Adelaide property values hitting ‘balance’ as price surge slows

More Adelaide properties have dropped in value over the last six months according to a new study, although the city’s inner-ring suburbs show strong growth.

Housing in Seaton. Photo: Tony Lewis/InDaily

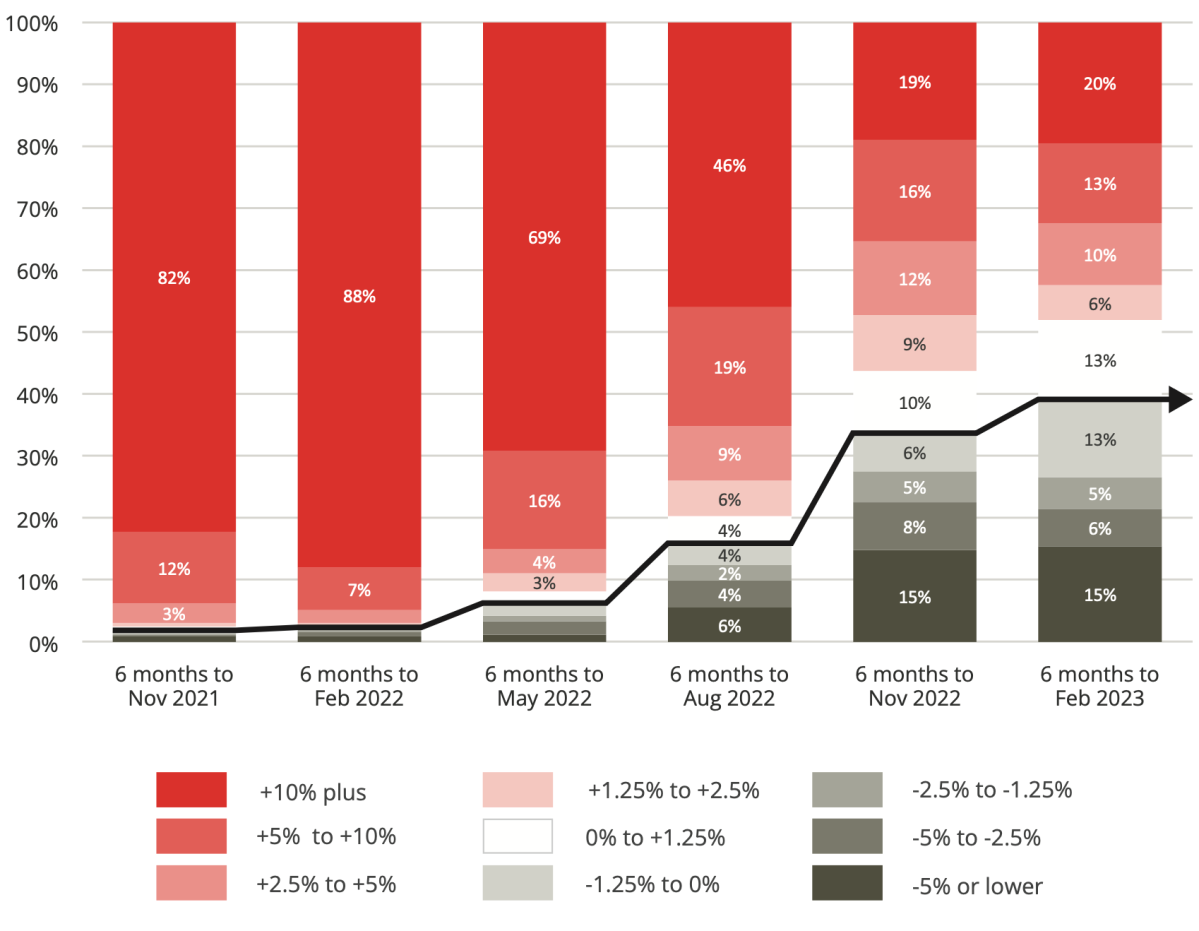

Analysis by AI property analytics firm PointData shows that in the six months to February 2023, 61.5 per cent of Adelaide properties experienced annualised price growth – down from 66 per cent in November 2022.

