Adelaide house prices soar into 2022

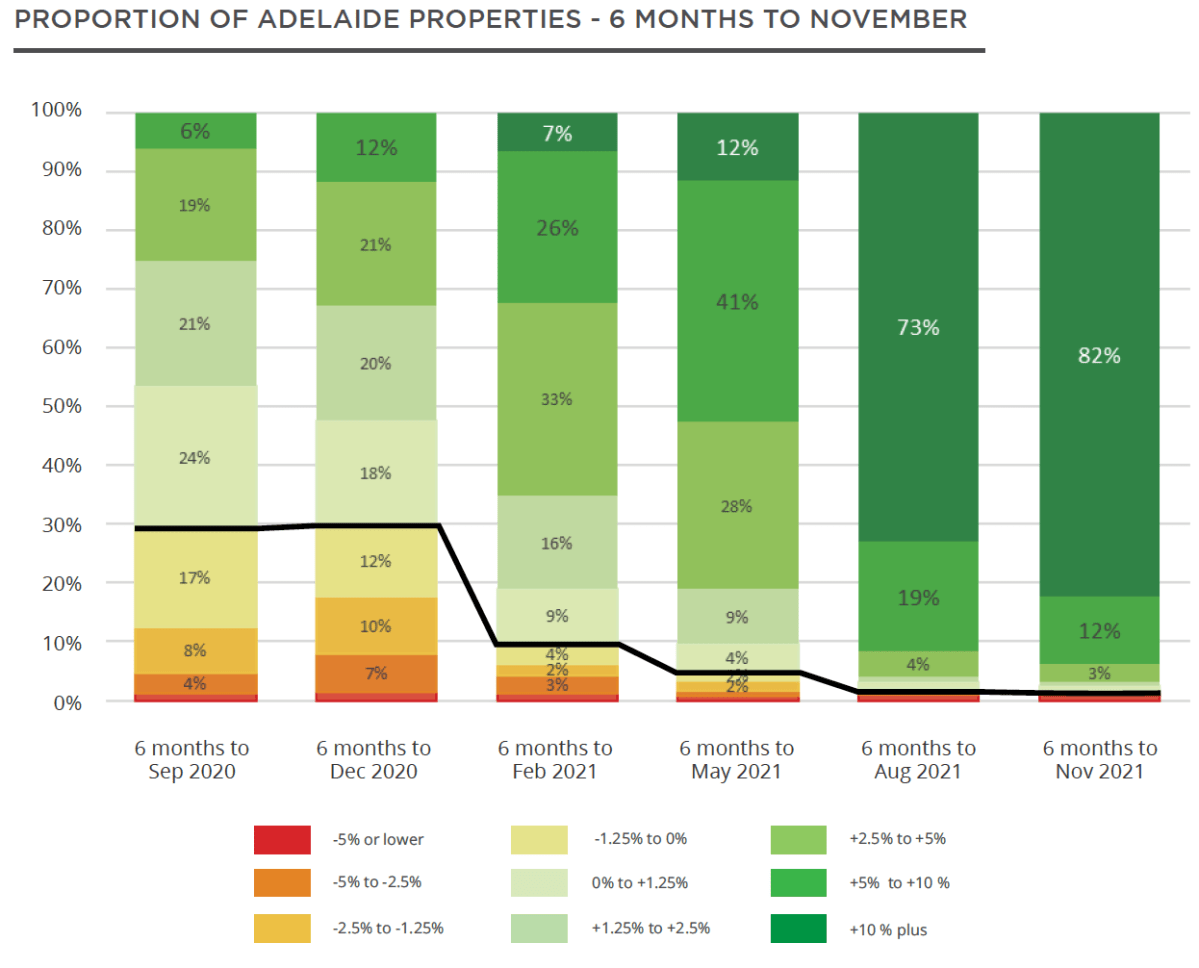

More than three quarters of properties in Adelaide are on track to record an annual price growth of more than 10 per cent, with outer ring suburbs in the city’s far north and south now contributing to the state’s booming house values, according to a new breakdown of the metropolitan real estate market.

Photo: Supplied

Pointdata’s Lay of the Land Summer Edition released at the end of last year shows 82 per cent of properties in metropolitan Adelaide have had an annualised price growth of 10 per cent or more in the six months to November 2021.

At the start of 2021, just seven per cent of metropolitan properties fell into this category.

Further, 94 per cent of Adelaide houses are on track for annual price growth in excess of five per cent by May this year, according to Pointdata’s latest breakdown.

Breakdown showing proportion of Adelaide properties in each annualised price growth band. Eighty-two per cent of homes are in the 10 per cent or more bracket (Graph: Pointdata)

The AI property analytics firm said their curated property price trends analysis indicate growth of more than two per cent per quarter in most areas of metropolitan Adelaide.

“The inner-ring suburbs surrounding the CBD continue to lead in levels of growth, with many achieving in excess of 7.5 per cent in the previous three months,” the report states.

“However it is no longer just the predictable affluent areas leading the way. The outer-north and south are keeping pace.

“While this is welcome news for property owners in these areas, it is less welcome for first-home-buyers.

