Will the Federal Budget spending spree deliver for SA business?

South Australia is a state largely dominated by small to medium private businesses. So, what will last week’s big-spending federal budget mean for the state’s economy?

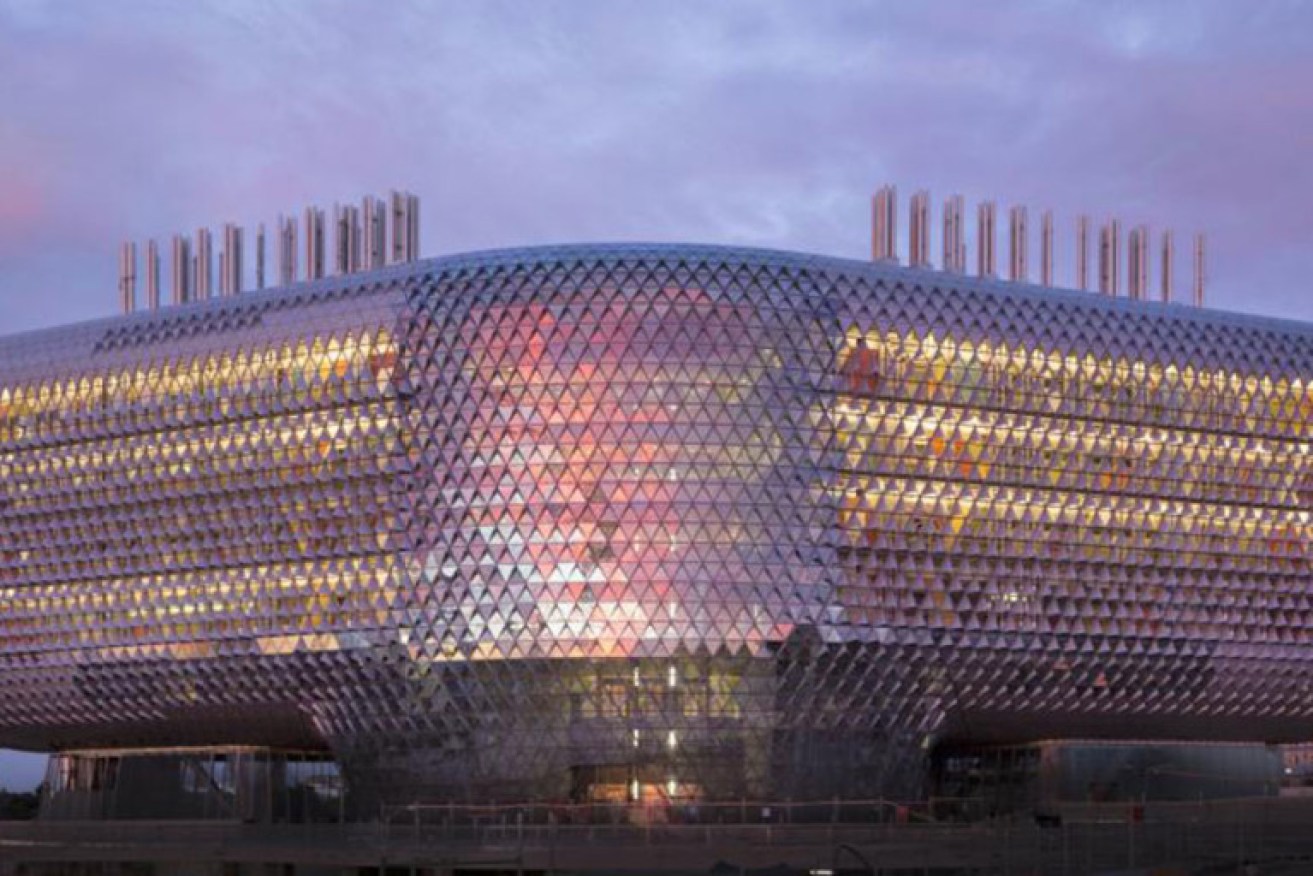

The Modern Manufacturing Strategy aligns well with key SA industries including medical. Picture: Woods Bagot.

Treasurer Josh Frydenberg’s October 6 Federal Budget was clearly aimed at stimulating the Australian economy and creating jobs – with any concerns over how we are going to pay for it having to wait until later.

The big question is whether the measures will lead to the desired behaviours that are so critical to the budget’s success.

Will people who get tax cuts spend the money or save it?

Will businesses buy more assets if they get a full deduction, or will they remain cautious?

South Australia is a state largely dominated by small to medium private businesses. Given the circumstances elsewhere, we can all agree that South Australia has been relatively lucky and life generally feels like its heading back to ‘normal’.

But this very much depends on which industry you operate in.

Hospitality and Tourism, for example, has been far more heavily impacted by COVID than many other industries.

Given that, let’s take a closer look at some of the main business measures from the budget, and what they mean for SA.

