Centrelink’s income reporting system is changing. Here’s how.

UPDATED: Changes to Centrelink benefits income reporting kick in on Monday. While Services Australia says the new rules make it “much simpler” for recipients, some low-income earners remain confused about how the system will work. Jessica Bassano has some answers.

Photo: AAP/Dan Peled

What will change?

From 7 December, low-income earners’ will report to Centrelink what they’re paid from their workplace within their allocated reporting period.

Economic Justice Australia chief executive Leanne Ho told InDaily that currently, Centrelink recipients calculate how many hours they’ve worked and how much they’ve earned within an allocated reporting period.

Low-income earners then declare the gross amount and hours worked to Centrelink in order to receive their welfare payment each fortnight.

Under the new system, low-income earners will report the gross earnings, as shown on their payslip, that aligns with their reporting period to Centrelink.

Ho said this should reduce confusion for those who worked inconsistent hours.

“Previously people might have got a payslip (from their workplace) that covered a different period to their Centrelink reporting period,” Ho said.

“They’d have to work out which bit of their payslip fell into that Centrelink reporting period based on what is on their payslip.”

She said the change should particularly benefit casual workers, whose hours were often sporadic.

“They won’t have to think: ‘I’m going to work another two shifts in the upcoming reporting period and add that to the amount I’m reporting,’” Ho said.

The way in which people report was not expected to change.

Ho’s comments come as some low-income earners received conflicting information from Centrelink which advised them that they would continue to report as they currently did into the new year.

One letter seen by InDaily and dated November 23 advised the person, who wished to remain anonymous, to continue to “report even if you have not received some or all of the pay yet” in January.

Asked why people were receiving conflicting information, Services Australia general manager Hank Jongen said, while letters issued before December 7 “do mention the current reporting requirements and what customers need to do as of the date of the letter, we’re confident our alert messages, web content and other updates will minimise any confusion after the change kicks in”.

Information about the reporting changes on the Services Australia website is expected to be updated to clarify conflicting information received in letters.

Who is impacted?

Services Australia said the change would affect all low-income earners who received a Centrelink payment or whose partner received the following payments:

- ABSTUDY

- Age Pension

- Austudy

- Carer Payment

- Disability Support Pension

- Farm Household Allowance

- JobSeeker Payment

- Partner Allowance

- Parenting Payment single and partnered

- Special Benefit

- Status Resolution Support Services

- Widow Allowance

- Youth Allowance

Why is it changing?

The federal government has said the change is intended to prevent people from being paid the wrong amount and potentially incurring a debt.

The new system was due to start from July 1 but was deferred until December 7 due to the coronavirus pandemic.

In February, the government estimated it would save a total of $2.1 billion over four years and impact about 550,000 Australians who were reliant on welfare payments.

But, as a result of the coronavirus, the number of low-income earners reliant on government payments has drastically increased, with the number of people on the JobSeeker allowance reaching an estimated 1.5 million.

It follows an announcement last month that the Commonwealth would pay $112 million in compensation to about 400,000 individuals who received robodebts – a system ruled unlawful by the Federal Court.

Robodebt involved matching Australian Taxation Office and Centrelink data to take back payments from welfare recipients, and reversed the onus of proof to make the recipient prove they hadn’t been overpaid.

How often will I need to report?

Jongen said people would be required to report fortnightly.

He said those who weren’t paid during the fortnightly reporting period would not report paid income but would still declare their hours worked within the reporting period.

Low-income earners who receive other payments – such as Christmas bonuses, back pay or monthly income – would have the payment “apportioned” for correlating period, according to Economic Justice Australia (EJA).

“Centrelink will apportion the income forward, by dividing the amount of the lump sum by the corresponding employment period,” EJA said.

“For example, back pay for the previous 12 month period will be assessed when it is paid to an employee and divided by 52 weeks going forward.

“Where there is no corresponding timeframe with a lump sum payment, Centrelink can decide how to apportion the income forward, between two and 52 weeks.”

Didn’t I always have to declare my gross income to Centrelink?

Jongen said people have always declared their gross income to Centrelink.

“This isn’t changing,” Jongen said.

“The change is that they will now report the gross amount they were actually paid during their reporting period, as shown on their payslip.”

He said the new system would make it “much simpler for people to report their income to Centrelink”.

Will I be taxed more?

Ho said Centrelink recipients’ taxable income would not be affected.

“You’re taxed on the income you earn and that won’t actually change. It’ll actually mean that people are less likely to end up with debts,” she said.

“Rather than being taxed differently it will just mean that the debts are less likely to happen.”

Welfare advocate Kym Mercer said the current system had led to errors, with people forced to repay debts as a result.

She said the new system appeared to made it less likely for people to incorrectly declare their income to Centrelink.

What happens during the reporting period change over?

