Law Society slams push to privatise state “jewel”

The Law Society has warned of privacy risks, a potential increase in fraud, increased costs, and long-term financial pain for the taxpayer if the State Government goes ahead with its plans to privatise South Australia’s lands titles office.

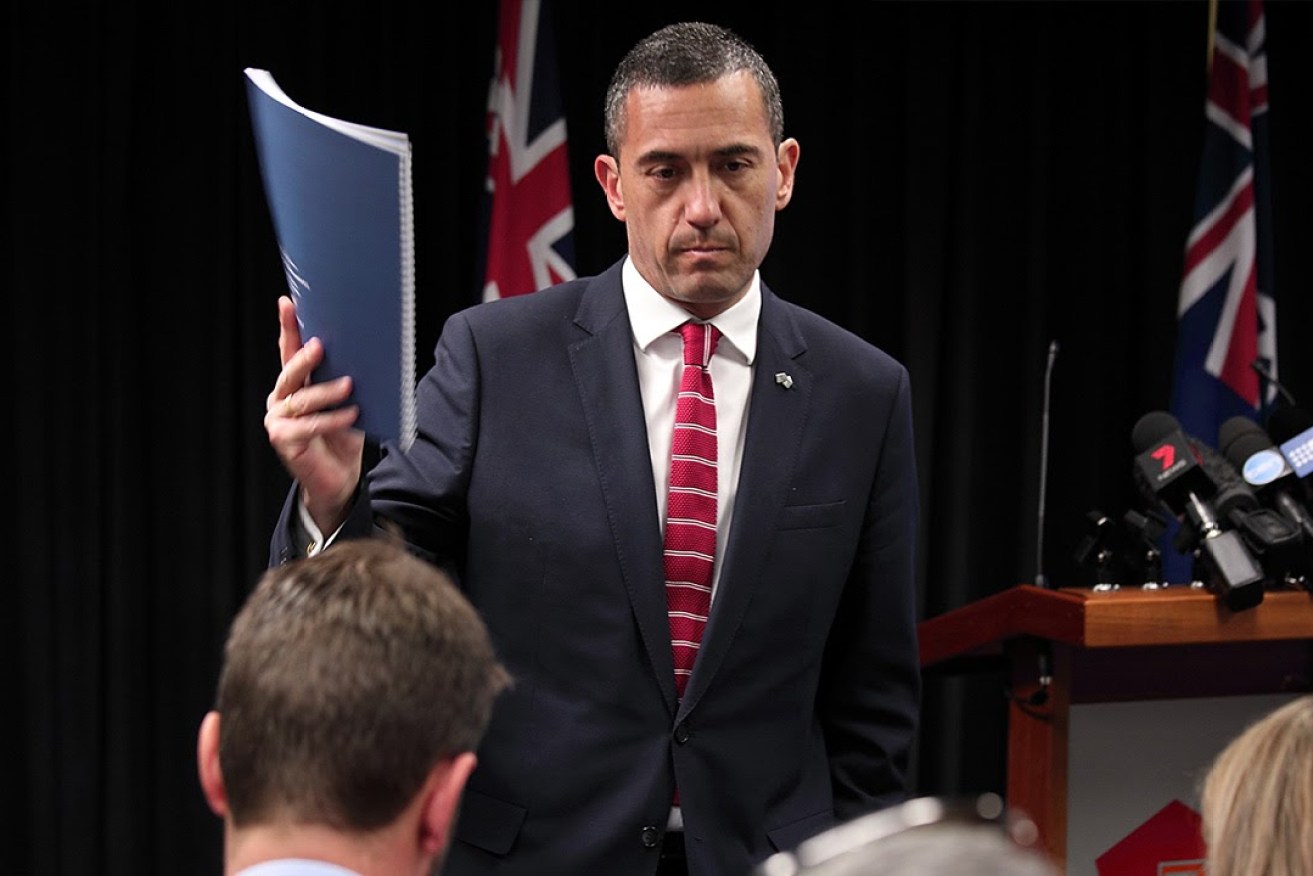

Treasurer Tom Koutsantonis is eyeing a huge windfall from the sale of the Land Titles Office. Photo: Tony Lewis/InDaily

As foreshadowed in this year’s budget, the Government this month called for expressions of interest from the private sector to take over the “transactional” functions of the Land Services Group – the government agency responsible for land titles and land and property valuations, among other property services.

