January consumer confidence lowest since GFC

Consumers have started 2016 on a pessimistic note after confidence fell for the third week in a row, marking the lowest January level of uncertainty since the Global Financial Crisis.

Consumers are more pessimistic.

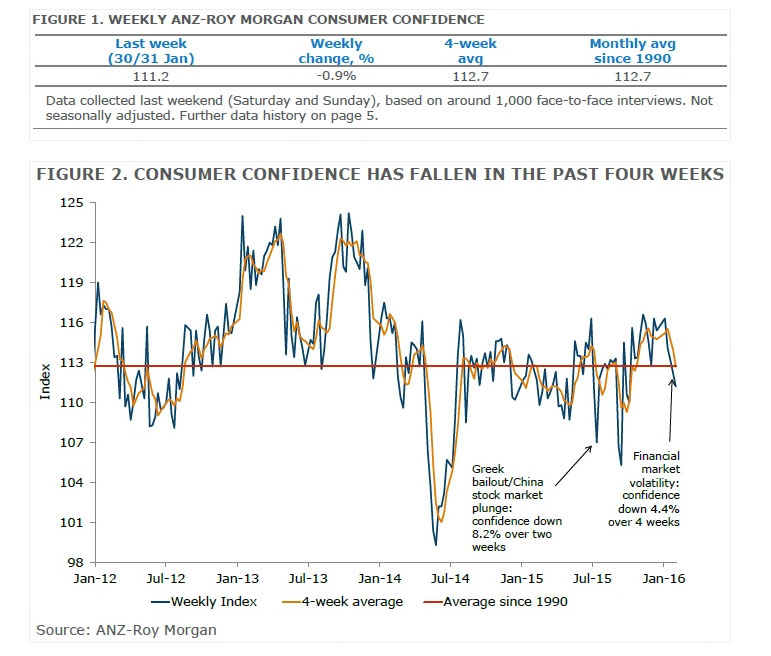

Latest results from weekly consumer polling on attitudes to personal, national and international finances by ANZ-Roy Morgan showed confidence had fallen one point and the lowest level for January since 2008.

The consumer confidence rating fell from 112.2 to 111.2 and down 4.4 per cent over the past four weeks.

On average, confidence was 2.1 per cent lower for week three, compared to December, with pollsters seeing the first fall in confidence in January since 2008.

ANZ chief economist Warren Hogan said the “Turnbull rally”, or the ascendance of new Prime Minister Malcolm Turnbull, had worn off.

“Confidence is now below the long-run average level and has reversed much of the ‘Turnbull rally’ from last year,” Hogan said.

“The weakness in global financial markets and concerns over the global economic outlook appear to be the main reason for the weakness in confidence, although recent market stability does have us wondering if there is a greater fragility in the domestic economy than we previously thought.

“The weakness in confidence highlights the powerful links between international instability and the domestic economy.”

Hogan said the board would take note of the international concerns despite solid domestic economic momentum.

“For today’s policy decision this will mean the RBA cash rate should stay right where it is at 2 per cent,” he said.

“Over time, we expect the case for a further modest interest rate cut will build and the cash rate will fall another 50bp by the end of 2016.”

The less volatile, four week moving average is also now trending down: Figure 2

Questions

Would you say you and your family are better off financially or worse off than you were at this time last year?

This time next year, do you and your family expect to be better off financially or worse off than you are now?

Thinking of economic conditions in Australia as a whole. In the next 12 months, do you expect we’ll have good times financially, bad times or some good and some bad?

Looking ahead, what would you say is more likely, that in Australia as a whole, we’ll have continuous good times during the next five years or so – or we’ll have bad times – or some good and some bad?

Generally, do you think now is a good time – or a bad time – for people to buy major household items?