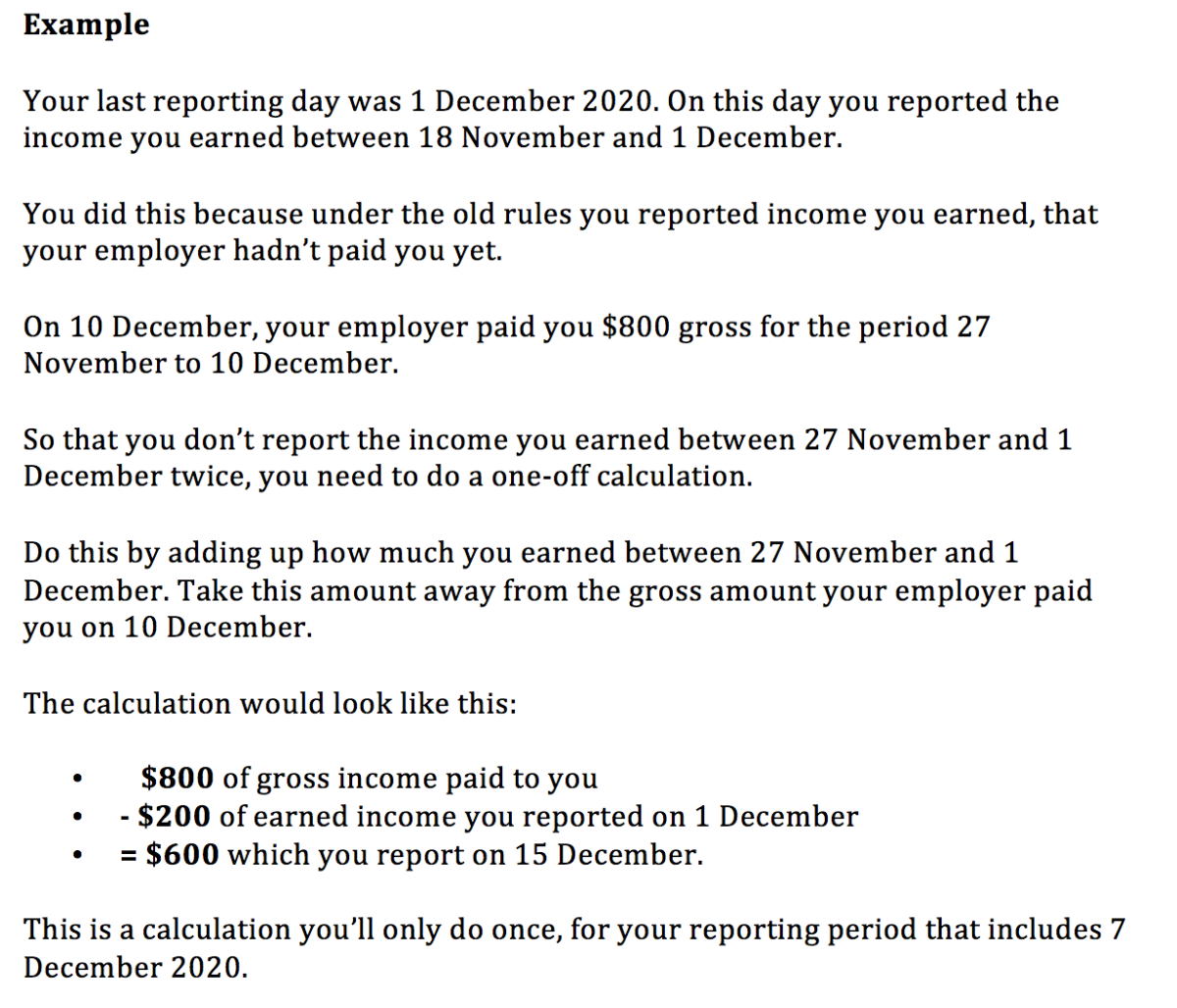

While the change to income reporting is due to begin on December 7, low-income earners who report prior to this date but are paid between December 7 and 18 may need to make a one-off calculation as a result of the change over.

Services Australia said this would prevent declaring income twice.

The government agency website provides the below example for those who do need to make the one-off calculation.

How to calculate the one-off report between December 7 and 18. Screengrab: Services Australia.

Will I need to upload my payslip to the Centrelink online service?

Jongen said people would not need to upload their payslips to Centrelink’s online services.

But he said low-income earners would still be required to report their hours worked in the reporting period in order to meet their mutual obligations.

“This means they report the gross amount they were paid in their reporting period, and the number of hours they worked during the same period,” Jongen said.

While Services Australia said it would not be necessary to upload payslips, South Australian advocacy group Uniting Communities Law Centre (UCLC) advises people to continue to keep copies.

The advocacy group is among a number of centres across Australia which provide free advice on a range of Centrelink-related issues.

People who are experiencing problems with Centrelink payments can find their state’s specialist legal centre through the Economic Justice Australia website.