The high cost of SA’s low-risk society

South Australia has created a low-risk environment that relies on government intervention to protect us from change, writes Richard Blandy, who argues that we must accept more uncertainty if we are to recapture our capacity for competitive growth.

South Australia is orderly and decent, but also risk-averse and slow-growing.

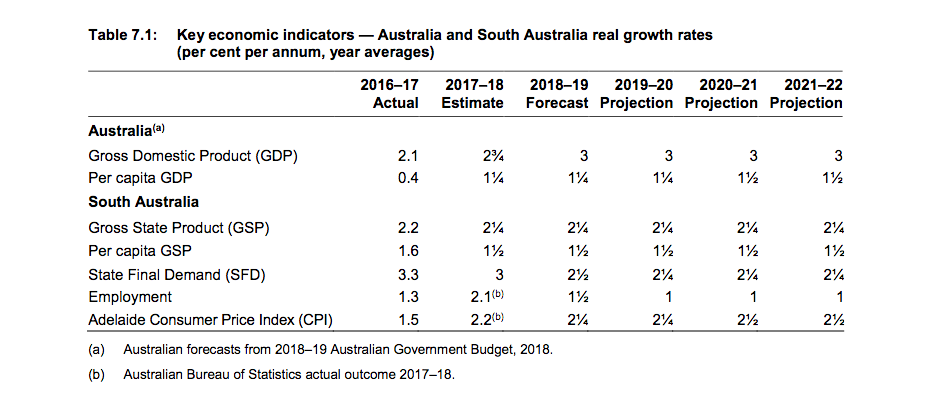

The table below, taken from State Treasurer Rob Lucas’s recent South Australian Budget, is remarkable.

What it shows is that State Treasury expects no improvement in South Australia’s economic performance over the next four years – the life of the Marshall Government until the next election.

South Australia’s economic growth (2.25% p.a.) is expected by the Treasury to persistently trail Australia’s as a whole (3% p.a.). South Australia’s economic growth is expected by the Treasury to be only three-quarters of Australia’s economic growth.

But South Australians’ income levels (per capita GSP) are expected to grow 20% faster than Australians’ income levels as a whole. This remarkable result could only happen, given that South Australia’s economy is growing more slowly than Australia’s, if South Australia’s population were to grow much more slowly than Australia’s.

This must imply that the Treasury expects South Australian employment growth to be very much less than Australia’s employment growth. At present South Australia’s employment growth rate is less than half of Australia’s as a whole. This situation is clearly expected by the South Australian Treasury to continue. It is why our children, or in my case, grandchildren, increasingly have to move interstate or overseas to find work.

This is not good enough.

The South Australian Government must raise the growth rate of the South Australian economy to match or exceed the growth rate of the Australian economy, thereby generating the growth in South Australian jobs that will stop so many of our young people having to leave the state.

Treasury’s forecasts highlight arguments I have made over many years about this state: the fact that we are fabulously endowed with natural resources, highly-skilled, industrious, people, and stable, democratic, political institutions. The fact that we have not made as much of this fabulous endowment as we should have done. The fact that we have been Australia’s worst-performing or second-worst-performing state economy over the past decade.

For most of the last half-century our economic performance has not been disastrous – simply mediocre in comparison with our potential. Our organisational inadequacies have been sufficiently masked by Commonwealth economic interventions and intergovernmental arrangements that we have slipped only slowly relative to our fellow states and territories.

More recently, our rate of slip has accelerated as some of these interventions and arrangements have stopped propping up our economy as effectively as they once did. The underlying weaknesses of our own, South Australian, arrangements for producing goods and services have been thrown into clearer focus. Unless these weaknesses are rectified, our continued economic slide relative to the rest of Australia, not to mention our own potential, will continue.

A rapidly-growing economy involves harnessing a mosaic of capabilities to the production of an extraordinary variety of goods and services that people, businesses and governments are willing to pay for. Governments throughout history and across the planet have proven themselves over and over again as hopeless at directly organising an economy so that it grows rapidly over any sustained period of time.

Treasurer Rob Lucas. Photo: Tony Lewis/InDaily

South Australians, by contrast, appear to have a predominant view – at least at the ballot box – that some precise set of initiatives or investments supported by the State Government will fix our lack of economic growth. So they vote for the party with the most appealing, Government-supported, investment proposals.

