Not enough competition in SA wine grape market: ACCC

The highly concentrated market for wine grapes in South Australia’s Riverland region is among a series of problems undermining competition in the industry, a report by the national regulator says.

Riverland vineyard. Photo: Michelle Robinson/Flickr

An interim report of a wine grape market study by the Australian Consumer and Competition Commission warns that competition in the industry is being undermined by:

- Imbalances of bargaining power between growers and winemakers.

- A lack of price transparency.

- High market concentration.

- Fear of retribution and other barriers to switching winemakers.

- A lack of sign-up to a code of conduct.

Across the country, the wine grape industry is characterised by imbalances in bargaining power between winemakers and growers, it says.

And the decade-long oversupply of wine grapes from which the industry has only recently emerged has convinced many growers to trade away “the benefits of competition in order to ensure that they have a buyer of their produce, and, as a result, have needed to agree to potentially unfair and uncertain contract terms”.

“The ACCC heard that most growers prioritise securing a grape buyer in the medium term over receiving the best price,” the report reads.

“This suggests that they value certainty of sale in all years over having the flexibility to seek higher prices in periods when market conditions are favourable.”

But the report singles out the Riverland region, where growers are affected by particularly high market concentration, and most have agreed to long-term contracts that minimise price competition.

The Riverland is the nation’s largest wine producing region, stretching from Paringa to Blanchetown.

About 57 per cent of the region’s growers supply grapes to winemaking giant Accolade, under 15 year rolling contracts through wine grape conglomerate CCW Co-operative Limited.

“There is a particularly high concentration of processing capacity in the Riverland, with one winemaker having around half of the regional processing capacity,” the report reads.

“These agreements have a significant impact on the competitive dynamics of the Riverland wine grape market.

“As CCW has an agreement to sell its grapes to Accolade, it cannot threaten to switch supply to another winemaker (and) a large proportion of the Riverland’s grapes are not available to be purchased by other winemakers.”

In a statement to InDaily today, a spokesperson for Accolade Wines said the company welcomed the opportunity to participate in the ACCC’s process, and to provide a detailed submission addressing the matters discussed in the report.

“In 2009, Accolade Wines was a founding signatory of the Australian Wine Industry Code of Conduct, which covers commercial relations between winegrape growers and winegrape buyers,” the spokesperson added.

According to the ACCC report, the number of growers in the Riverland Region fell by 21 per cent between the years 2000 and 2018.

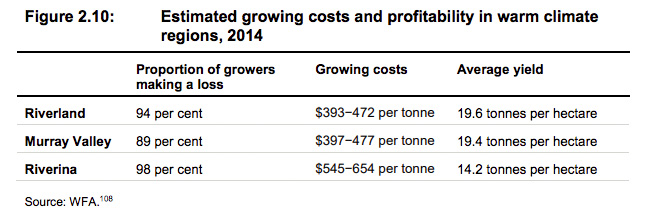

The vast majority of remaining growers in the region – 94 per cent – make a loss.

Most growers in other warm climate regions in Australia also make a loss.

A table from the ACCC report.

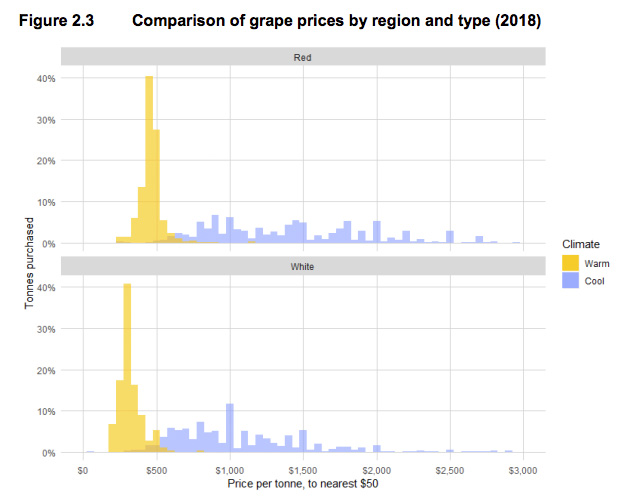

Growers in cool climate regions can demand significantly higher prices for their grapes.

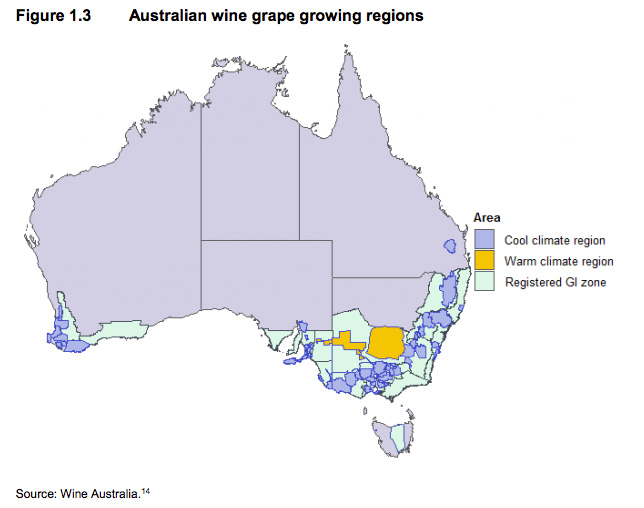

Image: ACCC

Image: ACCC

The report argues that too few major winemakers have signed up to the Wine Industry Code of Conduct.

The ACCC is threatening to recommend making the code compulsory.

“In the absence of a significant improvement in voluntary code participation in the near future, the ACCC may need to recommend that the code be made mandatory,” it reads.

“Of the major winemakers with a winery located in the Riverland, Accolade is the only code signatory.

“Pernod Ricard, another major buyer of grapes in the region, is also a signatory.”

It also recommends the simultaneous publication of prices across the industry.

Under the proposed reform, winemakers would be required to provide indicative prices to an independent body by 8 December for all grapes intended to be purchased from growers in warm climate regions during the subsequent harvest.

“With transparent price information, growers can make well-informed business and risk management decisions, negotiate more effectively, and adapt to changing consumer trends,” the report reads.

“Currently, much of this information is not available to growers in time to inform decisions.

“When growers can access and compare accurate pricing information from multiple winemakers, this enables them to determine which winemaker will provide the best price, or has historically provided good prices, before committing to sell to a particular winemaker (and) ensures that winemakers compete effectively for grapes and the market operates efficiently.”

You can read the full report here.

Submissions responding to the interim report are due June 28. You can make a submission here.

InDaily contacted CWW Co-operative Limited, Accolade Wines and Riverland Wine for comment.

Want to comment?

Send us an email, making it clear which story you’re commenting on and including your full name (required for publication) and phone number (only for verification purposes). Please put “Reader views” in the subject.

We’ll publish the best comments in a regular “Reader Views” post. Your comments can be brief, or we can accept up to 350 words, or thereabouts.

InDaily has changed the way we receive comments. Go here for an explanation.