The proportion of Adelaide properties to experience a decline in value increased from 34 per cent to 38.5 per cent.

The findings published in the Real Estate Institute of South Australia’s quarterly “Viewpoints” newsletter are in stark contrast to the real estate market this time last year, when PointData found 95 per cent of Adelaide properties were growing in value by more than 5 per cent.

At the time, 88 per cent of Adelaide properties were experiencing growth in excess of 10 per cent. Now, the proportion of properties that fit this profile is only 20 per cent.

PointData said the latest figures represent a shift towards “balance” in Adelaide’s property market.

The proportion of Adelaide properties growing by more than 10 per cent in value has decline significantly since February 2022. Graph: PointData

“The residential property market in Adelaide continues to move towards complete balance, whereby there are almost the same number of areas experiencing positive growth (61.5 per cent) as negative growth (38.5 per cent),” it said.

“While 20 per cent of areas continue to see growth in excess of 10 per cent, there has been a shift in other positive growth bands towards neutral (i.e. 0 per cent growth).

“It is a similar story for negative growth areas, whereby the -1.25 per cent to 0 per cent band has increased from 6 per cent to 13 per cent since the summer edition.”

According to PointData, 208 Adelaide suburbs are experiencing price growth (up from 160 suburbs last quarter), while 152 are in decline (down from 198).

The median sale price in suburbs experiencing positive growth is $768,000, while the median sale price in negative growth suburbs is $776,000.

Kent Town was the top-performing suburb for short-term sales growth, increasing 8.6 per cent over the last three months.

Evandale (7.3 per cent), College Park (6.9 per cent), Angle Vale (6.8 per cent) and Medindie (6.3 per cent) rounded out the top five.

“A common thread throughout the majority of the pandemic was the exceptional performance of Adelaide’s high-value inner-ring areas,” PointData states.

“As prices begun to correct in early 2022 it was these areas which experienced the greatest magnitude of negative growth, reclaiming some (but by no means all) of the growth experienced since 2020.

“The tides have once again turned, with the affluent areas of Kent Town, Evandale and College Park leading the way in growth in the three months to February.”

Despite the property market cooling off, only 21 per cent of Adelaide properties are worth less than $450,000, according to the study.

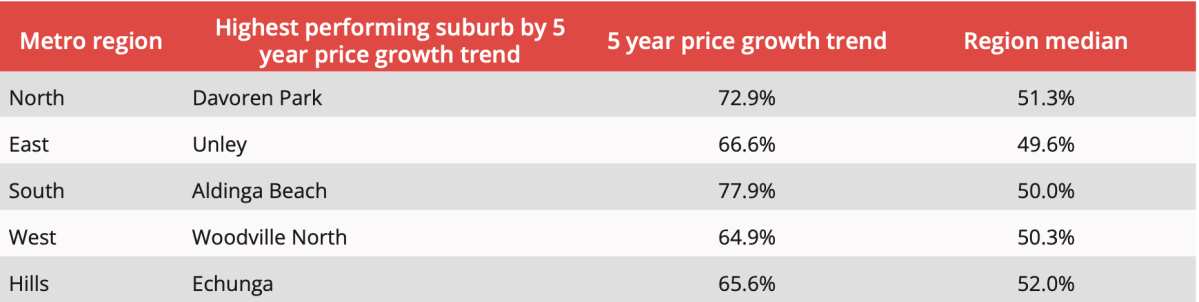

Over the last five years, Aldinga has experienced the most price growth at 77.9 per cent.

Top suburbs by region for price growth over the last five years. Unley, listed in this supplied graph as being in Adelaide’s east, is inner south. Table: PointData

PointData said the longer-term figures indicate that property prices will continue to rise.

“It would be remiss to not acknowledge that the covid-boom accelerated this growth over this period,” it said.

“And it is also possible that many of properties in metro Adelaide were not realising their full value 5 years ago anyway (when comparing what is available in Adelaide to our eastern state cities, it is possible our properties are still somewhat undervalued).

“While there have been some areas which have experienced a correction in the past 12 months, historical trends suggest that property investment over the longer-term is likely to remain fruitful and the saying ‘safe as houses’ will hold true.”