The group’s income stream is reportedly around $100 million a year. The State Government aims to keep that income while offering a buyer an annual service fee in return for giving the new operator the capacity to commercialise the group’s vast store of data.

However, the potential privatisation – with a 40-year contract in the offing – has raised widespread concern in the property industry, including among conveyancers and surveyors, given the agency is the repository of all land information for the state.

The Law Society has now raised its deep concerns about the sale, writing to Treasurer Tom Koutsantonis to warn of potential threats to the security of private data, the quality of service and financial risks to the state.

With responses to the Government’s tender due on January 13, the society warns the Government has not yet explained how people’s data will be protected, nor made a compelling case for the sale.

It accuses the Government of failing to undertake “proper, informed public consultation” on the move.

President David Caruso said the Land Services Group was one of the state’s most important assets, as well as being the most efficient and lean government agencies.

“A land title is probably the most valuable asset a family holds. Public confidence in the system is critical,” Caruso said. “A secure land registration system is also essential to the economy of the state.

“If we are to learn the lessons of history, we should be wary of selling off assets where a private entity will hold a monopoly. All too often, this results in higher costs to consumers as private operators are driven by profit rather than by serving the best interests of the community.”

He said the privatisation of the service could compromise the security of large volumes of sensitive personal data relating to property titles.

The Government had not provided “sufficient information” about how the data would be safeguarded against exploitation for corrupt or fraudulent purposes.

Caruso also questioned the financial wisdom of the deal.

“The Land Services Group is one of the few remaining jewels in the state’s asset portfolio. It is innovative, efficient, secure and delivers high quality services to users, as well as a handsome dividend to the state. It has recently undergone a major system upgrade to accommodate the introduction of electronic conveyancing, the biggest change to property transactions in more than 150 years.

“The Government has failed to make a compelling case for placing the Land Services Group in private hands, let alone offering a 40-year contract to the successful bidder. With technology and innovation evolving rapidly, it is likely the contract will become obsolete long before the end of that period. This would give the private entity considerable bargaining power to re-negotiate terms, likely at huge cost to the taxpayer.”

The society’s concerns echo those of surveyors, who are concerned the privatisation will compromise the state’s efficient and well-regarded system in order to copy less efficient jurisdictions such as Ontario, Canada, which has privatised its lands title function.

The Law Society’s submission to Koutsantonis points out that in jurisdictions where lands title registries have been privatised, title insurance is an inevitable part of the conveyancing process.

“This is certainly the case in Ontario,” the submission says. “In Australia, there has been very little need for title insurance because of the robustness of the system and the Government guarantee. It is highly likely that a private operator will introduce title insurance as an ‘unregulated’ part of its business. This will substantially increase the cost of conveyancing transactions.”

The chair of the Law Council’s property committee, Philip Page, told InDaily that while Ontario’s privatisation and the likely sell-off of the NSW lands title function were being highlighted by the Government, it failed to note that the UK had twice rejected a similar move after consultation.

“The UK knocked it back for similar reasons (to those highlighted by the Law Council) – very similar indeed,” Page said.

Koutsantonis told InDaily that the Government had provided “a number of guarantees” to protect the public interest and the integrity of the lands title system through the commercialisation process.

“Strong data security and service delivery requirements will be imposed on the new provider through contractual clauses, including penalties, step in rights and ultimately termination of the contract,” he said.

“Fees will also continue to be set by the State Government for all key services, and the State Government will only proceed with the sale if the sale price represents good value to the taxpayer over the long term.”

The Government is eyeing two privatisations at the moment, with a scoping study also examining selling off some of HomeStart Finance’s loan portfolio – a move causing concern within the lender, which was set up to help people into the market.

Together, the sales would give the Government a substantial budget boost ahead of the 2018 state election, just as the commercialisation of the Motor Accident Commission’s compulsory motor insurance work allowed the Treasurer to shoot the budget back into surplus.

Both proposals have attracted little public attention.