Economic growth hits post-GFC low

The Australian economy expanded by 0.5 per cent in the June quarter as annual growth slowed to a fresh post-GFC low of 1.4 per cent.

Photo: Tony Lewis/InDaily

The quarterly increase was the same as the revised March quarter data and in line with market consensus, which was for annual growth to soften.

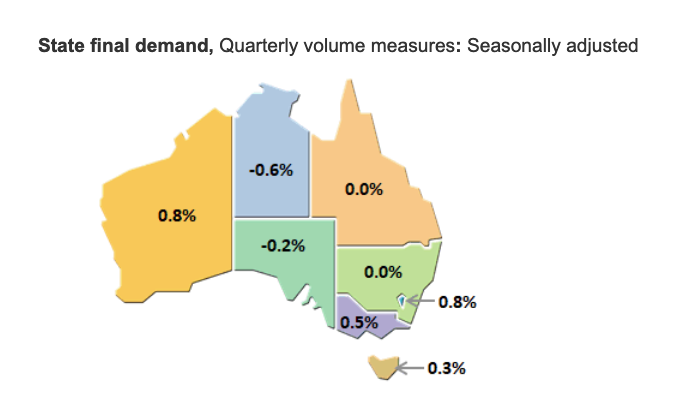

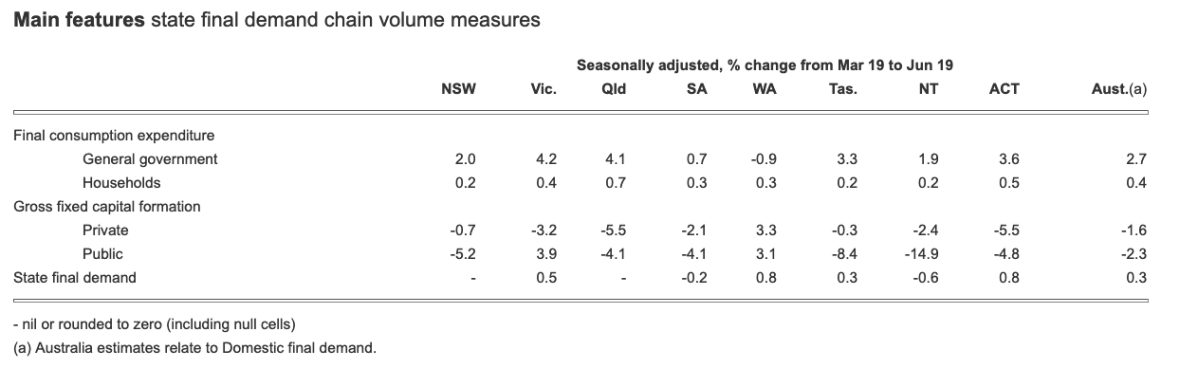

South Australia’s state final demand contracted by 0.2 per cent, with only the Northern Territory recording a worse performance.

BIS Oxford Economics economist Dr Sarah Hunter said there were no big surprises in the national figures, with net exports and government spending underpinning sluggish growth.

The main drag came from inventories and construction, while consumer spending remains in the doldrums, increasing by just 0.4 per cent for the quarter – albeit a slight uptick on the pace of growth over the prior quarter.

Hunter said growth was likely to remain relatively subdued until the early 2020s, but that year-on-year expansion may have found a floor.

“The June quarter is likely to be the trough for the (year-on-year) growth rate … as the very weak quarters from late 2018 and early 2019 drop out of the calculation,” Hunter said.

Source: Australian Bureau of Statistics

The ABS said South Australia’s state final demand performance included weakness in non-dwelling construction (down – 6.6 per cent), which was driven by falls in energy-related projects.

“Household consumption expenditure partly offset this fall, driven by increased spending on discretionary items,” the bureau said.

Nationally, government final consumption expenditure contributed 0.5 percentage points to GDP growth during the quarter, while household final consumption expenditure contributed 0.2 percentage points.

Net exports contributed 0.6 percentage points to growth this quarter, reflecting strong exports of mining commodities.

Mining gross value added increased 3.4 per cent with strong production of coal and liquefied natural gas, while mining profits rose by 10.6 per cent driven by strong export growth and a continued rise in the terms of trade.

Mining investment rose 2.4 per cent, with increases in investment in machinery and equipment.

Hunter said while there will be some support for households from recent cash rate cuts and federal government tax breaks, weak income growth will fundamentally constrain spending in the near term.

She also flagged that the residential construction downturn has further to run, while the positive contribution from net exports is also likely to fade, though remain positive, with the ramp up in LNG exports set to taper off.

– AAP with additional reporting by InDaily

Want to comment?

Send us an email, making it clear which story you’re commenting on and including your full name (required for publication) and phone number (only for verification purposes). Please put “Reader views” in the subject.

We’ll publish the best comments in a regular “Reader Views” post. Your comments can be brief, or we can accept up to 350 words, or thereabouts.

InDaily has changed the way we receive comments. Go here for an explanation.