Higher unemployment looms in 2024, but that doesn’t mean a spike in job losses.

The past year has been unlike any other for Australia’s jobs market, which heads into 2024 in a position of historic strength despite the creeping effects of higher interest rates starting to soften conditions.

Its been a remarkable year for the jobs market, and 2024 is shaping up to be no different. Photo: TND

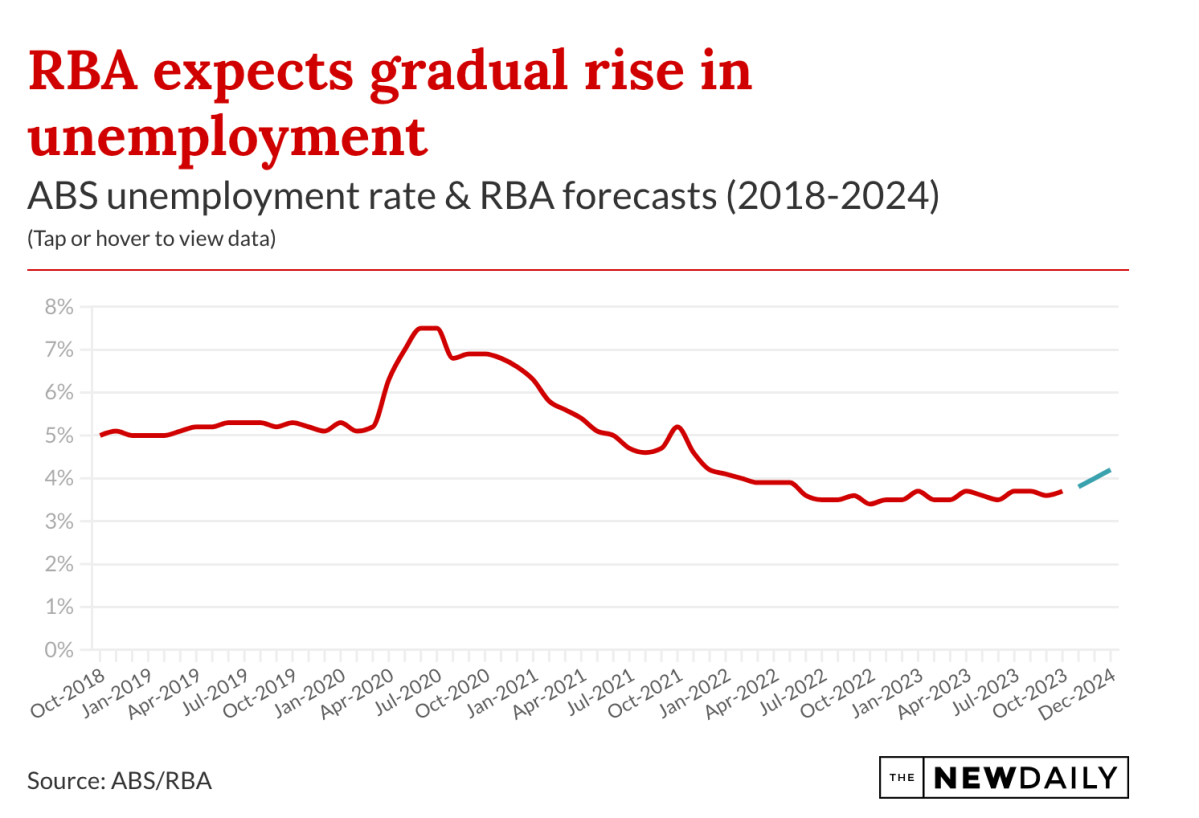

Unemployment sat within a tiny 0.2 percentage point window for most of the year between 3.5 per cent and 3.7 per cent, before rising to 3.9 per cent in November in what could be a sign of what’s to come for workers.

On the one hand, that’s a run of remarkable stability made even more surprising by economic upheaval elsewhere as rates have increased.

But the upward trajectory in the jobless rate heading into 2024 is also an ominous sign that the financial pain engineered by the Reserve Bank has begun to slam the brakes on the jobs market – albeit gradually.

It all begs important questions for workers; How far will unemployment rise in 2024? And does that mean job losses or just fewer new jobs?

Leading economists are predicting the latter will be the case and that Australia’s jobs market will undergo an orderly softening next year, with jobs growth to continue slowing and participation to remain very high.

All else equal, that means higher unemployment, but as University of Melbourne professor Jeff Borland explained, a spike in layoffs is unlikely.

“What you’re most likely talking about is a continued slowing of employment and jobs growth,” Borland said.

“I don’t think we’re talking about a sustained period of negative employment growth.”

Indeed, APAC economist Callam Pickering outlined a similar view, saying workers shouldn’t expect jobs market conditions to plunge significantly.

Some perspective is useful here – while unemployment is set to rise and jobs growth is slowing, vacancies remain at historically strong levels.

That will help workers who are looking to move jobs or find themselves between roles in the coming months, with plenty of opportunities available.

“There remains incredibly strong demand for workers across the nation,” Pickering said.

Unemployment rising

As things stand the Reserve Bank predicts unemployment will rise to 4 per cent by June and then to 4.2 per cent by the end of 2024.

