No vacancy: Logistics space in northern suburbs dries up

Adelaide’s northern suburbs have run out of logistics properties, with a COVID-induced flurry of tenants pushing the area’s vacancy to zero.

Photo: CBRE

Logistics businesses are turning to the western suburbs and the outer north for remaining land now that the northern suburbs are fully occupied.

New data from CBRE demonstrates a “chronic undersupply” of logistics space in Australia, particularly in Adelaide which has an average vacancy rate of below 1 per cent.

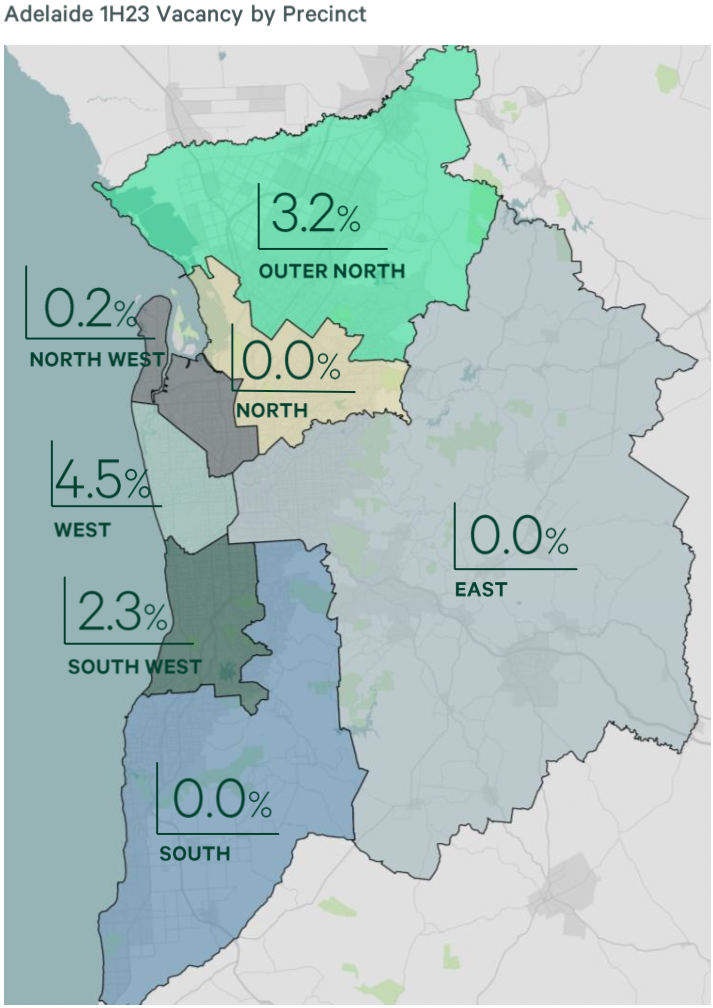

The largest decline was recorded in the North precinct, down from 1.5 per cent in the second half of 2022 to 0 per cent in the first half of this year.

Other areas experienced an uptick in vacancy, with the west rising by 250 basis points, the south west by 230 points and the outer north by 200 points.

The spread of logistics vacancy in Adelaide. Photo: CBRE.

CBRE South Australian director Jordan Kies said the state’s figures reflect the national trend, with Australia’s vacancy rate dropping from 6.3 per cent to 0.6 per cent.

“Adelaide has traditionally been the baby brother to Melbourne which has the larger distribution centres,” Kies said.

“Prior to COVID, clients would order products and it would jump on a truck and be driven to Adelaide overnight and arrive in the morning. What happened with COVID was that businesses required actual facilities in Adelaide to store more product because otherwise they couldn’t get the product.

“As a result, our leasing demand went through the roof – hence why we haven’t got much vacancy at the moment.”

Kies said the drop in vacancy was a function of a lack of spend on good quality logistics buildings in Adelaide.

“Adelaide has a fundamental flaw of not a lot of good quality space – so we’ve got a lot of secondary stock which has been a major beneficiary in this market,” he said.

“When there’s little vacancy, a lot of tenancies are going into the older buildings and there’s been good rental growth in that space as well.”

As for when more logistics stock might come online, Kies said developers are holding off because of high interest rates.

“We had developers that were guns blazing saying they’ll spec build a whole bunch of buildings,” he said.

“Now with the new environment with higher interest rates and slightly softening of the cap rates they’re saying they’ll wait for a pre-commitment tenant.”

With the north at 0 per cent vacancy, the CBRE director said new pockets in Adelaide are gold mines for developers.

“The western suburbs are like hen’s teeth – it’s absolutely gold,” he said.

“But there’s not a lot there because it got rezoned to higher-order use.

“Essentially what’s left is Adelaide Airport which is leasehold land or Mile End which is tightly held. Then you go to the next best thing which is the northwest like Gillman and Port Adelaide – super attractive given all the defence activity.”