Cooper Energy takes control of gas plant amid price surge

Adelaide-based Cooper Energy will buy back the Orbost Gas Processing Plant in Victoria for at least $270 million, as east coast spot gas prices continue to rise.

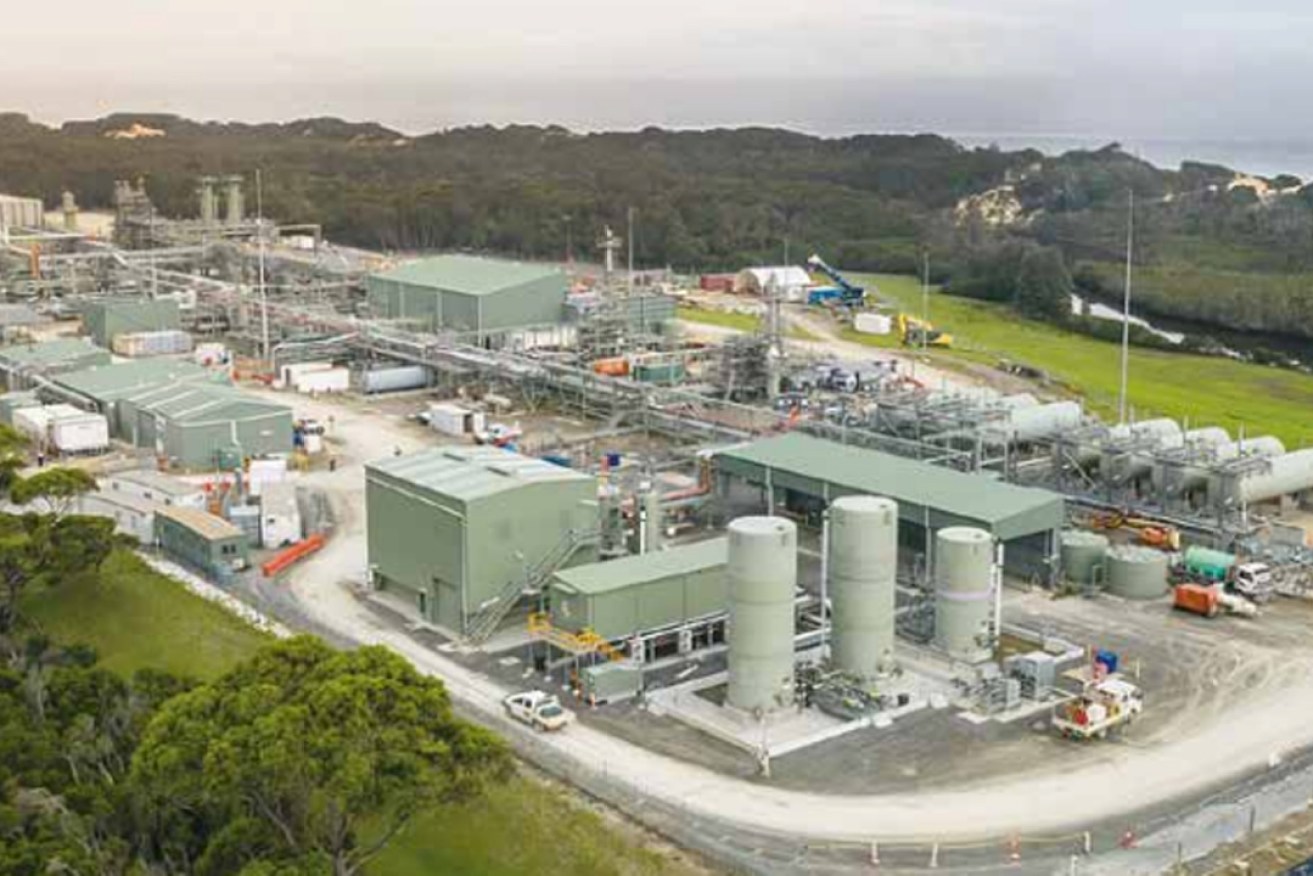

The Orbost gas plant in Victoria where the majority of Cooper Energy's gas is processed. Photo: Supplied.