Personal tax cuts

Previously flagged personal tax cuts are being brought forward, with the maximum benefit of $2,745 at $120,000. In the absence of a vaccine, many South Australians are still nervous about the possibility of a second wave. Whether this will impact their decision to either spend or save the extra dollars will obviously depend on personal circumstances.

The overall trend has seen savings and repayments of debt increase significantly since COVID hit.

These changes are backdated to 1 July 2020, but we are likely to see the cash around December and a tax refund when lodging returns from July 2021. It is hoped that refunds will provide further economic stimulus at that time.

Infrastructure funding

A $625 million infrastructure spend in South Australia on various road, sports facilities and other projects is certainly welcome.

But the real economic opportunity here will be to ensure local procurement so it creates jobs for SA workers and not interstate contractors.

Manufacturing

The Modern Manufacturing Strategy is a $1.5 billion program, with national manufacturing priorities that align very well with SA industries – the key here will be to keep a close watch on how to get involved.

Manufacturing priorities that SA holds expertise in include Resource Technology & Critical Minerals Processing, Food & Beverage, Medical Products, Recycling & Clean Energy, Defence and Space.

Global Trade

A number of measures were announced to help simplify international trade. For example, the development of a $320 million digital service to underpin export permits and certifications. These measures are great news for our outstanding SA food and wine producers.

Decreasing GST revenue

South Australia’s GST share decreasing is by $1.3 billion but what will this mean for our local economy and state government expenditure?

People are currently spending more on food and health, which are GST-Free. We ask, again, if it is time to look at broader tax reform, including the GST rate and base.

Instant Asset Write-Off (IAWO)

A full deduction on new assets will now be available to businesses with a turnover of less than $5 billion and if installed by 30 June 2022. With the increased turnover threshold, this measure will apply to almost all SA companies.

There’s no need to rush as this measure effectively gives SMEs almost 21 months to purchase assets and there is no cap on new assets.

The write-off also applies to second-hand goods for businesses with a turnover less than $50 million. Or, if turnover is between $50 million and $500 million, the assets cost less than $150,000 and are purchased before 31 December 2020.

However, this measure will only help create South Australian or Australian jobs if we start manufacturing more Plant & Equipment locally – otherwise we are just creating more jobs for overseas manufacturers.

Writing off the asset for tax purposes will create a large Deferred Tax Liability. While many companies want to keep tax and book depreciation the same, if they write off the asset in their books it will make the balance sheet look pretty bad for the bank, so it’s probably best to keep separate tax and book fixed asset registers.

Loss carry back

The loss carry back initiative will allow businesses that make a loss in the 2020-2022 financial years to carry back to profits from FY2019 year onwards and get a tax refund.

Businesses can potentially use the IAWO to create a tax loss, then carry that loss back and claim the refund, and use that refund to purchase more assets, thereby creating further stimulus.

However, the loss carry back is only available to corporates – not partnerships, trusts or sole-traders (which are used by a significant number of SMEs)

BDO would like to see IAWO and the loss carry back initiative become permanent parts of tax law for SMEs, not just temporary measures.

SME Business Tax concessions

Eligible businesses with turnovers up to $50 million – up from $10 million – will be able to deduct start-up costs, prepayments, and get access to concessional rules relating to trading stock, PAYG and GST. However, importantly, there is no change to access to CGT Small business entity tax concessions which have a turnover threshold of $2 million.

This measure is probably not going to provide a massive boost for business and is a missed opportunity to align thresholds.

The FBT exemptions for car parking and multiple phones & laptops from 1 April 2021 are a welcome inclusion for SME’s. A number of SME’s would like to have seen the removal of FBT on entertainment to stimulate the hospitality industry.

JobMaker Hiring Credit

This new initiative will see businesses receive $200 per week if hiring a 16-29 year old and $100 per week if hiring a 30-35 year old. In either case, the employee must have previously been receiving JobSeeker, Youth Allowance or Parenting Payment, and there must be an increase in the employee headcount of the business and payroll.

This measure also includes further support for Apprentices.

JobMaker cannot be claimed by businesses currently receiving JobKeeper.

While it is a welcome incentive to get people back into work, it will be interesting to see how this discriminates against older unemployed people and younger employed people looking to change jobs.

This budget has been a good start with a fair bit for South Australian SMEs to be happy about, but let’s wait and see whether the measures have the desired effect before calling it a success or otherwise.

It will be interesting to see what happens in future budgets in order to pay for all the spending and also whether governments at all levels make a concerted effort to procure local goods and services.

To hear more about the current business environment in SA and how we can ensure our state is a place for business to flourish beyond these times of uncertainty – join BDO for a live online event ‘Rethink the Direction for Business in South Australia’ on Tuesday, 20 October.

This publication has been carefully prepared but is general commentary only. It is not legal or financial advice and should not be relied upon as such. The information is subject to change and cannot be relied upon to cover any specific situation. Please contact Tim Sandow, Tax Partner, BDO SA to discuss these matters in the context of your particular circumstances.

.