TAFE’s $15m debt collection chase

TAFE SA has been chasing more than $15 million in unpaid debts from students and other clients this year, amid warnings it faces an increase in bad debt write-offs due to the financial impact of COVID-19 on students.

Photo: Tony Lewis/InDaily

TAFE SA CEO David Coltman told InDaily a short time ago that TAFE SA’s unpaid debtor balance stood at $15.1 million at the end of October.

However, he said this included one debt worth “approximately $6 million” which has recently been recovered.

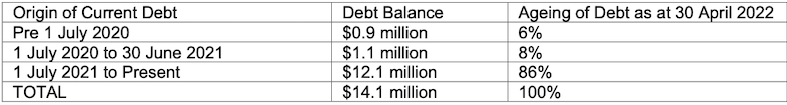

It comes after figures tabled in Hansard earlier this year showed TAFE SA’s outstanding debtor balance stood at $14.1m as of April 30, 2022 – down from $14.7m at the same point in 2021 and $14.5m in 2020.

The breakdown showed that $900,000 of the unpaid debt arose before July 1, 2020.

The majority of the unpaid debts – $12.1 million – are less than 12 months old and arose between July 1, 2021, and April 30, 2022.

A further $1.1 million in debts between July 2020 and July 2021 remain unpaid.

A breakdown of TAFE SA’s outstanding debt as of April 30, 2022. Table: Hansard

TAFE SA in July last year resumed the use of third-party debt collectors to chase down unpaid fees from students after pausing the practice at the onset of COVID-19.

The vocational training provider in May this year began searching for a new external debt collection agency to track down students – including visiting their homes and making “phone demands” to pay up – in a bid to recover $220,000 in unpaid debt each month.

The Auditor-General’s annual report shows TAFE SA wrote off $437,000 in bad debts last financial year after resuming third-party debt collection.

The report, published in September, warned that TAFE SA’s unrecoverable debt could increase over the coming years.

“Doubtful debt provisioning and bad debt write-offs may be higher over the following financial years due to the inability for students to quickly recover from the individual financial impacts of COVID-19,” the report states.

“Bad debt write-offs will invariably flow from the resumption of regular debt collection processes.”

The report said TAFE SA writes off a debt when it is advised by its debt collector that it would be “uneconomical to collect” the unpaid debt, or no activity has occurred after 180 days.

SA-Best MLC Frank Pangallo asked the Malinauskas Government in parliament on May 17 for the breakdown of TAFE SA’s outstanding debt position.

He also asked the government to list the five biggest debts on TAFE SA’s books and a breakdown of debts by local and international clients.

Education Minister Blair Boyer responded on July 5 with the breakdown of TAFE SA’s outstanding debt position but did not disclose the largest individual amounts owed, citing privacy considerations.

He also stated TAFE SA “will not increase course fees to cover debts”.

TAFE SA told InDaily its procurement process for a new third-party debt collector is still “ongoing”. Submissions for the tender closed on June 2.

The education provider is expecting the new debt collection agency to handle 320 debtors accounting for $220,000 in unpaid debts each month.

In response to inquiries from tenderers in May, it said the age of the unrecovered debts “could vary from 45 days old to up to six years”, although “the majority of the debt referred is aged less than 90 days”.

TAFE SA declined to reveal to tenderers its current and target debt recovery rate.

It also said “very few” debtors would need to be tracked down via skip tracing as TAFE SA usually has two forms of contact information for each debtor.