SA’s economic outlook: public spending covers crash in private investment

Analysis of South Australia’s economic performance over the term of the Weatherill Government shows a concerning lack of growth, writes economics commentator Richard Blandy.

The 2017-18 Budget Statement projects state debt to rise to $15 billion by 2018.

Over the term of the Weatherill Government, South Australia’s economic performance has been weak by comparison with Australia’s as a whole and the two leading economies of Victoria and New South Wales.

Any assessment of economic outcome should look over the whole term because annual South Australian economic growth figures have been subject to massive revisions. For example, the increase in South Australian Gross State Product in 2015-16 was announced in November 2016 as 1.9%. This has just been revised down to 0.3%.

The just-announced increase in South Australia’s GSP for 2016-17 of 2.2% is similarly unbelievable in the context of what we know generally about the South Australian economy.

There is no reason to suppose that this situation is changing. On the contrary, the Government’s resort to both employment and investment subsidies (“industry attraction”) reveals an emerging economic crisis. Private investment has crashed. The unemployment rate is only as low as it is because large numbers of South Australians have moved for work interstate.

This dire situation has been covered up by a very large increase in Government investment spending (the ubiquitous road works are supposed to give voters a feeling that things are moving forward). State debt has ballooned from $9 billion in 2013 to $14 billion in 2017, and is projected in the 2017-18 Budget Statement to rise to $15 billion by 2018 – 13% of projected Gross State Product. Nine years ago state debt was less than $2 billion – only 2% of GSP.

At some point in the next term of Parliament the rate of increase in Government spending will fall and/or South Australian Government taxes and charges will rise and/or the South Australian Government will sell more publicly-owned assets and/or state debt will rise more than presently predicted. South Australia’s rate of economic growth will fall further. Yet more people will leave the state as the medium-term economic outlook worsens – keeping the South Australian unemployment rate down – to be hailed again by the Government as evidence of the success of its economic strategy.

In the context of the persistent structural problems facing the advanced economies – resulting in low productivity growth and greater income inequality – inward-looking economic policies are becoming more popular, with adverse consequences for national and state, as well as global, economic growth.

Far from returning to the faster economic growth of the pre-GFC era, the world economy appears to be stuck in a slower trajectory, although there are some developing countries, such as India, whose economic reform efforts are starting to bear significant fruit.

Hence, the international and national economic contexts for the South Australian economic outlook are also not encouraging.

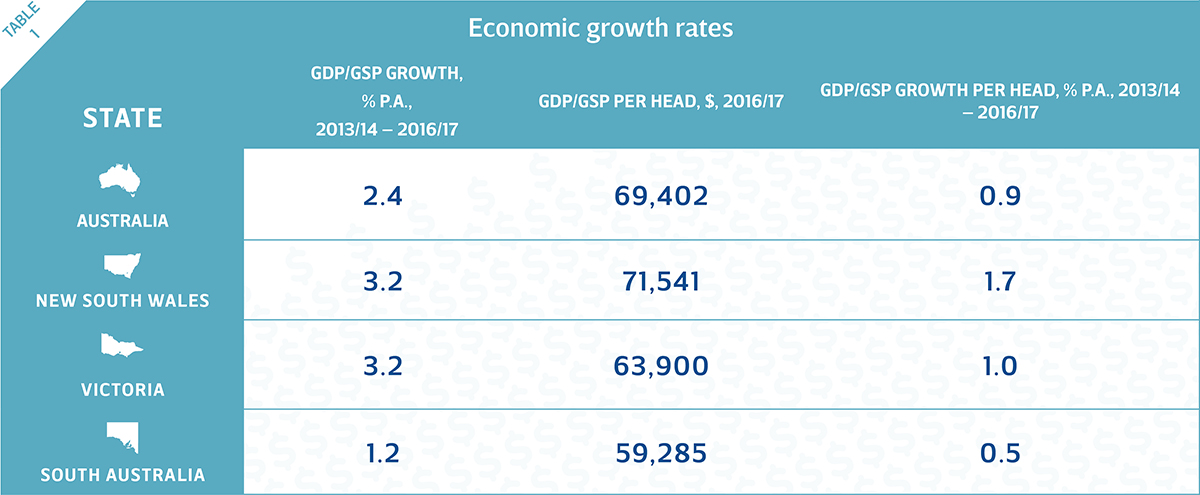

Table 1, below, shows the rate of growth of Gross State Product for South Australia, New South Wales and Victoria, as well as the rate of growth of Gross Domestic Product for Australia as a whole, from 2013/14 – 2016/17, coinciding as well as the figures will allow with the term of the Weatherill Government to the present time.

