Politics muddles the tax debate – again

Australia’s tax debate continues to be mired in uncertainty and piecemeal tinkering, writes Adelaide tax lawyer Andrea Michaels.

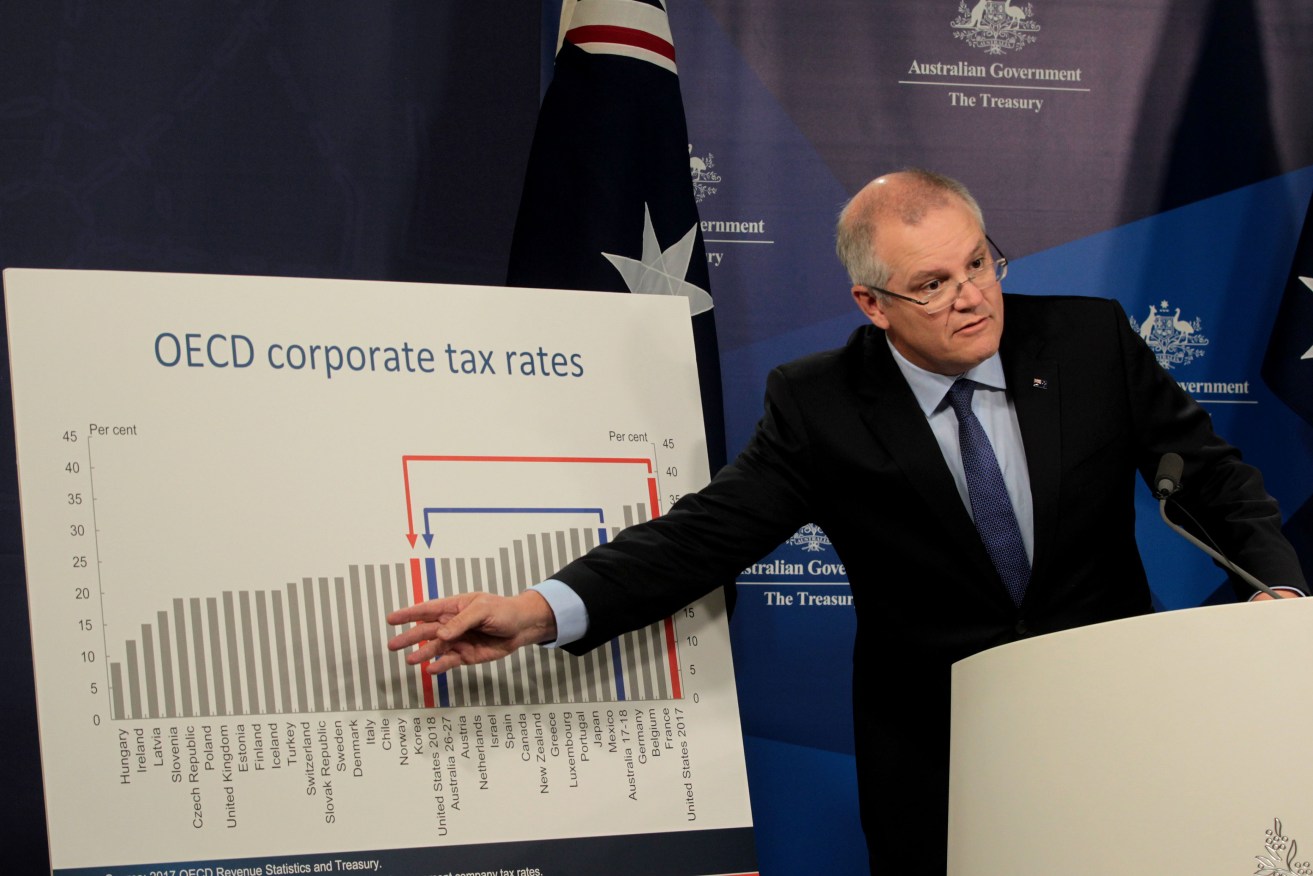

Federal Treasurer Scott Morrison during one of the Goverment's many attempts to sell its corporate tax cuts. Photo: AAP/Ben Rushton

Tax policy debate in Canberra is making national headlines again. The Coalition Government’s yet-to-be-passed corporate tax cuts and the Opposition’s franking credit policy, now affectionately known as the “granny tax”, continue to drive news bulletins. One piece from ABC journalist Emma Alberici on the federal corporate tax cuts a month ago was pulled, reworked and reposted, but it still made good reading – even if it upset the PM and Treasurer in the process.

But the thing I find interesting about tax policy is that while there isn’t ever only one answer, there can certainly be a wrong answer – and that’s usually an answer based around politics. That’s what’s happening now and it’s muddying the waters around the real issue – which is a need for wider, sustainable economic reform.

Balancing self-interest over sustainable growth

Ultimately the problem Australia faces is slow growth, particularly around wages. While industry wants the government help to boost profits and investment, national spending on social security, NDIS, education and health are putting pressure on the public purse. Yet we’ve got to find the money to pay our bills from somewhere.

