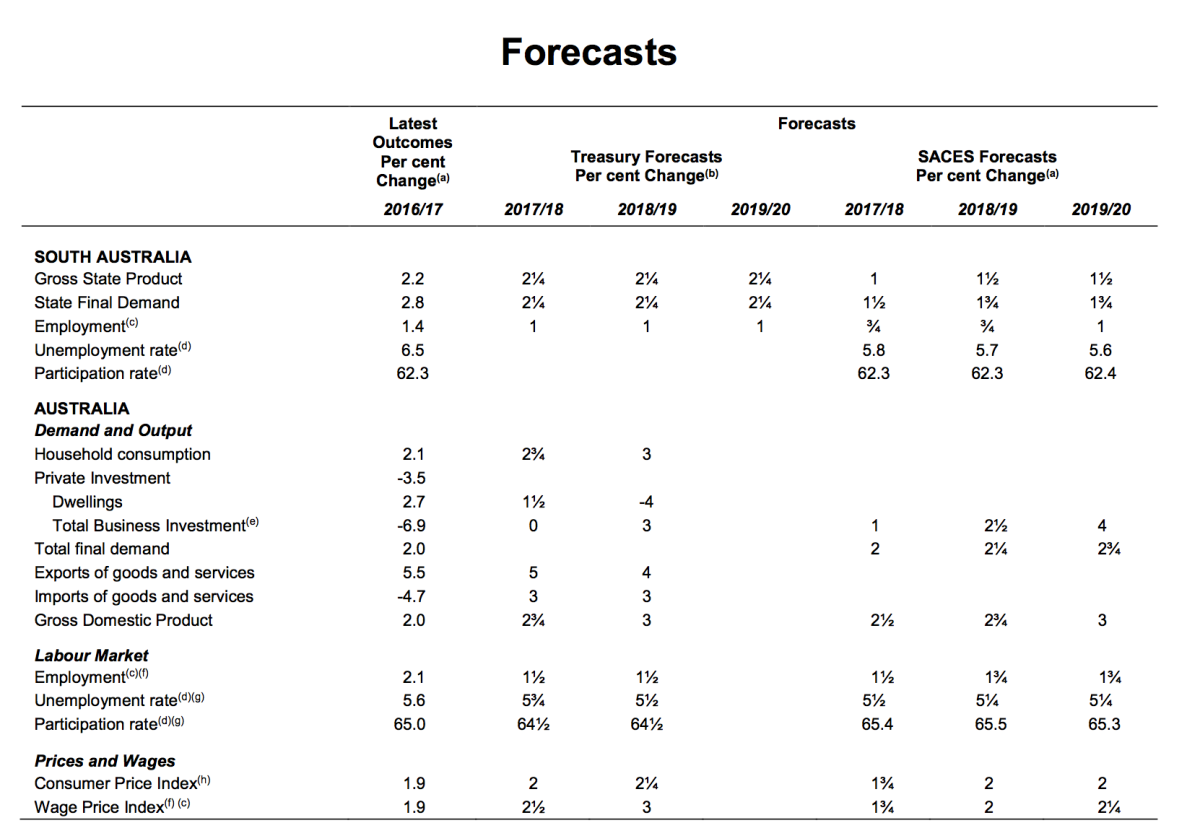

SACES predicts Gross State Product (GSP) to grow by 1 per cent in the next financial year, with the easing based on an expected fall in farm output.

The centre’s predictions for economic growth over the next three years fall well below those of Treasury, which forecast a 2.25 per cent increase next financial year.