Source: Australian Bureau of Statistics, Australian National Accounts: State Accounts, 5220.0: Table 1. Gross State Product, Chain volume measures and Current prices, 2017.

As can be seen in Table 1, South Australia’s rate of GSP growth, over the whole period of the Weatherill Government for which we have data, has been half the rate of Australia’s GDP growth and less than 40% of the rate of growth of GSP in New South Wales and Victoria. Nevertheless, South Australians had an output per head that was 85% of the average for Australia as a whole (and 93% of Victoria’s), but growing at a far slower rate than Australia’s as a whole (only 55%) and only a half to a third the rate of Victoria and New South Wales.

What these data show is that SA has grown only very slowly over the term of the Weatherill Government and that, if we keep going at this rate, we will become much less productive, and ultimately poorer, than people in New South Wales and Victoria, notwithstanding the exodus of job-seeking South Australians, to those states, particularly.

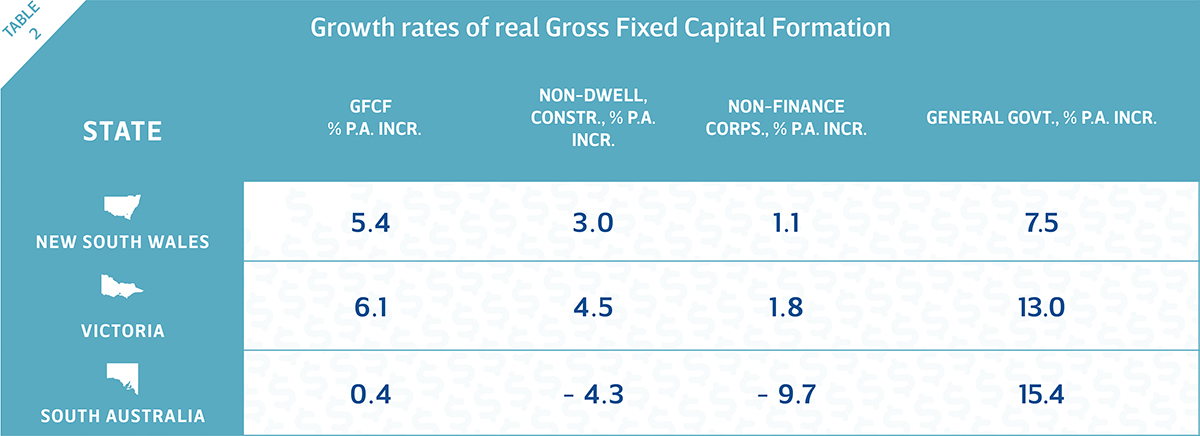

Table 2, below, shows the difference in investment patterns between South Australia, New South Wales and Victoria, from 2013/14 – 2016/17, coinciding as well as the figures will allow with the term of the Weatherill Government to the present time.

Source: Australian Bureau of Statistics, Australian National Accounts: State Accounts, 5220.0: Tables 21, 22 and 24. Capital Stock by Type of Asset, institutional sector and industry.

As can be seen in Table 2, South Australia’s increase in investment was pitiful compared with New South Wales and Victoria. Major falls occurred in investment by non-finance companies in South Australia and in non-dwelling construction, unlike in the major States. By the same token, investment in South Australia by Government rose at the very fast annual average rate of 15% p.a.