Business leaders and everyday taxpayers are listening carefully to what the government plans to do. But they don’t always get it right.

Self-interest is at the top of the agenda. For big business, it’s investor demand and the search for higher profits, while smaller businesses want an environment that helps them survive and grow. For individuals, bracket creep and high marginal tax rates are a big problem. Now the massive super industry is in a panic about the Labor announcement on scrapping franking credit refunds. So much so, the Opposition announced a tweak to the policy to carve out pensioners.

Conflicting interests create tension when taxation policy is really meant to help drive the economy, ensure fairness and safeguard the wellbeing of the community.

While we operate within a competitive global economy, it’s not always easy for policy-makers and it will always be a balancing act. It’s not just a balancing act in terms of policy choices, there’s also the politics and drama of getting changes through parliament (cue Derryn Hinch with his interesting side deals in exchange for his vote for the corporate tax cuts ).

If those corporate tax cuts could ever get through we can tick the box re attracting inbound investment, but we also need to make sure our taxation policies are holistic, effective, reasonable and deliver benefits for the majority. The jury on still out on that count.

A race to the bottom

Doing nothing, just trying to ‘patch things up’ or working to appease one section of the community really doesn’t solve the problem in the end. You can’t just put your toe in the water with tax reform, and that’s been our issue for a long time.

We’ve been debating the good, bad and the ugly of corporate tax cuts since the small business tax cuts in the 2016 Budget. The current corporate tax proposal would cost us $65 billion over the first 10 years. But it raises some questions. Will it deliver the panacea the government is looking for in terms of jobs and wages growth or is it a gamble? Does the trickle-down economic model always work?

It depends on circumstances. In the UK, research shows reducing company tax rates hasn’t provided a major boost yet in terms of growth or wage increases. In response to the US tax cuts, the IMF has predicted an increase in short-term growth, but on the condition that the US government doesn’t cut spending. The IMF predicts increased deficits will be the end result. In Greece, a rather extreme example, the government borrowed money to increase wages for government employees and to lower corporate tax rates yet, in the end, as we know, it put them into unmanageable debt. I don’t think anyone believes there was a good outcome there.

Noted economist Saul Eslake said recently he wasn’t sure about the link between cutting company tax rates and increased investment into Australia – warning tax policy shouldn’t be a “race to the bottom”. Likewise, respected American economist Arthur Laffer warned many years ago that trickle-down economics only works when taxes are extremely high or “prohibitive” to start with and then they are lowered to an average range. After that point, he said, further cuts usually result in reduced revenue without stimulating economic growth.

Indeed, many people are angry that corporate tax rates are being discussed in isolation, labelling it unfair.

ATO figures show significant numbers of the largest Australian and foreign-owned companies already pay very little or no tax at all. If they are our biggest employers, will cutting the corporate tax rate have any impact on their employee wages or recruitment? And are any theoretical gains effectively wiped out by the reality of the 10-year timeframe to eventually get to a rate of 25 per cent? How many new employees are you going to be able to hire on a 0.5 per cent tax cut in 2024?

So where to now?

We need to look at tax rates as part of wider policies to drive long-term growth, while finding ways to raise revenue through an increase in broad-based taxes like the GST. I’m still waiting for that news.

We now have Senator Hinch interested in an arrangement that will oblige companies that receive the tax cut to gradually increase wages. How that can be legislated is another question.

We should expect to see personal tax rates addressed in the next federal Budget if recent government comments are anything to go by. It will be interesting to see what is proposed there given proposed company tax cuts and the Opposition’s tax announcements. It’s important to consider the impact of Australia’s franking credit system which most other countries don’t have. The impact of this system in tax credits flowing down to shareholders means cuts to individual tax rates are likely to have a greater impact on our economy than just the corporate tax rate changes that have been proposed so far.

The pieces of the puzzle need to fit together. In fact, the Liberal corporate tax cuts actually reduce the impact on the taxpayer of Labor’s franking credit refund freeze – i.e. with lower corporate taxes, the grannies will get less back anyway. It makes the costing of these policies an interesting dilemma.

In the end, we will all have our views on tax. I hope the government encourages this debate, because we really need to sort this out properly and make some decisions. The Turnball government is pushing for a final result from the Senate on the corporate tax cuts in the next two weeks. If it’s not done by then, parliament won’t be back until the week of the federal Budget and the business community will continue to have to operate with the uncertainty it’s faced over the last couple of years.

It’s all getting just a tad tiring. Leadership needs to show us the big picture, announce the plan and get on with it. Nothing is going to be perfect with all this tinkering around the edges, but I sure hope it will lead us in the right direction. We need to remember that what we’re talking about is economic theory based on assumptions. Let’s hope some of them turn out to be right – until then I remain sceptical.

Andrea Michaels is the Managing Director of South Australian commercial law firm NDA Law. She is a member of the Labor Party.