Centrelink income reporting changes to begin next month

Changes to the way welfare recipients report their income from December 7 will require low-income earners to declare the gross amount they’ve been paid during the reporting period, rather than the amount earned – but welfare advocates say mutual obligations or working credits won’t be affected.

Photo: AAP/Dan Peled

The federal government introduced draft legislation regarding the changes earlier this year in a bid to prevent people from being paid the wrong amount of welfare benefit and potentially incurring a debt.

The change was due to start from July 1 but was deferred until December 7 due to the coronavirus pandemic.

In February, the government estimated the new system would save a total of $2.1 billion over four years and impact about 550,000 Australians who were reliant on welfare payments.

But the impact of the coronavirus pandemic on the job market has pushed the number of people on the Jobseeker allowance to an estimated 1.5 million in the months since.

Low-income advocate Kym Mercer told InDaily that currently, payment recipients reported income to Centrelink either online, through the government’s phone application MyGov or in person, by estimating how much they would be paid based on their pay rate and hours worked.

But this could differ from what recipients were actually paid – particularly for people employed on a casual basis – which the government has since conceded could lead to errors.

Mercer said under the new system, Centrelink recipients would declare the gross amount an employer paid before tax and other deductions for each corresponding reporting period.

Recipients would also need to report the amount their partner had received in the reporting period.

Mercer said while the change of system may prevent further debts, it had left some low-income earners confused and anxious about whether their mutual obligations would be affected and how those who were paid monthly would be impacted.

Job seekers must meet certain mutual obligations – such as working a set number of hours each fortnight – in order to continue receiving their allowance.

These low-income earners are obliged to declare these hours to Centrelink in order to receive their payment or contact the department to explain why they did not meet the punitive requirements.

South Australian advocacy group Uniting Communities Law Centre (UCLC) said recipients would continue to declare the hours they’d worked along with their gross pay.

A spokesperson for the organisation said mutual obligations would not be impacted.

“Under the new changes to employment income reporting, a Centrelink recipient is still required to keep a record (for example keep copies of payslips) and report hours worked during their entitlement period for mutual obligation purposes,” the spokesperson said.

UCLC said those who were paid on a monthly basis would continue to report to Centrelink based on their pay period.

“For example, if a person is paid on a monthly pay cycle, their pay will be applied from the beginning of the fortnight in which it is paid and apportioned forward for the associated earning period,” a spokesperson said.

“For example, 31 days of income will be applied from the beginning of the fortnight in which it is paid and apportioned forward for 31 days.”

According to Economic Justice Australia (EJA) lump sums, including back pay and bonuses, would be assessed when paid.

“Centrelink will apportion the income forward, by dividing the amount of the lump sum by the corresponding employment period,” it said.

“For example, back pay for the previous 12 month period will be assessed when it is paid to an employee and divided by 52 weeks going forward.

“Where there is no corresponding timeframe with a lump sum payment, Centrelink can decide how to apportion the income forward, between two and 52 weeks.

“While these new changes have been implemented to improve the reporting system, Centrelink have assured EJA that any Centrelink recipients struggling with online reporting will be able to opt to speak to a person who will be able to assist them.”

They said working credits, which increased the amount a low-income earner could make before their Centrelink payments were reduced, would remain unchanged.

Low-income earners can “build up” working credits when their total income – not including the Centrelink payment – is less than $48 per fortnight, according to Services Australia.

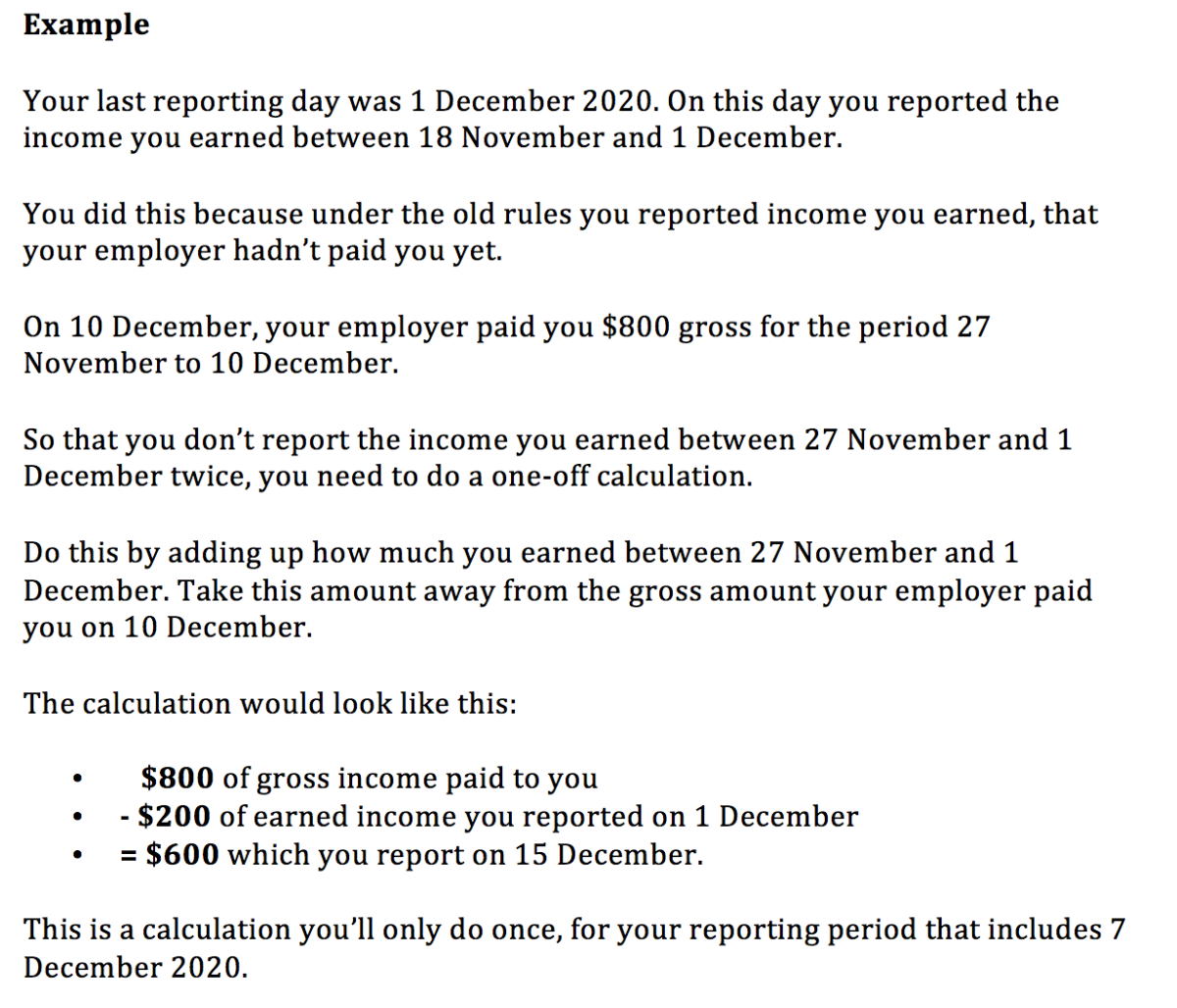

The Department said while the change was due to come into effect from December 7, people who reported prior to this date but were paid between December 7 and 18 may need to make a one-off calculation as a result of the change over.

It said this would prevent declaring income twice.

How to calculate the one-off report between December 7 and 18. Screengrab: Services Australia.