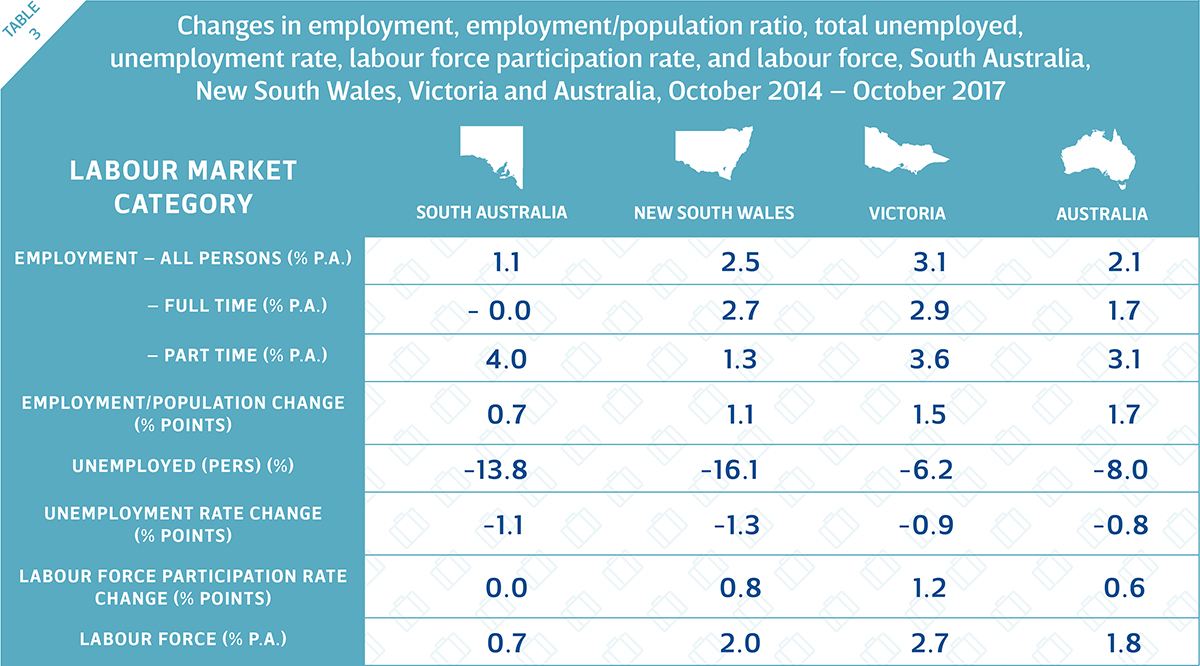

The labour market outcome of these economic growth rate differences from October 2014 to October 2017 is shown in Table 3, below.

Source: Australian Bureau of Statistics, Labour Force Australia, Tables 1, 4, 5 and 7, Labour force status by Sex, Australia, New South Wales, Victoria and South Australia – Trend, Seasonally adjusted and Original.

As can be seen (first row), employment growth in South Australia over the period of the Weatherill Government has been half the national rate and about a third of the rate in Victoria. Furthermore, all of the employment growth in South Australia has been in part-time jobs, unlike in Australia as a whole and in New South Wales and Victoria, which have had significant growth in full-time jobs.

Employment has grown far more slowly than population in South Australia, unlike Australia as a whole and in New South Wales and Victoria. This is consistent with the zero increase in the labour force participation rate in South Australia compared with Australia as a whole and in the eastern states. It is also consistent with the low rate of growth in the labour force in South Australia, compared with Australia and the eastern states. These are all signs of a comparatively low rate of increase in demand for workers in South Australia.

The large fall in the number of people unemployed in South Australia is curious, therefore. It cannot be due to a strong demand for labour in South Australia because Table 3 shows that the demand for labour has been weak. The labour force participation rate has not increased in South Australia (unlike the eastern states and Australia as a whole, where employment has grown strongly). As a result, the labour force in South Australia has grown at only a third of the rate of New South Wales and a quarter of the rate in Victoria. The fall in unemployment in South Australia must be due, therefore, to interstate and possibly overseas, migration of workers from South Australia keeping labour force growth down – not to the success of the Weatherill Government’s economic policy in creating jobs.

It is time for South Australians to demand a State Government that will set fast economic and employment growth parameters for the state that reward private sector initiative and investment without businesses kowtowing to the state.

Richard Blandy is an Adjunct Professor of Economics at the University of South Australia, an Emeritus Professor of Economics at Flinders University, and a contributor to InDaily.