Australia’s largest funeral firm assures investors: More people will die this year, probably

Better vaccination and a mild flu season kept more Australians alive last year, but spare a thought for those in the industry of death, reports Bension Siebert.

"Long term industry fundamentals are strong: 240k deaths per annum by 2034 in Australia", InvoCare's full year results report reads.

Funeral services company InvoCare says “soft market conditions, namely, a lower number of deaths” impacted its bottom line 2018, but it has told investors the market is “normalising” and more Australians will probably die this year.

InvoCare is the parent company of White Lady Funerals and Simplicity Funerals – each of which runs three funeral homes in Adelaide – and owns several funeral service, memorial and cremation businesses across Australia, New Zealand and Singapore.

In a statement to the Australian Stock Exchange late last week, InvoCare CEO Martin Earp said, “Operating results for 2018 were impacted by soft market conditions, namely, fewer deaths”.

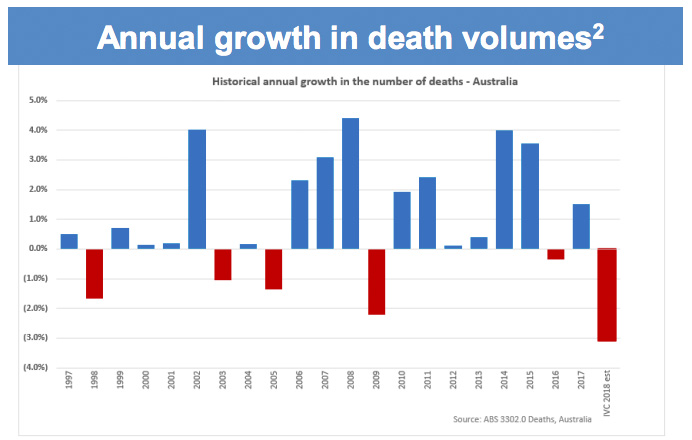

A screenshot from InvoCare’s 2018 full year results report.

“History suggests that these conditions are unlikely to be sustained and that reversion to the positive long-term trend is typical,” he added.

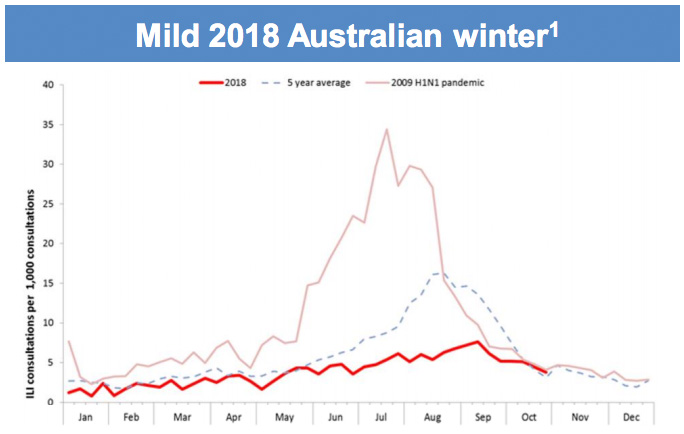

The company released its full year results in a report to the ASX that same day, explaining that effective vaccination programs and an unusually mild winter flu season had caused the dip in “death volumes”, but “expectation is for the number of deaths to return to long term trend”.

Two consecutive years of reduced deaths is rare – last occurred in 1990/1991.

“Improved trading in the Australian funeral business in (the final three months of 2018) and January 2019 is pointing towards the market normalising,” and deaths per year are expected to grow by 50 per cent by 2034, it reads.

“Death volumes were lower in Australia due to mild winter and effective flu vaccinations,” the report reads.

“Calendar 2018 saw unusually low number of deaths, down an estimated 3.1 per cent on 2017.

“Two consecutive years of reduced deaths is rare – last occurred in 1990/1991.”

A screenshot from InvoCare’s 2018 full year results report.

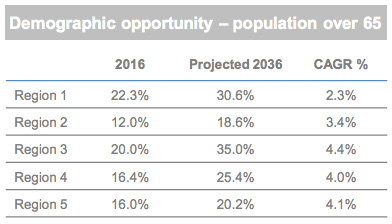

A screenshot from InvoCare’s 2018 full year results report.

The report also details the company’s Regional Acquisition Strategy.

InvoCare has been buying up small funeral homes in regional Australia to capitalise on what is described as a “demographic opportunity”: more retirees are moving from the city to the country before dying there.

Under the strategy, the company will “focus on a select number of regional areas in Australia that collectively account for circa 19,000 deaths per annum (38 per cent of the total regional opportunity)”.

“Deaths in regional Australian markets are ~50,000 per annum (~1/3 of all deaths in Australia).”

Specific regional funeral businesses are “selected due to their favourable demographics and ability to be supported by InvoCares’s existing network”.

“At the beginning of 2018, InvoCare had an estimated market share of circa eight per cent in regional areas, representing a significant growth opportunity,” the report reads.

“At the end of 2018 this has grown to circa 13 per cent.”

Making the case for the strategy, the report analyses five unnamed Australian regions and compares current death rates to a “projected funeral case growth rate (CAGR)”:

The company deployed about $73 million in capital and made $14 million in revenue from its regional acquisitions in 2018, according to the report.

InvoCare has also been renovating its funeral homes and shopfronts.

It hopes the renovations will increase the company’s market share from about 33 per cent to 40 per cent over the next ten years, on top of the acquisitions strategy.

Want to comment?

Send us an email, making it clear which story you’re commenting on and including your full name (required for publication) and phone number (only for verification purposes). Please put “Reader views” in the subject.

We’ll publish the best comments in a regular “Reader Views” post. Your comments can be brief, or we can accept up to 350 words, or thereabouts.

InDaily has changed the way we receive comments. Go here for an explanation.