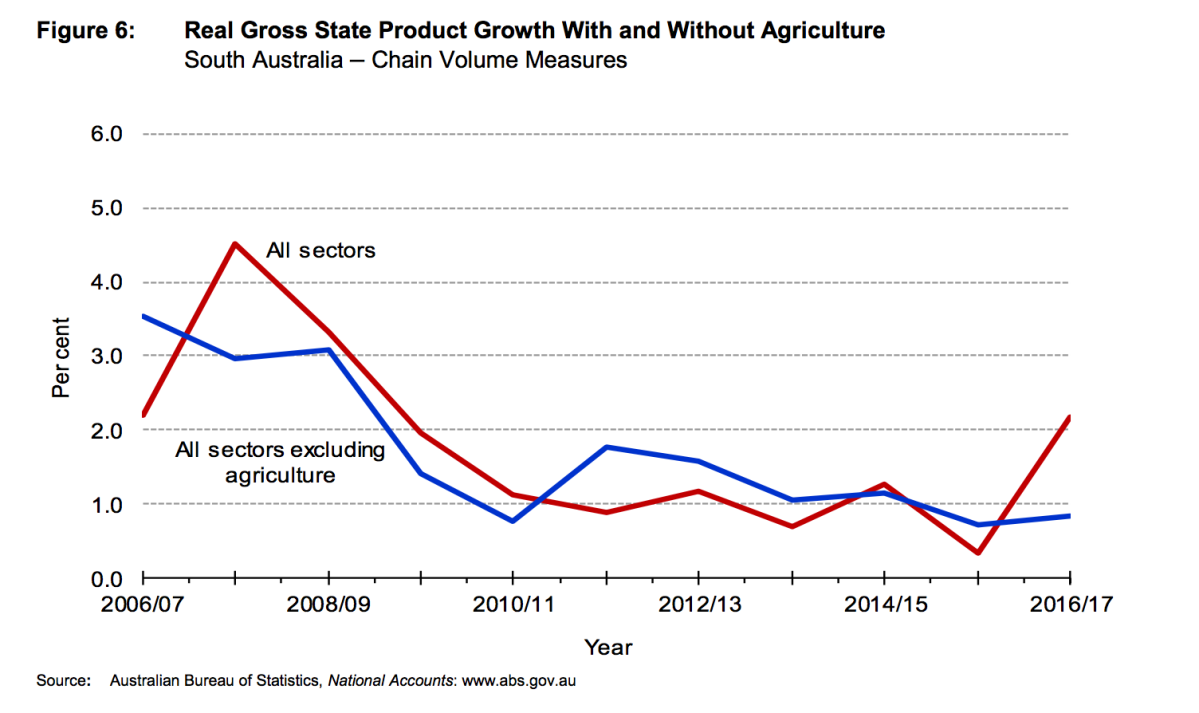

“The state’s real Gross State Product (GSP) grew by 2.2 per cent (in 2016-17), which is a significant improvement on average annual growth over the past 5 years of around 1 per cent, and roughly in line with growth in Australia’s real GDP,” the report says.

“However, the farm sector is responsible for much of the rise in GSP as a consequence of the strong winter crop in 2016. Outside the farm sector, growth remained stuck around 1 per cent, as it has for several years now.”

More recent economic indicators suggest the economy has strengthened through 2017, with a recovery in business investment and a sharp lift in public infrastructure investment.

However, SACES says the outlook for the economy into the new year is “somewhat uncertain with both positive and negative factors having a bearing”.

On the plus side, the report says, business and investment and labour market conditions have shown encouraging signs of recovery, with construction activity likely to remain robust in the first half of 2018 and private business investment also providing a boost.

South Australia has also avoided the surge in residential property prices occurring in the eastern capitals, helping to improve our comparative cost advantage.

“On the downside, forward indicators for the labour market do not indicate a strong resurgence in the next year,” the report says. “The recent closure of auto manufacturing will undermine jobs growth in the short term, but we estimate that the negative impact yet to come will be less than 0.5 per cent of South Australian employment. And while there have been some interesting and welcome commencements of new economic activities in the state, these will need to continue across a wide front if South Australia is to sustain recent rates of employment growth.”

The report’s sternest warning is in relation to the outlook for the state’s farm incomes.

It says there will certainly be a fall in farm output after last financial year’s above-average performance, which will “push down headline GSP growth”.

“The level of winter crop production for 2017/18 is projected to be 6.2 million tonnes, down 45 per cent and 14 per cent below the annual average level over the previous decade. However, certain parts of agriculture such as viticulture may still perform relatively well depending on how seasonal conditions evolve.”

While business investment has grown solidly since late 2016, it appears to be slowing.

“Much will depend on developments in the external economy as the capacity of the State Government to engage in further demand stimulus is limited,” the report says. “On these grounds we are forecasting growth of 1 per cent in 2017-18, and employment growth of 0.75 per cent. employment growth at this rate would be sufficient to broadly keep pace with expansion of the population, maintaining the unemployment rate around its current level.”

SACE’s forecasts compared to those of state Treasury.

This chart shows the positive impact of agriculture on South Australia’s GSP.

The report has mixed news on South Australia’s export performance.

South Australia’s international exports were flat in 2016-17, the report says, with the farm sector again saving the day.

“Total export values for the year were up just 0.8 per cent,” it says. “But for the very strong winter grain crop in 2016, overseas exports probably would have fallen. This is a somewhat disappointing result considering national exports grew 5.5 per cent.”

Goods exports dropped by 1 per cent, but services exports grew strongly – up 8.2 per cent after a “hefty” 19 per cent rise in 2015-16.

On the upside, goods exports appear to have grown strongly since late 2016.

The deputy director of SACES, Steven Whetton, said while there were positive signs in the South Australian economy “they need to be sustained and, in particular, the recovery in business investment needs to gather more strength if we are to see a return to stronger rates of output and employment growth rates over the longer term”.

He warned that while the report predicts modest growth in employment over the next two financial years, it will mirror population growth and therefore will not improve the unemployment rate.

“A subdued job market flows through to household spending and confidence and household incomes remain a significant area of uncertainty,” Whetton said.

“Although incomes have shown some signs of improvement recently, growth in wages remains sluggish, which is holding back household spending, leaving investment spending from business and government as the main driver of growth.”