Santos profit windfall as energy demand and prices rise

Adelaide-based oil and gas producer Santos has reported a $3 billion dollar after-tax profit – up 221 per cent – in full-year results for 2022, off the back of increased energy demand and rising prices.

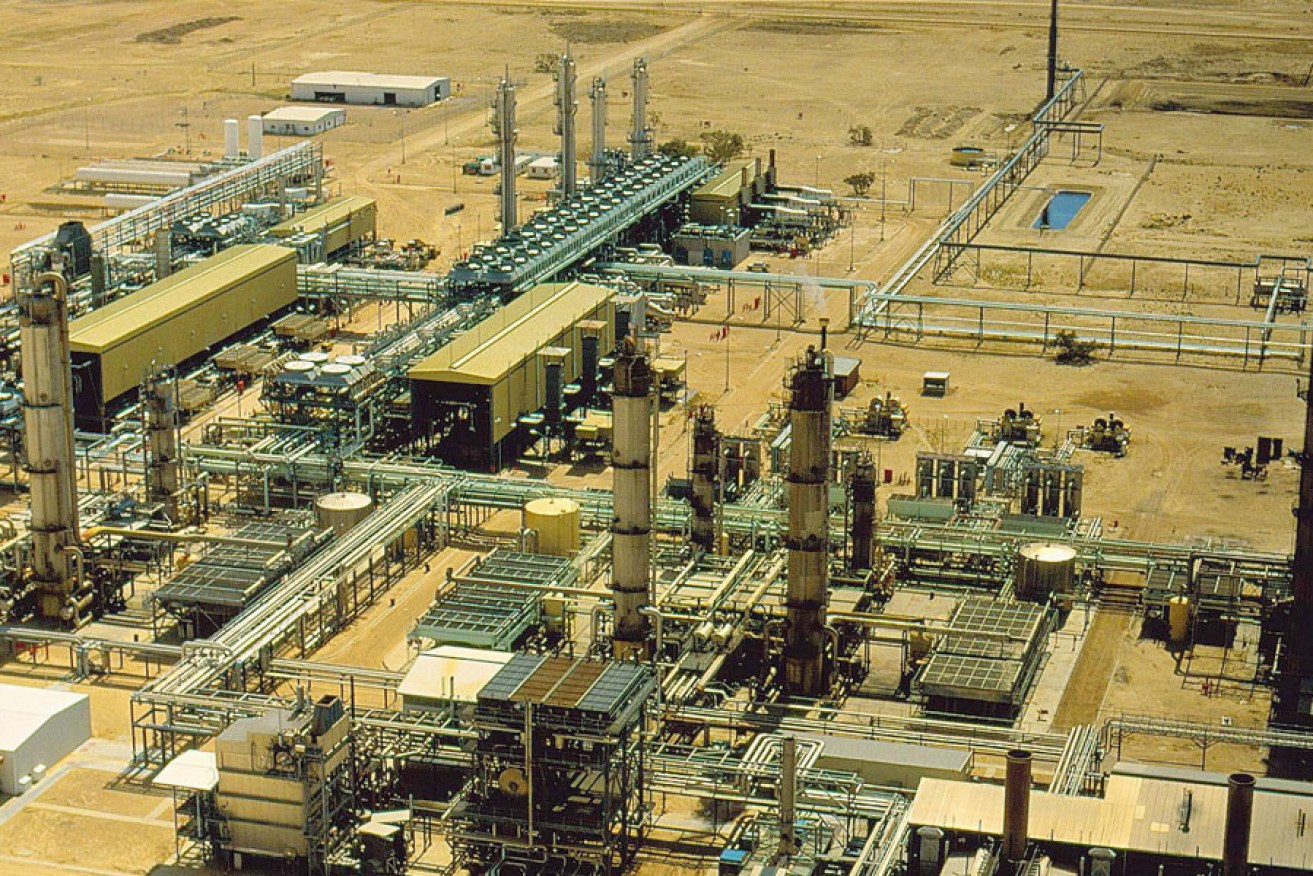

The Santos gas plant in Moomba, South Australia. Supplied image

Santos today reported an after tax profit of US $2.1b, while underlying profit rose by 160 per cent to US $2.4b (AU $3.5b) and free cash flow jumped by 142 per cent to US $3.6b (AU $5.25b).

“The results reflect significantly higher oil and LNG prices compared to the corresponding period due to stronger global energy demand combined with a higher interest in PNG LNG following the Oil Search merger,” the company said in a statement.

Santos paid US $1.1b in government royalties and excise, royalty-related taxes and income tax in 2022 and said it spent US $385m “in our host communities supporting local business and community initiatives”.

The company said it would return US $1.5 billion to shareholders for 2022 under the company’s capital management framework, comprising US$755 million in unfranked dividends and the previously announced on-market share buyback of US$700 million, of which US$384 million had been completed by the end of 2022.

Santos managing director and CEO Kevin Gallagher said the results “demonstrate the strength of Santos, with strong diversified cashflows and capacity to provide sustainable shareholder returns, fund new developments and the transition to a lower carbon future”.

“Strong free cash flows mean we are in a position to deliver higher shareholder returns through an increase in the final dividend and previously announced increase in the on-market buyback, consistent with our disciplined capital management framework,” he said.

“Demand for our products has remained strong in both Australia and internationally, due to increased demand and shortages of supply from producing nations because of global underinvestment in new supply sources.”

Meanwhile, SA-based copper and nickel miner OZ Minerals today reported its net profit after tax more than halved to $207 million for 2022 on net revenue of $1.9 billion, ahead of its acquisition by mining giant BHP.

OZ Minerals managing director and chief executive Andrew Cole said the company had a stronger second half after a challenging start to 2022 amid adverse weather, COVID-19 absenteeism, supply chain disruption, inflationary pressures and a weaker copper price.

“We continued to invest in our growth projects with expansions advancing at Carrapateena and Prominent Hill and final investment approval to develop our fourth operating asset, the West Musgrave copper-nickel project in Western Australia,” he said.

Higher production costs reflected one-off disruptions in the first half, industry wide inflation and labour costs.

Mining operations needed additional support from contractors, diesel and power prices rose and higher hourly rates were paid for both operator and maintenance crews due to interstate market demand and turnover rates.

OZ Minerals low‐cost copper and nickel assets are in demand in a world that is decarbonising and its acquisition will add to BHP’s global footprint as it looks beyond iron ore and coal.

As the use of copper increases globally over the next 20 years more than half is expected to be used for clean energy, including electricity grid infrastructure and equipment that will power homes and businesses.

Nickel is an essential ingredient for lithium batteries used in electric cars and energy storage.

-with AAP