Cooper Energy puts foot on gas as prices explode

Spiking east coast gas prices and improved production from its Victorian operations are providing Adelaide-based oil and gas company Cooper Energy with a needed boost in the final weeks of the 2021-22 financial year.

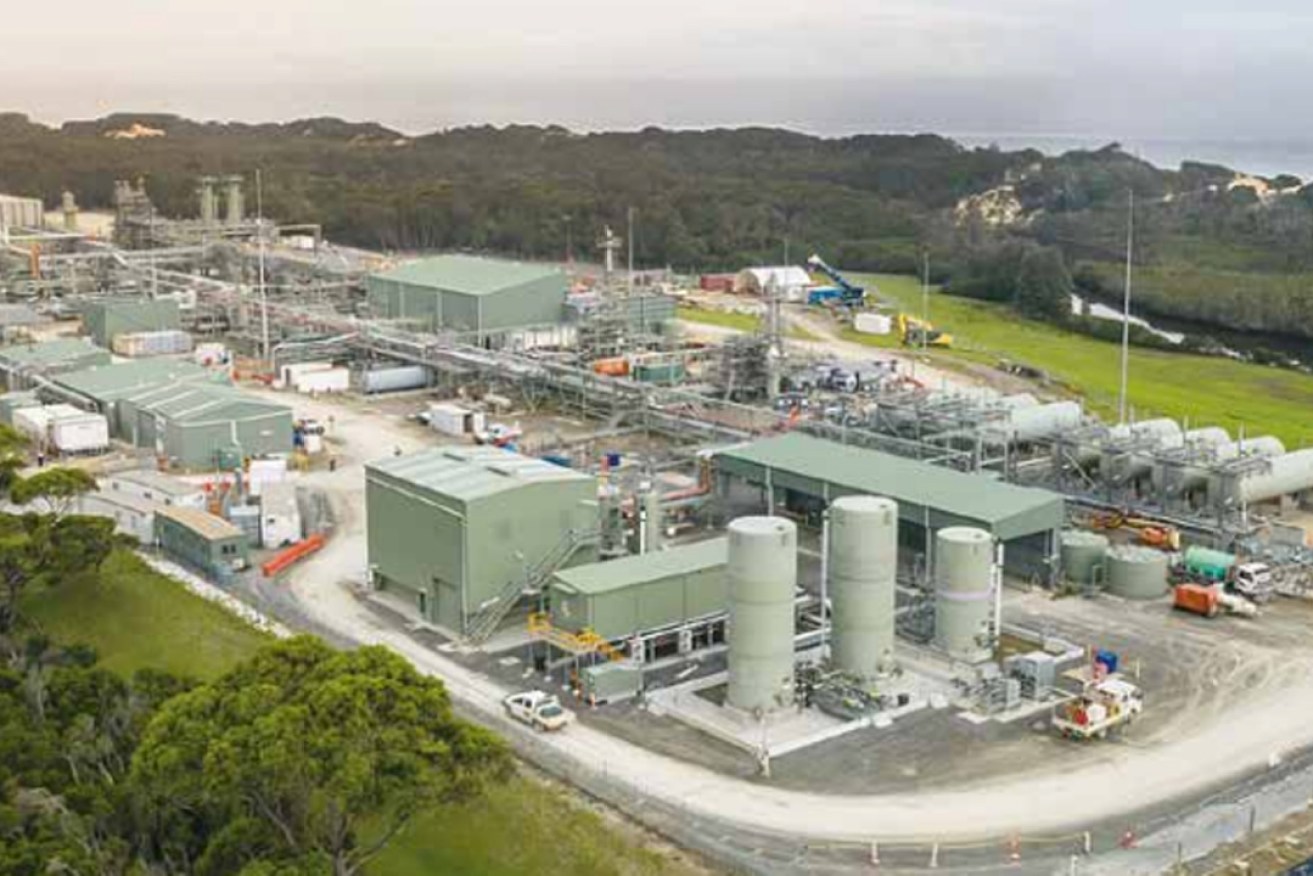

The Orbost gas plant in Victoria where the majority of Cooper Energy's gas is processed. Photo: Supplied.

The listed company this week increased its earnings guidance for the second time in the past month telling the Australian Securities Exchange it now expected financial year earnings to be up to $78 million. That’s up significantly from its estimate in the $53 to $63 million range in December and the revised figure of $57-$68 million forecast in May.