The truth is, unfortunately, that nobody knows with any degree of certainty (least of all a political party) what will succeed (however plausible the prospectus). Most new ventures are destined to disappoint their brave backers. But a few will succeed – some brilliantly.

This handful of winners will attract imitators, suppliers, and all sorts of allied investments. The economy will continually restructure around these, unknowable in advance, winners. The wasted investments in failing ventures are kept to a minimum if they are allowed to founder as soon as it is apparent that they cannot succeed on their own two legs.

Governments, on the other hand, that have proposed or supported particular initiatives cannot let them rapidly fail. Hence, they prop them up (at least until the next election) with favours of one sort or another, which are funded by taxing or adversely regulating other businesses or the community more broadly, thus reducing business viability and jobs growth generally.

Another important reason for governments to meddle in the economy is that with every change in demands and supplies, some people improve their position while the position of others worsens, maybe contrary to the government’s preferences.

What stops this process being simply a zero-sum game of winners and losers is the effort made by people to improve their lot by exercising creative ingenuity, finding and learning useful skills, working better, saving, and investing in a large range of different activities. By doing these things, people extend the sum total of productive capability in their area – in South Australia, or Australia, or the world, for that matter.

Our political class has not been capable of building adequate evolutionary capability into the South Australian economy.

Our economy, when it is working well, endlessly creates and destroys opportunities for individuals and groups, adding more opportunities than it destroys in the process. This is economic evolution at work, with the economy constantly evolving in patterns which give it survival and growth capability.

Thus, as I have written before, there is a dark side to a good economy with its fast growth, vibrancy, colour, spontaneity, surprise, adventure and drama: there is uncertainty, insecurity, inequality and disorder.

My message during the term of the last Labor Government is the same now: if only we could be certain, secure, equal and orderly, what a fine world this would be. If we could freeze the economy when it assumes a pattern we like, we could be spared the pressures of an endlessly chaotic existence. Perhaps, if we asked governments to put anti-jiggling controls into place, the pattern of the economy could even be engineered in an orderly way towards preferred designs.

These sorts of ideas have been tried with great diligence, intelligence and morality in many places at various times. Nowhere could these ideas have had better chances for success than in South Australia. Unlike a large number of less fortunate places, we have achieved many of the ends here: we have a very decent, unpressured, orderly, egalitarian, low-risk society.

But we also have a low-opportunity and low-growth economy. As we have shifted away from a mode of coping with uncertainty by spontaneous grassroots responses towards a mode of giving the authorities sufficient power to protect us from unplanned change, we have lost economic growth capability.

We have failed to evolve economically in patterns which are in tune with maintaining a competitive edge in an ever-changing world economic environment.

If we are to regenerate our economic performance the South Australian Government will have to put our economy back into winning mode by providing more opportunity and incentive for spontaneous, grassroots adaptations to economic changes, and by providing less opportunity for state authorities to “direct” such higgledy-piggledy efforts.

We will have to give more rein to the exercise of small group productive initiatives and to accept a less ordered, more uncertain, more pressured, but a more vibrant, colourful and adventurous, existence.

There will be casualties in the short run among those who become exposed to more competition and uncertainty. These are far fewer than the doomsayers will scare us by claiming.

We should never forget that the doomsayers have stopped many of the new and different jobs that would have been created if we had not pursued an illusory political capability to pick industries, jobs and well-being, in the face of the forces unleashed by an ever-changing world.

People learn to adapt quickly and we will learn to be winners again. I’ve written – and I still believe – that our children and grandchildren, especially, will put colour and movement back into the state’s economy.

South Australia’s real economic tragedy remains not that businesses prove to be mortal in the face of global economic change, but that too few new firms are being born to replace them and to grow rapidly, as a result of the very same global forces.

That is entirely due to South Australian Government policy. Our political class has not been capable of building adequate evolutionary capability into the South Australian economy. We have known of the need to forge such a capability for at least a quarter of a century, at least since the Arthur D. Little Report into the South Australian economy in the dying days of the Bannon Government.

South Australia’s economic future depends on our capacity to build such a capability – cut taxes significantly, reduce government spending significantly and deregulate significantly.

In upcoming articles, I hope to discuss what some overseas states and countries have done – how much they have cut spending and taxation and regulations and how fast they are growing, as a consequence.

Richard Blandy is an Emeritus Professor of Economics at Flinders University.