The buyback comes five years after Cooper Energy sold the plant to energy infrastructure business APA Group.

Cooper Energy announced yesterday it will also undertake a fully underwritten $244 million equity raise comprising a $84 million placement to institutional investors and a two-for-five accelerated, non-renounceable entitlement offer to raise $160 million.

Following the acquisition, Cooper Energy will operate three gas fields and two gas plants supplying domestic gas into the south-east Australia gas market.

It comes at a time when the Orbost plant is approaching its nameplate capacity for the first time after a number of problems and upgrades, coinciding with surging spot gad prices, which reached $40 per gigajoule in Victoria this morning.

The Orbost plant is on Victoria’s south-east coast near Lakes Entrance and has been plagued with issues during upgrades and since Cooper began using it to process gas from its new Sole gas field in the Gippsland Basin in early 2020.

It was also shut for several days in late March and early April for maintenance work that was hampered by flooding in the area and forced the evacuation of all non-essential personnel.

However, it performed at or above 60 terajoules of gas a day for 21 days during May, with a maximum rate of 66 TJ/d achieved, almost reaching its nameplate capacity of 68TJ/day for the first time.

The listed company also operates and owns 50 per cent of the Athena Gas Plant, near Warrnambool, where it processes gas from its Casino, Netherby and Henry fields in Victoria’s Otway Basin.

It also has production wells in South Australia’s Cooper Basin in partnership with Beach Energy.

The Orbost purchase comes at a time of increased winter demand for energy, unscheduled outages at coal-fired power stations and gas shortages due to the war in Ukraine that have led to soaring gas and electricity prices across much of Australia.

Cooper this month increased its earnings guidance for the second time in the past month telling the Australian Securities Exchange it now expected financial year earnings to be up to $78 million. That’s up significantly from its estimate in the $53 to $63 million range in December and the revised figure of $57-$68 million forecast in May.

The guidance boost is being driven by huge increases in the Victoria and Sydney spot markets, which averaged $10.33 per Gigajoule (GJ) and $10.98/GJ respectively in March but jumped to $32.95/GJ and $29.87/GJ respectively in May.

During May, Cooper Energy sold 367 TJ of gas that was surplus to its sales agreement into the spot market, netting the company about $11.5 million for the month, less transport costs.

Managing Director David Maxwell said the acquisition was transformative for the company and represented the next step in its twin gas supply hub position that is underpinned by attractive market dynamics through the tightening south-east Australia gas supply.

“It accelerates our strategic position in the Gippsland Basin and strengthens our end-to-end capability to produce, process and deliver gas to our high-quality domestic customers and the spot market,” he said.

“Ownership of the Orbost Gas Processing Plant provides Cooper Energy with complete control of integrated operations in the Gippsland Basin and this provides a platform for future development opportunities in the region.

“We look forward to welcoming the employees and integrating the plant into our portfolio, maintaining a laser focus on safely delivering gas to the Australian domestic market, growing production and maintaining our industry-leading net-zero carbon position.”

APA Group bought the Orbost plant from Cooper Energy in mid-2017 as part of a $270 million plant upgrade project.

Delays in the upgrade led to Cooper energy receiving a $9.9 million damages payout from APA in 2019-20.

Cooper began using it to process gas from its new Sole gas field in the Gippsland Basin in early 2020.

Under the terms of yesterday’s sale agreement, Cooper will pay APA a fixed payment of $210 million at the acquisition’s financial close, which is expected on July 31. A fixed deferred payment of $40 million will be made 12 months later and a further $20 million a year later.

Performance payments of up to $20 million and up to $40 will be due two and three years after financial close depending on the plant’s output.

Cooper Energy expects to announce the outcome of the Institutional Entitlement Offer to the market on Thursday and will remain in a trading halt until then.

At the time of yesterday’s trading halt, Cooper Energy shares were trading at $0.315, giving it a market capitalisation of $514 million.