The big end of town bounces back

In the year that saw the economic and emotional blow of Holden’s closure, South Australia’s biggest companies surged forwards, according to the SA Business Index – InDaily’s annual review of the state’s top 100 companies.

Photo: Tony Lewis / InDaily

The overall value of the Index – based primarily on market capitalisation – has risen by 33 per cent on last year to hit just under $50 billion.

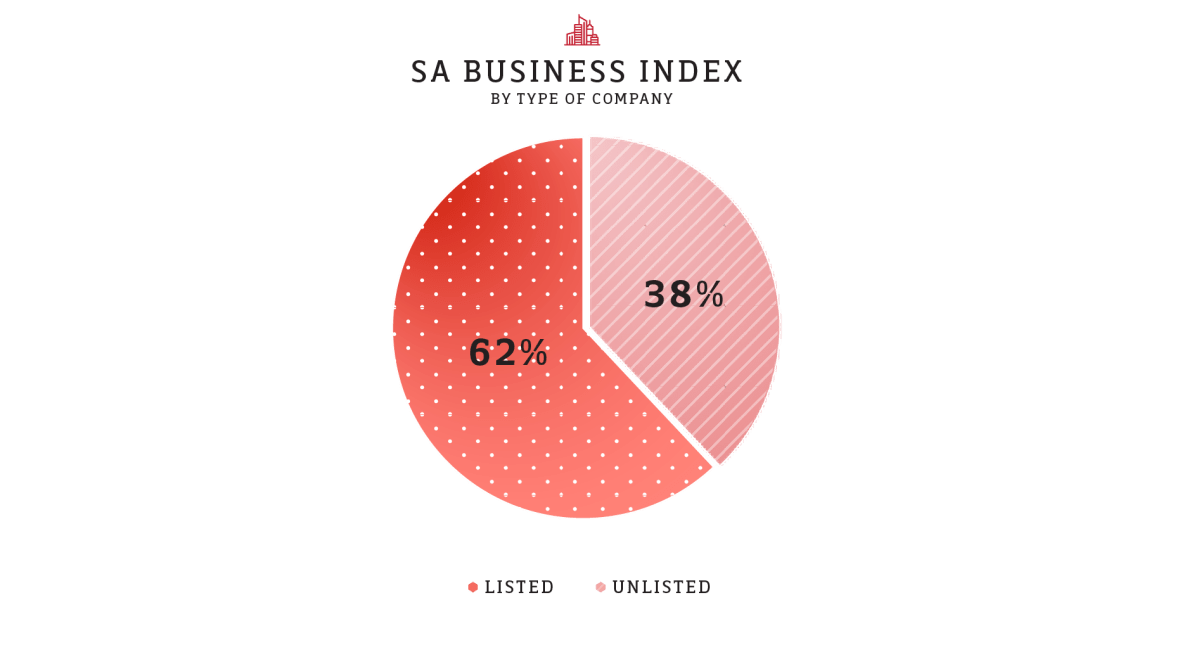

The number of listed companies on the Index has risen to 33, reflecting a share market at 10-year highs.

Produced by Adelaide financial services firm Taylor Collison, the Index is limited to South Australian entities with an Adelaide ownership register, South Australian-operated entities, or companies founded and majority-owned by South Australians.

