Super returns jump as retiree balances grow

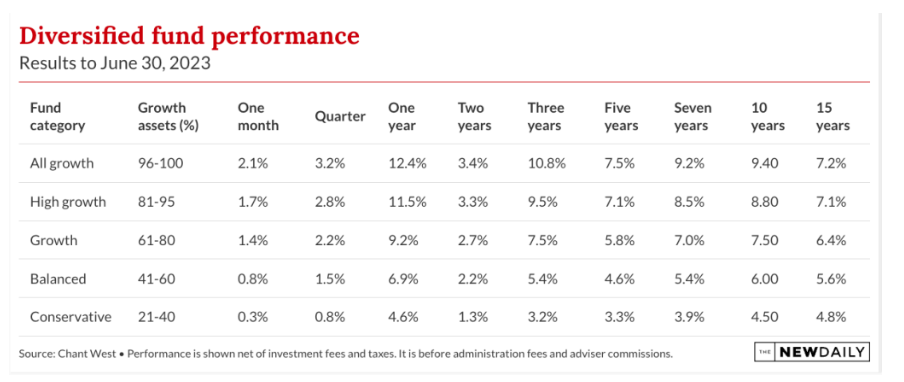

Superannuation fund members enjoyed a stellar year to June 30, 2023, with returns on the median balanced fund with 61 to 80 per cent growth assets reporting 9.2 per cent growth, according to Chant West.

The figures beat both the inflation rate of 6 per cent and the 3.3 per cent losses recorded the previous year.

It also adds to the strong performance over time this decade, regardless of the COVID-19 market bust.

Those returns highlight the durability of superannuation as an investment.

“Funds have shown their ability to limit the damage when markets are weak, but still capture substantial upside when markets perform strongly,” Chant West’s research manager Mano Mohankumar said.

Over the pandemic the median growth fund lost 0.6 per cent in 2020 but recovered with a dramatic 18 per cent jump the following year.

“There was a reward for fund members who have remained patient and maintained a long-term focus,” Mohankumar said.

Where the best growth was

Over the year to June, eight of the top-10 performing funds were industry funds, with Mine Super returning 12 per cent and Vision Super returning 11 per cent.

All the top-10 funds returned better than the 9.2 per cent median performance with the two retail funds, Mercer and IOOF, returning 9.9 per cent and 9.7 per cent respectively.

Chant West’s tables include all funds that have significant growth allocations, but misses some smaller funds with growth assets of less that $1 billion.

Nonetheless, its measurements cover the vast majority of pooled superannuation assets.

Researcher SuperRatings said all balanced funds (60 to 76 per cent growth assets) were likely to be in positive territory.

Much of the growth came from strong sharemarkets, with Australian markets returning 14.4 per cent and offshore markets 18.3 per cent over that time.

“Bonds were pretty flat for the year, with Australian bonds returning 1.2 per cent and international bonds losing 1.2 per cent,” Mohankumar said.

Rising interest rates saw the cash allocation have its strongest year in a decade with a return of 2.9 per cent.

The figures on unlisted allocations are not yet collated, but Mohankumar said infrastructure was expected to make double-digit returns while private equity and unlisted property will finish slightly in negative territory.

Unlisted property has been hit by a weakening market for office buildings which have been affected by the permanent move to working from home in many sectors.

Meanwhile, listed real assets were mixed, with Australian listed property up 7.5 per cent while international listed property and international listed infrastructure were down 5.9 per cent and 2.8 per cent, respectively, Mohankumar said.

Longer term

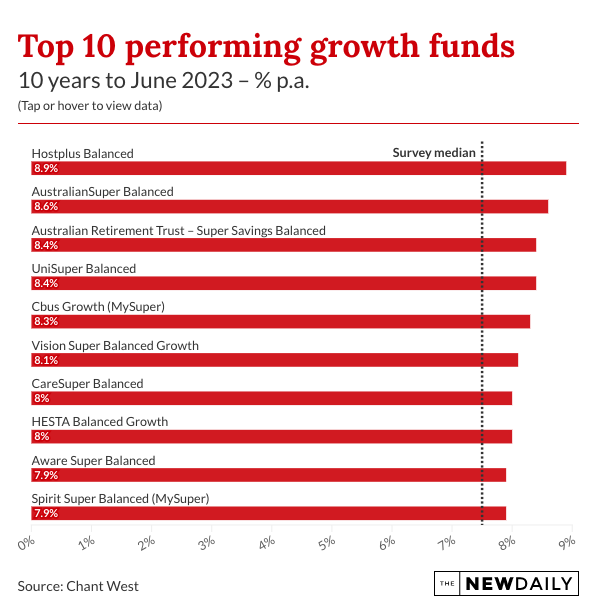

Looking at returns over 10 years, the big industry funds came to the fore.

Hostplus, AustralianSuper and Australian Retirement Trust took the top three places with returns of 8.9 per cent, 8.6 per cent and 8.4 per cent respectively.

The top 10 all performed better than the median return of 7.5 per cent and all were industry funds.

Super continued to outperform the expectations of its creators, which were that growth funds would outperform inflation by 3.5 per cent annually.

However, over the 31 years since compulsory super began in July 1992 “the annualised return was 7.8 per cent while the annual CPI increase was 2.7 per cent, giving a real return of 5.1 per cent – well above that 3.5 per cent target,” Mohankumar said.

All that means that the retirements of everyday Australians will be better than was expected.

The super system is continuing to evolve, with research from Rainmaker showing that 40 per cent of the massive $3.3 trillion superannuation pool is owned by retirees.

By 2028 this figure will grow to 50 per cent.

“These estimates have far-reaching implications for the superannuation landscape and investment strategies,” said Alex Dunnin, executive director of research and compliance at Rainmaker Information.

Retirees increased ownership of pool

“Understanding the shifting dynamics and increased ownership by retirees is crucial for devising effective investment strategies and ensuring the long-term sustainability of the superannuation system,” Dunnin said.

Regulator APRA recently found that funds need to improve the assistance they give to retiring members to develop an effective retirement strategy.

The figures also demonstrate that the ownership of wealth in the super system is heavily slanted to older people with self-managed funds.

Retirees own 40 per cent of superannuation assets, but only 26 per cent of investments in APRA-regulated funds are in retirement phase.

APRA-regulated funds had $2.25 trillion on behalf of 20.6 million members last June, while SMSFs held $869 billion on behalf of only 1.12 million members.

The average member balance of a pooled fund was $100,000, while for an SMSF it was $746,000.

As retiree funds grow, retirees are increasingly able to get by without spending all their super savings.

Assistant Treasurer Stephen Jones said that one in three cheques written by super funds represent bequests to heirs following the death of members.

There needed to be further conversations about the purpose of super and how best to ensure it is implemented, he said.

“It’s not the purpose of superannuation to have a tax-preferred, state planning mechanism. It’s for providing for people in their retirement,” Jones said.

This story first appeared in our sister publication The New Daily, which is owned by Industry Super Holdings.