“Telling is the average first-home-buyer loan size in SA, which in September hit new heights at $346,000, $41,000 more than the same time last year.”

The figures broadly align with data from fellow property analytics company Corelogic, which today released its final home value index for 2021.

The report found Adelaide last year recorded an increase in dwelling values of 23.2 per cent – 2.2 per cent above the national capital city growth average – along with a median price jump of 7.2 per cent in the last quarter of 2021.

However, Adelaide’s median house price remains at $569,882 – the third-cheapest capital city behind only Darwin and Perth. Sydney is the most lucrative market with a median property value of just under $1.1 million.

It comes as interstate arrivals continue to put heat into the Adelaide real estate market, with a tripling in SA house purchases by New South Wales and Victorian buyers contributing to a lack of housing supply along with the return of international expats at the start of the pandemic.

Adelaide also currently has the least amount of available rental space of any Australian capital city, with a rented dwelling vacancy rate of just 0.6 per cent according to the Real Estate Institute of Australia.

Pointdata also highlighted figures from Sydney mortgage brokers True Savings indicating first-home buyers in Adelaide take on average 6.6 years to save for a deposit – the longest average time of any capital city.

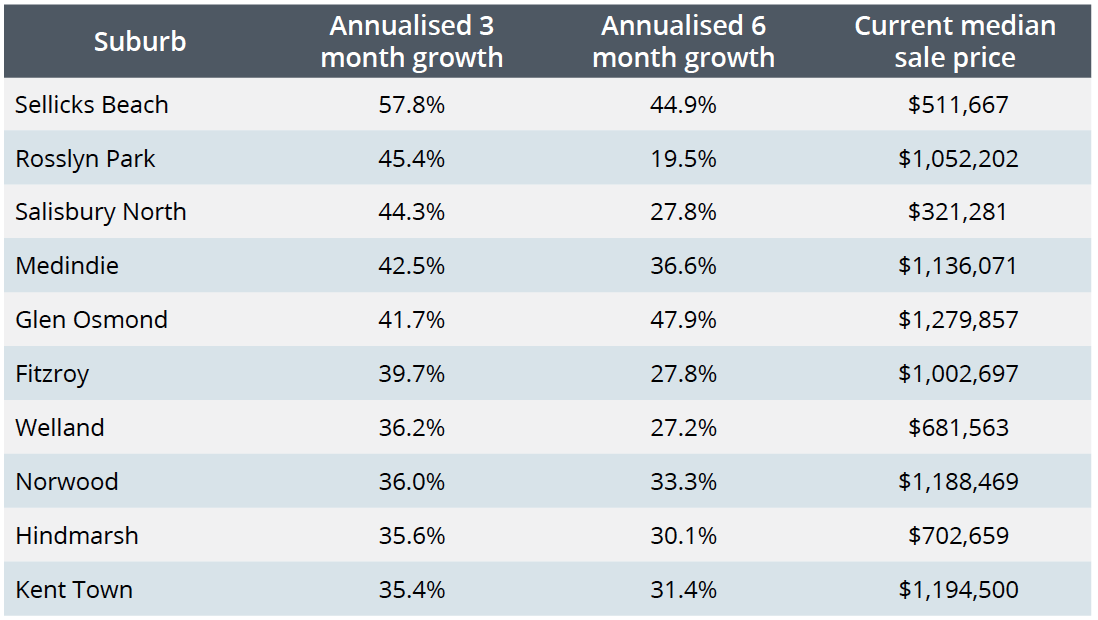

Meanwhile, Pointdata’s suburb by suburb price index reveals Sellicks Beach recorded the highest growth in value in Adelaide at the tail end of 2021.

The outer southern suburb had an annualised price growth of 57.8 per cent in the three months to November and has a current median sales price of $511,667.

Its current price growth trajectory puts the area’s median price on course to increase by more than $100,000 over the course of a year.

The top five price growth suburbs in Pointdata’s index – Rosslyn Park, Salisbury North, Medindie and Glen Osmond – all recorded three-month annualised price growths greater than 40 per cent.

Pointdata’s top ten suburbs by three-month annualised price growth to November 2021 (Table: Pointdata).

Pointdata policy planner Will Harmer said the findings represented a “remarkable achievement” for the Adelaide property market, and pointed to a shift away from the traditionally high-value inner-ring suburbs.

“Interestingly, in our Spring Edition, the majority of suburbs in our top 10 risers were typical ‘inner-ring’ suburbs,” Harmer said.

“In our latest edition, this has shifted with suburbs in middle and outer ring areas growing just as rapidly e.g. Sellicks Beach, Salisbury North and Welland.

“This may be as a result of prices in middle and outer rings being ‘more affordable’ for first home owners.”

The top five suburbs by price growth in Pointdata’s September edition were Glen Osmond, Clarence Gardens, Toorak Gardens, Black Forest and Urrbrae.

Harmer said there were possible signs the Adelaide real estate was starting to cool off but it was still too early to tell.

“Buyer caution as a result of macroeconomic factors such as fixed interest rates rising have led to minor market adjustment, however all of this could be offset by the incoming migration increases as signalled by the federal government,” he said.

“It will be interesting to see how the next 12 months plays out with respect to these key policies.”