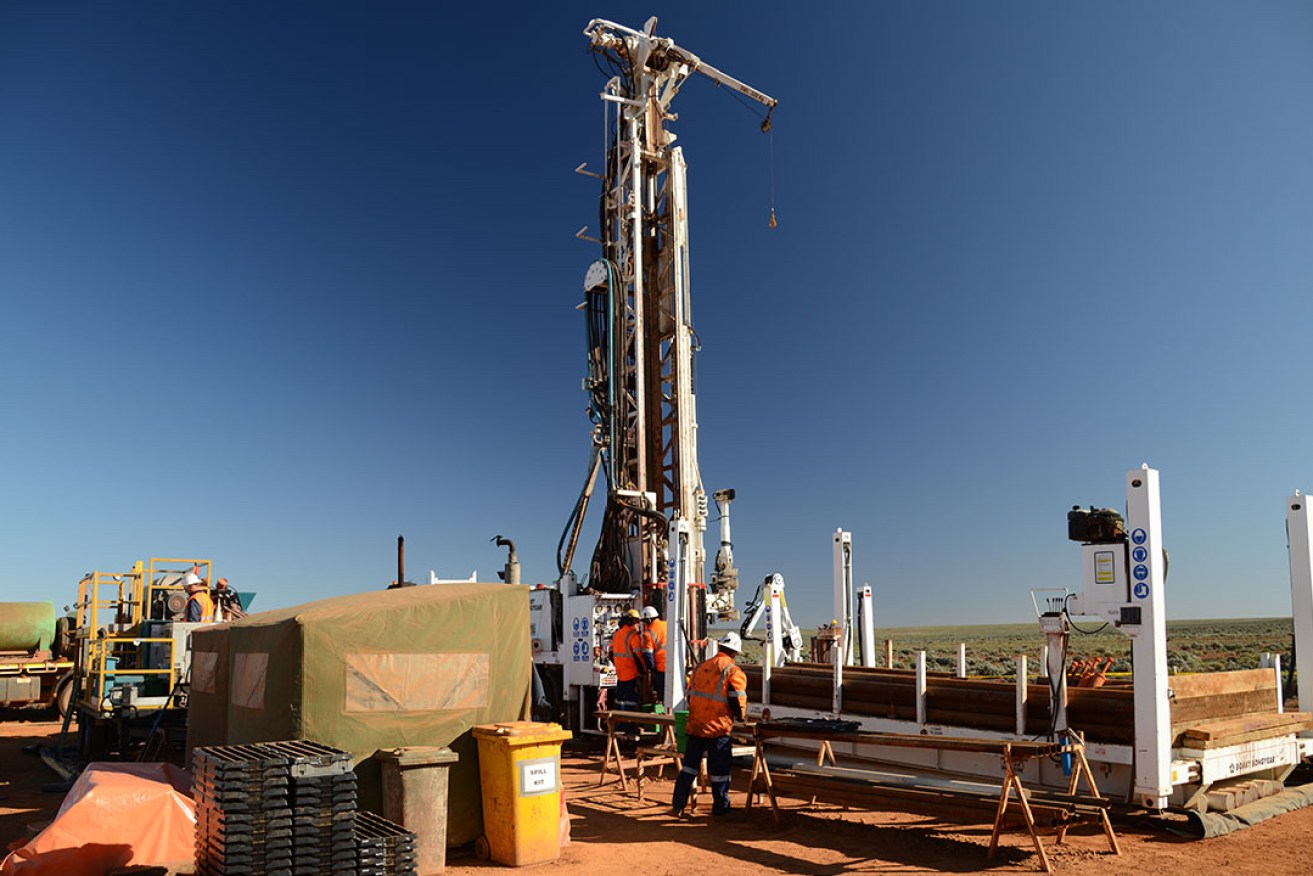

Boart Longyear stands down workers as drilling revenues dive

Mining services company Boart Longyear has reported a US$19 million reduction in revenue for the March quarter, blaming declines in global exploration activity for the result.

The publicly listed ASX company has stood down staff in many parts of the business and slashed executive pay packets as it tries to ride out the COVID-19 crisis, which it expects will have an even greater impact on revenues next quarter.

The world’s largest integrated mineral exploration products and services company, whose Asia Pacific regional headquarters is in Adelaide, revealed a $45 million loss for calendar year 2019 in February.

Revenue for the three months ending March 31 fell to US$171 million from $190 million for the same period last year.

Boart Longyear’s Global Drilling Services division had an average of 260 drill rigs operating in the period, down from 284 last year with an average rig utilisation of 38 per cent, down from 41 per cent last year.

In a statement to the ASX this morning, the company said impacts from COVID-19 on its operations increased through March with exploration activities declining, as a result of government-imposed closures along with customers choosing to delay projects.

All non-essential operating and capital expenditures have been reduced and the board, CEO and all group executives have agreed to temporarily reduce their pay by 75-100 per cent collectively.

The company has temporarily moved into a partial or full stand-down of the workforce in most parts of the business.

“What is unclear to us currently is the duration of the impacts of COVID-19 on the industry and ultimately our operations,” the company said.

“The steps taken to date by the executive team have been measured to ensure that Boart Longyear will be in a position to continue to support the mining industry when it returns to its normal operating levels.”

The statement said underlying demand for its drilling services, drilling products and geological data services remained strong. However, it anticipated a postponement of some exploration spend in the June Quarter due to impacts from the COVID-19 pandemic.

“Overall, we saw drilling activity down as customers delayed decisions and through continued lack of funding for junior mining companies in some jurisdictions,” it said.

“We anticipate, following a recovery from COVID-19 impacts, that exploration spend levels will regain momentum heading into the second half of 2020.”

Boart Longyear’s CEO Jeff Olsen said the impacts of COVID-19 began to be visible primarily in the drilling services group from late February and increasing through March.

“The full impacts of COVID-19 are not yet known but will likely have greater impact in Q2,” he told the ASX this morning.

“We are encouraged by the fact that in many parts of the world that mining activities have been designated as essential services.

“This means that over the coming weeks we anticipate that we can continue to work with mines to create the necessary process changes to maintain safe working conditions for our employees to return to work, where appropriate.”

The company’s share price was down almost 10 per cent this morning to $0.61 following the announcement.

Boart Longyear was ranked No.30 in InDaily’s 2019 South Australian Business Index of the state’s top 100 companies.

Want to comment?

Send us an email, making it clear which story you’re commenting on and including your full name (required for publication) and phone number (only for verification purposes). Please put “Reader views” in the subject.

We’ll publish the best comments in a regular “Reader Views” post. Your comments can be brief, or we can accept up to 350 words, or thereabouts.