Employment growth of 3.3 percentage points is tipped over that period.

At first glance the idea that unemployment will rise without an accompanying spike in job losses is counterintuitive, but it’s actually remarkably simple.

As a statistical measure, unemployment takes in a measurement of the labour force (those able and trying to work) and estimates the proportion of those people who don’t have a job versus those who have paid work.

That means an expansion in the labour force can push unemployment upwards, while the underlying number of jobs in the economy still rises.

As much was evident in the ABS November labour force figures, which saw the jobless rate tick upwards to an 18-month high 3.9 per cent.

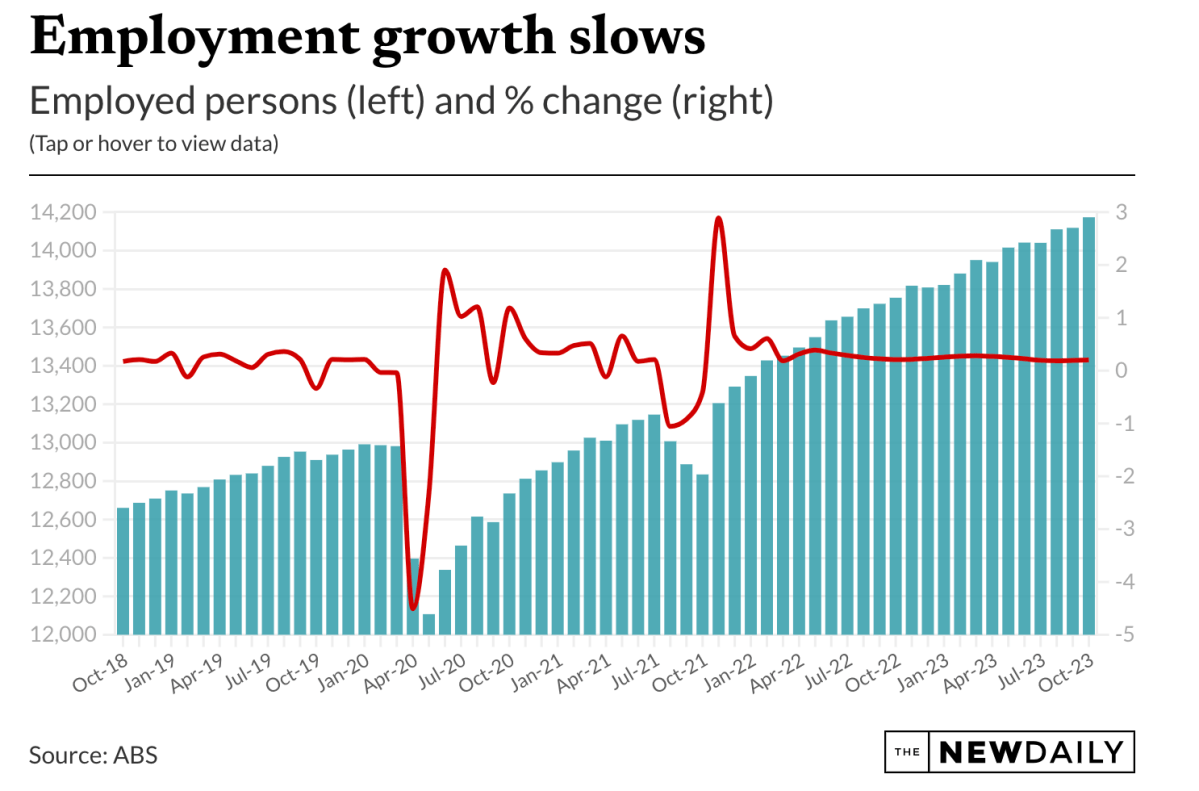

That came despite an estimated 35,600 rise in monthly employment, because the participation rate rose to a record high of 67.2 per cent.

In other words, what’s happening in the jobs market heading into 2024 is that fewer jobs are being created, rather than a net loss in employment.

“What you often see as an economy begins to soften is that unemployment increases, but you’re not necessarily seeing job losses, you’re just seeing lower levels of job creation,” Pickering said.

Borland said it has taken a while for the reality of a slowing economy to show up in labour market data, largely because the extent of worker shortages during COVID-19 has taken time to wash through the market.

He pointed to a “big gap” that emerged between available jobs and employment levels between 2021 and mid-2023, which has since begun to shrink amid higher rates and a slowing economy.

“We’re eating into that stock of vacancies,” Borland said.

“There has, in fact, been a substantial slowing in jobs growth over the past year.”

Wages growth to moderate

The likelihood that the jobs market will soften in 2024 also suggests that a recent rise in wage growth will also start to temper.

That’s because wages often reflect the demand for labour and how high workers can bid up their pay packets because their skills are scarce.

As the number of available workers relative to the number of jobs that need doing grows, that worker bargaining power also starts to erode.

The Reserve Bank anticipates Wage Price Index (WPI) growth will slow from 4 per cent in December 2023 to 3.7 per cent by the end of 2024.

Those outcomes suggest real wage growth (wages adjusted for price inflation) will continue to be negative over the next 12 months at least.

This story first appeared in our sister publication The New Daily.