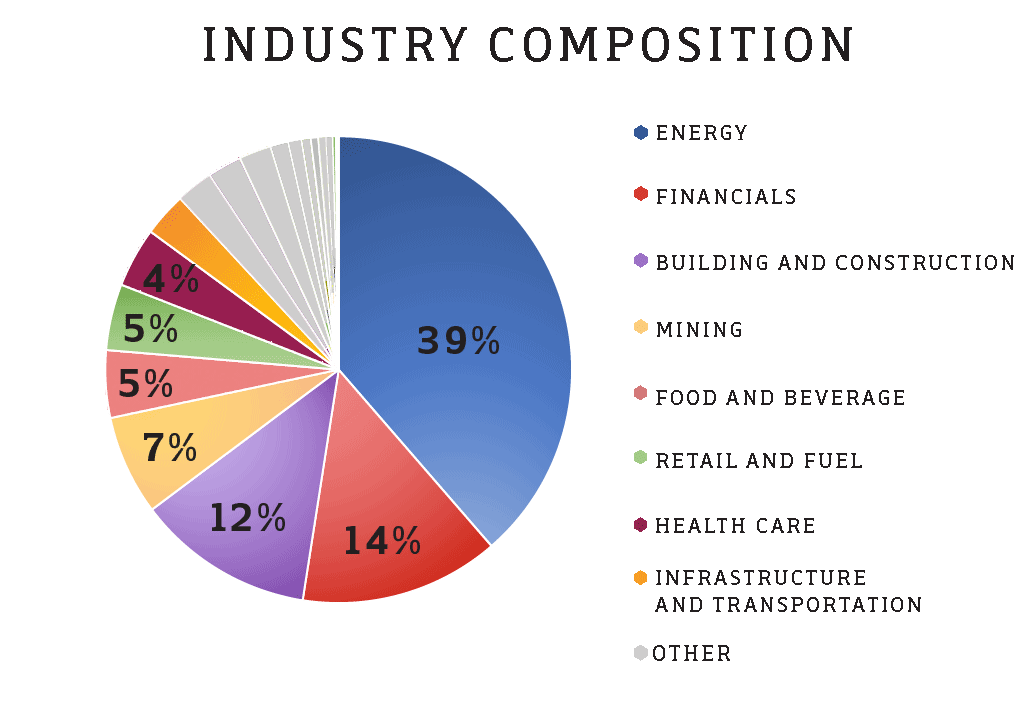

Energy, financial, and the building and construction sectors dominated the Index in 2017-18. Together these segments represent 65 per cent of the total value of the top 100 companies.

Energy was the standout sector, with the state’s largest company – Santos – almost doubling its market cap based on higher oil prices and its rejection of a hostile takeover bid. Beach Energy became the third-best returning stock on the ASX 200 on a rolling year basis, and Cooper Energy completed funding of its important Sole Gas Project.

