Murdoch scraps merger of News Corp and Fox

Rupert Murdoch has withdrawn a proposal to reunite News Corp and Fox Corp as the company is also exploring a sale of Move Inc, which operates the Realtor.com website, to CoStar Group, according to a regulatory filing and sources familiar with the process.

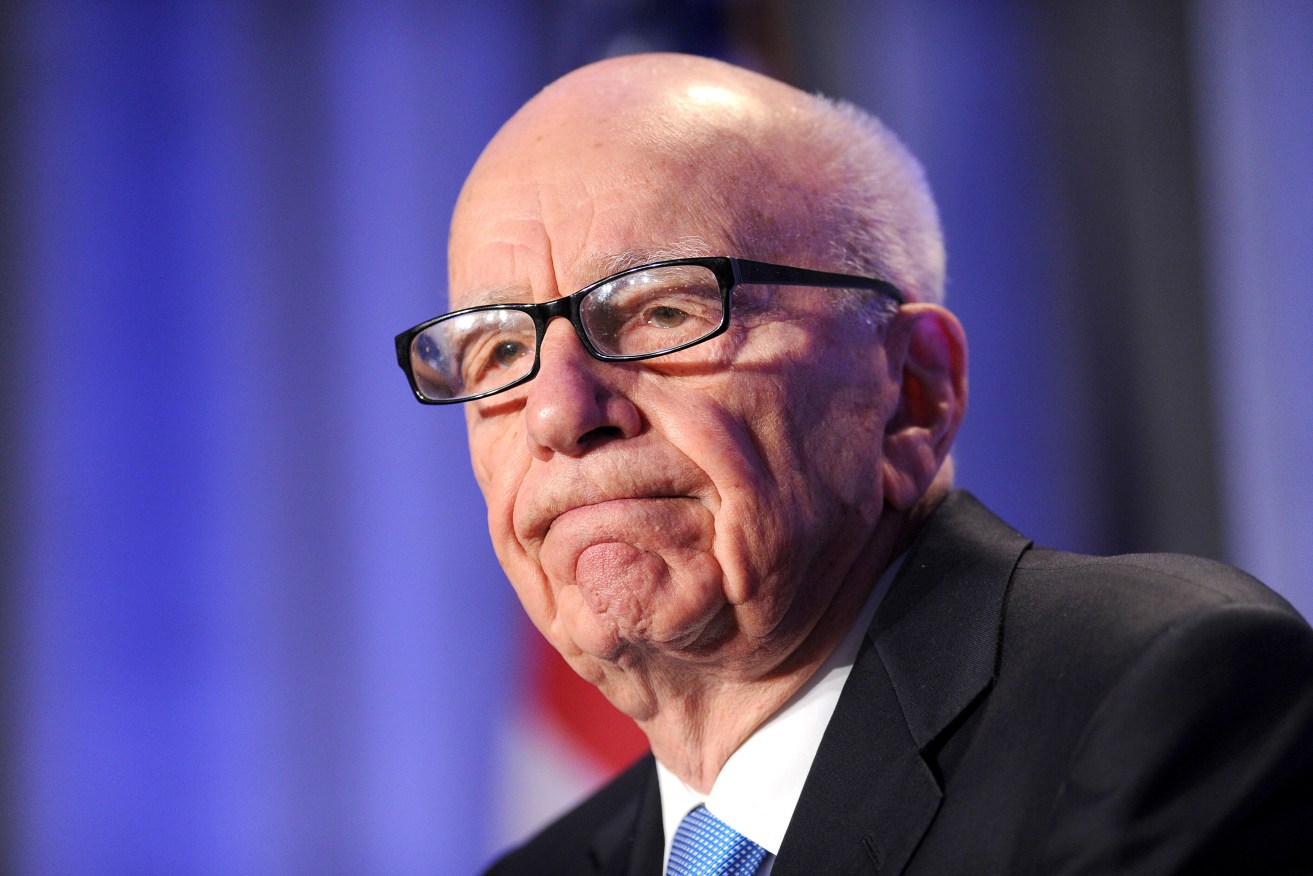

Rupert Murdoch. Photo: AP/Noah Berger

Three sources familiar with the matter said News Corp was in talks to sell its stake in Move to CoStar for about $US3 billion ($A4.3 billion).

Several top shareholders had publicly said they opposed the proposed combination, and on Tuesday News Corp said it was “not optimal for shareholders of News Corp and Fox at this time”.

The deal would have recombined the media empire Murdoch split nearly a decade ago.

News Corp confirmed the talks to sell Move to CoStar after Reuters reported it on Tuesday, adding there was no guarantee the discussions would lead to a transaction.

A spokesperson for CoStar said the company “continuously evaluates M&A opportunities across a broad range of companies to maximise shareholder value” and does not comment on “market rumours or speculation”.

No offer was exchanged between News Corp and Fox Corp before merger deliberations were abandoned, according to sources, who said pushback from News Corp shareholders played a role in those plans being scrapped.

A recent rally in News Corp shares meant Fox would have had to pay a significant premium for the merger to be agreed, something the Murdochs did not believe they could justify to shareholders, people familiar with the matter said.

While Fox’s stock is down five per cent, News Corp shares are up 25 per cent since the talks between the two companies were announced on October 14.

News Corp has a market capitalisation of about $US11 billion, while Fox is valued at more than $US17 billion.

Murdoch proposed reuniting his media empire last October, arguing that together the publishing and entertainment companies he split apart in 2013 would give the combined company greater scale in news, live sports and information, sources said.

Several people close to the Murdochs viewed the attempt to combine the media companies as driven by the 91-year-old Murdoch’s succession planning to consolidate power behind his son and Fox head Lachlan Murdoch, a notion the company described as “absurd” in November.

Some of News Corp’s larger shareholders, including Independent Franchise Partners and T Rowe Price baulked at the idea.

Rupert Murdoch and his family trust control about 40 per cent of News Corp and Fox. Had a deal been reached, they would have abstained from voting their shares when each company sought shareholder approval for the merger, because of the potential conflict of interest. This made securing the backing of other major shareholders a prerequisite to the deal going through.

News Corp agreed to buy Move in 2014 for $US950 million to diversify its digital real estate business which, at the time, was primarily in Australia.

Since then, News Corp investors had been calling on the company to spin off its digital real estate assets.

– Reuters