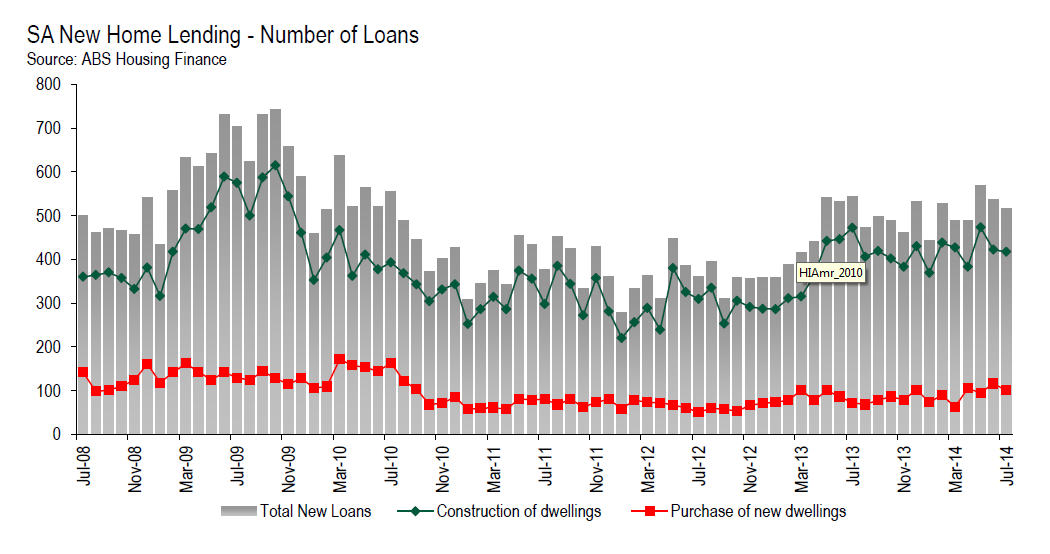

Housing finance data shows that lending for new dwelling purchases in South Australia fell during July, confirming earlier indications that a short period of recovery is over.

In seasonally adjusted terms, the number of owner occupier mortgages for new dwellings fell by 4.2 per cent in July compared with the previous month, Australian Bureau of Statistics figures show.

In the three months to July, owner occupier loans for the construction or purchase of new dwellings fell by 2.8 per cent in seasonally adjusted terms, totalling 1,528 loans during the quarter.

This was just down by 0.7 per cent on the same period twelve months earlier.

Residential building industry group, the Housing Industry Association, said the slowdown was a concern.

“These figures indicate that a slowdown in SA’s new homes market is starting to build,” Robert Harding, HIA Executive Director, South Australia said.

“New home lending is down by 5.6 per cent on July of last year. The decline in new home lending stands in contrast to the upturn in established dwelling activity over recent months.

“Established home loans were 2.4 per cent higher during July and are 4.5 per cent higher than a year earlier. The divergence in the performance between the new and established sectors indicates that further policy action in assisting new home building in the state may be required.”

Harding said the trend reflected the industry’s concerns that stamp duty in SA was far too high compared to other states.

“New home building has much to offer in terms of firing up the SA economy and carefully designed-measures around First Home Owner grants and stamp duty concessions have the potential to represent a win-win for home buyers, the SA construction sector and the state government.

“HIA’s recent Stamp Duty Watch report showed that the stamp duty burden for SA home buyers was the second highest in Australia, with typical stamp duty bills coming to some 4.0 per cent of the home price. The scope for reform in this area is great.”