Santos announces $2.7 billion loss

Robust write-downs to stave off bottoming energy prices have seen Adelaide-based oil and gas producer Santos post a hefty $2.7 billion loss and a 91 per cent drop in net profit.

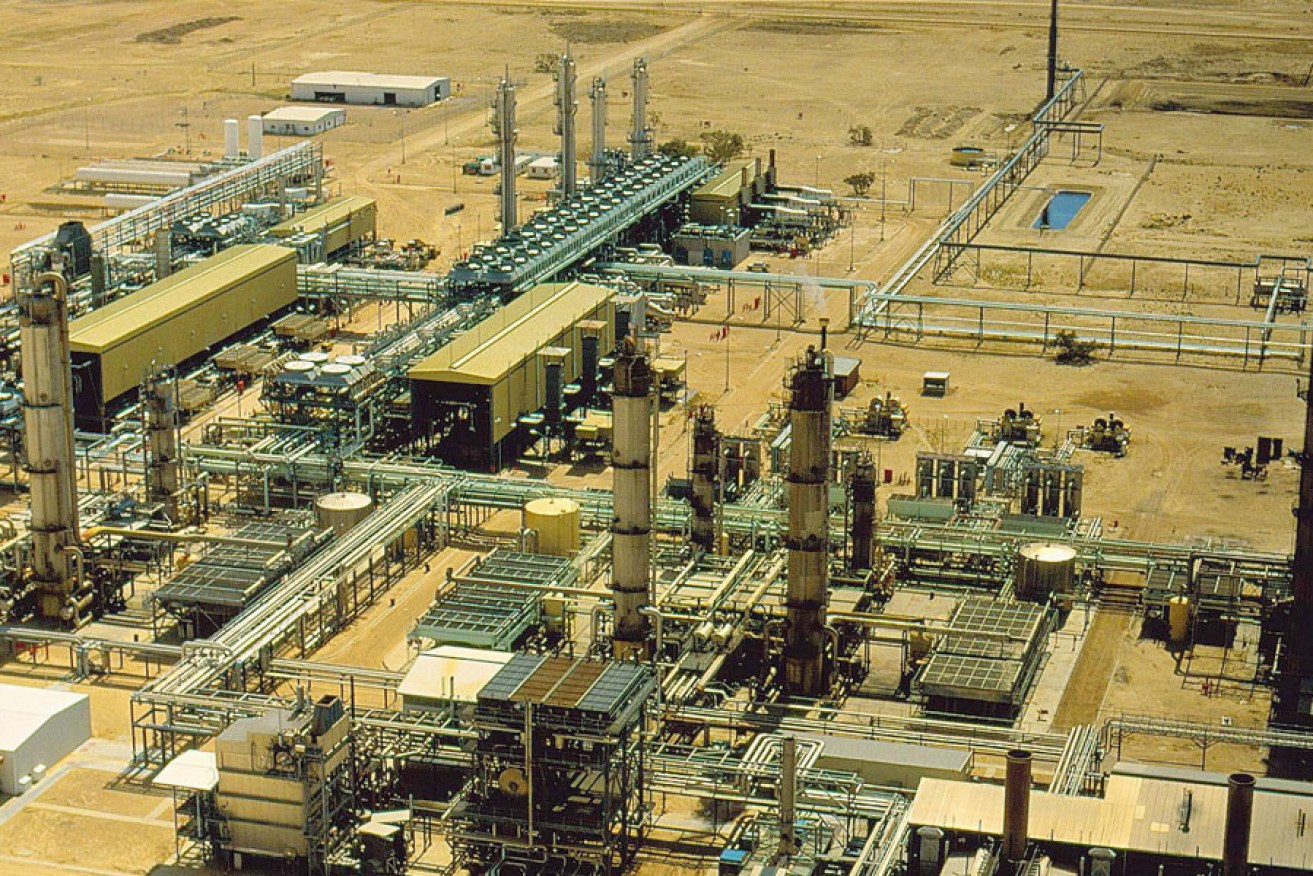

The Santos gas plant in Moomba, South Australia. Supplied image

The tough year was outlined in Santos’ 2015 full-year results which listed an underlying net profit after tax of $50 million, down 91 per cent.

Santos chairman Peter Coates said the producer’s 2015 financial performance reflected the impact of lower global oil prices that had been experienced across the oil and gas industry.

“Despite the continued pressure on the oil price, operationally the business performed well in 2015 with Santos delivering its highest production in seven years, best safety performance on record and the successful start-up of the GLNG project which has shipped 16 cargoes to date,” Coates said.

“It is a credit to management and staff to have maintained focus on safe and effective operations and project delivery in the face of the destabilising market conditions during the year.

“The actions the company took in 2015 to strengthen its balance sheet and lower its cost base have put Santos in a stronger position to manage through a period of low oil prices.”

Eighteen days into his job, Santos managing director and chief executive officer Kevin Gallagher he was focused on the “right strategy” to turn the company around.

“My priority is to assess our operations and put in place the right strategy to ensure that Santos is sustainable in a low oil price environment, while positioning the company to take full advantage of rising commodity prices,” he said.

Coates said during the year the company raised $3.5 billion, reduced capital expenditure by 54 per cent below 2014 levels and lowered production costs per barrel by 10 per cent.

“With $4.8 billion in cash and committed undrawn debt facilities and no material drawn debt maturities until 2019, Santos is well placed to deal with the short-term challenges,” Coates said.

Santos also announced a 20 per cent drop in sales revenue however production was up 7 per cent to 57.7 mmboe and average realised oil prices were down 48 per cent to $US54 per barrel.

Sales revenue was down 20 per cent to $3.2 billion and unit production cost per barrel was down 10 per cent to $14.40/boe.

Capital expenditure was down 54 per cent to $1.7 billion.

Santos was trading at 3.27 at 11.08am (AEDT).