The guidance boost is being driven by huge increases in the Victoria and Sydney spot markets, which averaged $10.33 per Gigajoule (GJ) and $10.98/GJ respectively in March but jumped to $32.95/GJ and $29.87/GJ respectively in May.

During May, Cooper Energy sold 367 TJ of gas that was surplus to its sales agreement into the spot market, netting the company about $11.5 million for the month, less transport costs.

In April it sold 90TJ on the spot market at an average price of about $15.25 per GJ.

“Since the company’s FY22 guidance was last updated (on May 16), there has been continued improvement in average processing rates at the Orbost Gas Processing Plant (OGPP) and a substantial increase in actual and forecast wholesale spot prices for gas in

Sydney and Victoria, in both cases beyond what had been expected as at the date of the last guidance update,” the company said in its statement this week.

“As a result of these changes, production guidance and sales volume guidance have been revised … reflecting a reasonable expectation of continuing the improved performance at OGPP and of continuing higher realised Australian east coast wholesale spot gas prices.”

Gas from Cooper’s Sole gas field in the Gippsland Basin off the Victorian coast is processed at the Orbost Gas Processing Plant in East Gippsland, which is owned and operated by APA Group.

The Orbost plant is on Victoria’s south-east coast near Lakes Entrance and has been plagued with issues since Cooper began using it to process gas from its new Sole gas field in the Gippsland Basin in early 2020.

It was also shut for several days in late March and early April for maintenance work that was hampered by flooding in the area that forced the evacuation of all non-essential personnel.

However, the average processing rate at OGPP for May was 55.7 TJ/d, 36 per cent higher than the average April processing rate of 41TJ/d.

It performed at or above 60TJ/d for 21 days during May, with a maximum rate of 66 TJ/d achieved, almost reaching its nameplate capacity of 68TJ/day for the first time.

Cooper’s Athena Gas Plant in Victoria’s Otway Basin achieved an average processing rate of 25.8 TJ/d in May, 18 per cent higher than the April rate.

The market has responded positively to Cooper’s latest announcement with its share price up more than 10 per cent this week to $0.315, its highest level since January 2021.

Cooper Energy listed on the ASX in 2002 and has steadily grown production and reserves in line with rising prices from 0.96 million barrels of oil equivalent (MMboe) in 2016 to 2.63 MMboe in 2021.

The company is on track for a record year for production, sales volume and revenue and will be looking for an improved result after reporting an underlying net loss after tax of $25.9 million in FY21.

Increased winter demand for energy, unscheduled outages at coal-fired power stations and gas shortages due to the war in Ukraine have led to soaring gas and electricity prices across much of Australia.

Fellow SA oil and gas companies Santos and Beach Energy this week announced they will add an extra drilling rig in the Cooper Basin to boost gas supply to the domestic market.

The program of works announced on Monday includes bringing a fifth drilling rig into the basin and aims to deliver an additional 15 terajoules of gas per day by the end of the year.

Santos Managing Director and Chief Executive Officer Kevin Gallagher said Santos will invest more than $430 million in SA’s Cooper Basin this year to develop and supply critical fuels such as natural gas.

“This investment will deliver more gas to the domestic market, which is desperately needed,” he said.

“Recent domestic gas supply and price pressures have been caused by a spike in gas-fired power generation to back up renewables and to replace the 30 per cent or more of coal-fired power generation that has been offline or not operating since early May.”

Santos and Beach are also experiencing share price surges on the back of soaring gas prices.

The Santos share price is up 35 cents this week to $8.40, its highest level since January 2020, just before the COVID-19 pandemic.

Fellow Adelaide-headquartered oil and gas company Beach Energy’s shares were up more than 15 per cent this month to $1.90 yesterday, their highest level since January 2021.

Last week, the Australian Energy Market Operator triggered the Gas Supply Guarantee Mechanism for the first time since the measure was introduced in 2017 in order to secure gas for power generators and ward off a potential shortfall in southern states.

Federal, state and territory energy ministers met on Wednesday and agreed on immediate actions to shore up gas supplies and restore confidence in the energy market.

The Australian Energy Market Operator has been instructed to procure and store gas supplies while regulators will be given more powers to ensure transparency in the sector.

The development of a national transition plan for the energy market ahead of the next meeting in July has also been agreed to by the energy ministers.

– With AAP