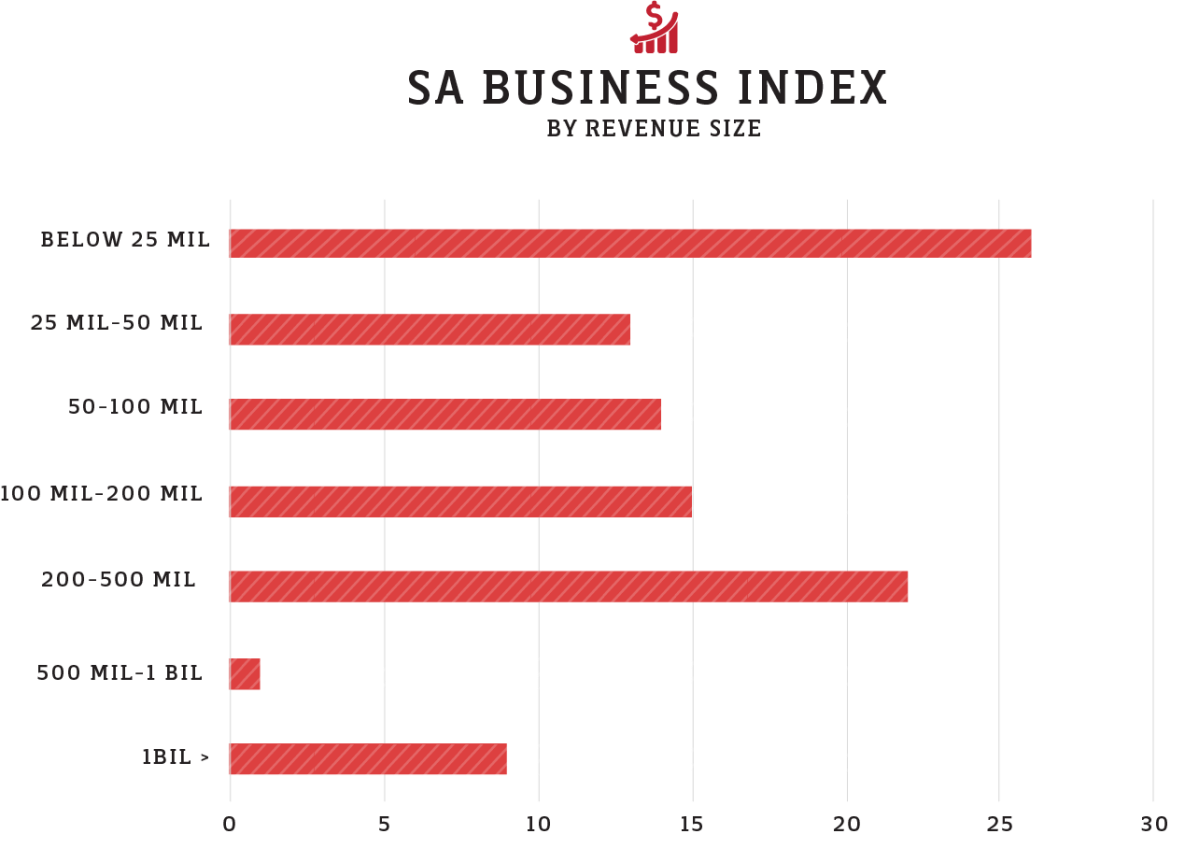

Not surprisingly given the above, revenue has had a positive shift in the past year with the number of companies in the $1 billion-plus bracket increasing to nine, up from six the previous year. Thirty-two companies recorded revenue above $200 million – an additional two compared to last year.

Taylor Collison director Scott Dolling said that after three years of flat performance, the Index had grown 33 per cent this year, outperforming global and local peers.

For example, the DAX 30 in Germany grew by 3.37 per cent, the Dow Jones index in the US grew by 17.04 per cent and, in Australia, the ASX S&P 200 went up by 7.7 per cent.

“But there’s still a long way to go, with Wesfarmers alone being worth more than the entire SA Business Index with a market cap of $A57 billion,” Dolling said.

For the future, Dolling said the energy sector was very promising.

“South Australia’s biggest sector is energy, providing an opportunity to be globally recognised as Australia’s energy state, similar to Western Australia being known for its metals and mining.”

The list of top 10 companies shows an array of positive stories. Number-one ranked Santos’s share price was up 79 per cent (year rolling), with profits strengthening. The number-two company, Argo Investments, produced a record high dividend of 31.5 cents. Number three Beach Energy had a powerful year of achievement, while fourth-placed Adelaide Brighton recorded double-digit revenue growth.

OZ Minerals, at number five, produced revenue of more than $1 billion with an employment base of 329 staff. At number six, South Australia’s largest private company – OTR owner Peregrine Corporation – employed around 4000 people and recorded revenue of $2.37 billion.

The top 100 list, however, also shows strong performances in its lower reaches.

This year the Index has special awards for Best New Entrant to the Index, Fastest Growing Private Business (valued in the $10m-50m range), Best Revenue Growth, and the Rising Star.

Rising Star award presented by People’s Choice Credit Union

This year’s Rising Star award, for the company that has risen the highest number of places in the Index, goes to a venerable South Australian company – transport and logistics firm Cochrane’s.

With more than 40 years’ experience in regional and metropolitan supply chain solutions, Cochrane’s employs 192 full-time staff with revenue approaching $50 million.

Cochrane’s is ranked 63 on this year’s list – up from position 99 last year.

Honourable mentions went to travel and accommodation company Discovery Parks (ranked 15, up from 41), and Kanmantoo mine owner Hillgrove Resources (ranked 65, up from 92).

Best New Entrant presented by HLB Mann Judd

Presented to a new entrant to the Index, this year’s winner is engineering and construction company RJE Global. RJE, ranked for the first time this year at 48th place, has revenues in excess of $100 million and employs 330 full-time staff. The company grew more than 50 per cent year-on-year.

Honourable mentions went to Duxton Broadacre Farms (ranked 58), which completed its IPO in January 2018 (another float originated by the Duxton Group), IT consulting company and Oracle developer PrimeQ Limited (81), and engineering firm Lucid Consulting Australia (68).

The winner receives a business solutions package from HLB Mann Judd valued at $15,000.

Fastest Growing Private Business $10-50 million presented by HLB Mann Judd

This award goes to GPA Engineering (ranked 77), with revenues of $40 million.

Honourable mentions went to broad-based consultancy firm Fyfe Pty Ltd (ranked 69) and wine company d’Arenberg (a new entrant ranked 88).

The winner receives a business solutions package from HLB Mann Judd valued at $5000.

Revenue Growth Award presented by the Local Government Association

This award goes to waste services company ResourceCo (ranked 24), which increased its revenue by 64 per cent over the year to hit $255 million. One of Australia’s largest recycling businesses, ResourceCo employs 492 full-time staff.

Honourable mentions went to Beach Energy, which supercharged its revenue following the acquisition of the Lattice assets from Origin, as well as IT consulting Oracle partner PrimeQ.