Lending support and brokerage services continue to have role in SA

The SA Property Landscape report will help inform critical business decisions in the coming year.

Photo: Tony Lewis/InDaily

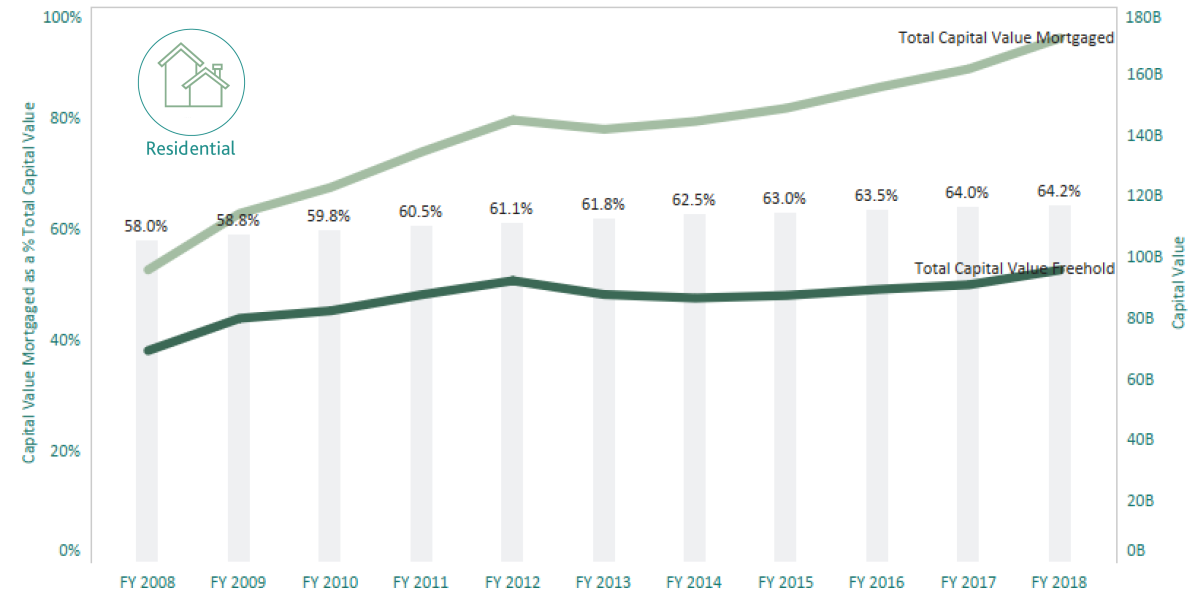

More South Australian property is subject to mortgage than at any time over the past 10 years, according to the SA Property Landscape report compiled by BDO and Land Services SA.

The report shows that 64.2 per cent of the state’s residential property capital values were subject to a mortgage at June 30 2018, an increase on 58 per cent only 10 years earlier.

The highest rate of debt was in the City of Playford, where 76.3 per cent of all residential property capital value was mortgaged.

BDO Business Services Partner Matt Laming said this higher percentage of mortgaged property means there is real opportunity for lending support and brokerage services industries in South Australia.

“Borrowers, more than ever, require loan packages tailored to their personal circumstances and don’t necessarily have the time to research for themselves,” he said

“With a plethora of 2nd tier lenders now offering real alternatives to the big 4 banks and securing 1 in 3 residential mortgages, navigating the lending market has become harder than ever for the average consumer.

“There is opportunity for lending support and brokerage services to assist in this process, and provide the best possible outcome for borrowers.”

Source: SA Property Landscape report

Areas experiencing high growth in residential property stock include City of Playford, which has grown by 26 per cent, or over 10,600 parcels of land, as a result of subdivision activity.

Mount Barker District Council experienced the largest growth in residential property stock over the past 10 years relative to its size, with an increase of 36% as a result of subdivision activity including new housing estates, such as Aston Hills.

The report shows a broader trend towards growth in South Australian residential construction and development, with on average 9,400 residential properties constructed annually, but nearly all growth in residential construction is confined to metro Adelaide.

Metropolitan Adelaide residential construction activity increased in 6 of the 10 years to 31 December 2017, but in only 1 of those years (2014) in our regional areas.

“Interpreting and understanding the wealth of data now available to us through organisations such as Land Services SA and the Real Estate Institute of South Australia is the next frontier in informing critical business decisions in South Australia for the Real Estate and lending industries, in particular,” Laming said.

Real Estate Institute of South Australia CEO, Greg Troughton said the data now available to businesses clarifies the trends, opportunities and issues facing the industry.

“A clear example is seeing what can be achieved with the changes in stamp duty on commercial transactions, which increased after concessions were introduced in December 2015,” he said.

“In the residential sense, stamp duty prevents, for example, the mobility of labour and so distorts decisions by families that would otherwise be of benefit to the whole economic community. Some relief for residential housing from the impost of stamp duty is warranted.”

This article is sponsored by BDO Adelaide.