SA’s top 100 companies 2017: the full list

InDaily’s South Australian Business Index 2017 – a ranking of the state’s top 100 companies – shows an increase in revenue of more than 6 per cent and a lift in market capitalisation of more than 5 per cent over the past financial year, thanks to a strong recovery in the energy sector.

The third annual version of the index, released today, shows strong growth among the cream of South Australia’s companies, with total revenue of the top 100 increasing by 6.45 per cent to hit just over $23 billion, while market capitalisation increased by 5.24 per cent to reach more than $37.5 billion.

The index, produced by Adelaide financial services firm Taylor Collison, is based on an analysis of revenue and estimated market capitalisation (scroll down to see the full list).

Taylor Collison director Scott Dolling said that despite downbeat perceptions in some quarters, the state’s top companies were healthy and still achieving strong growth.

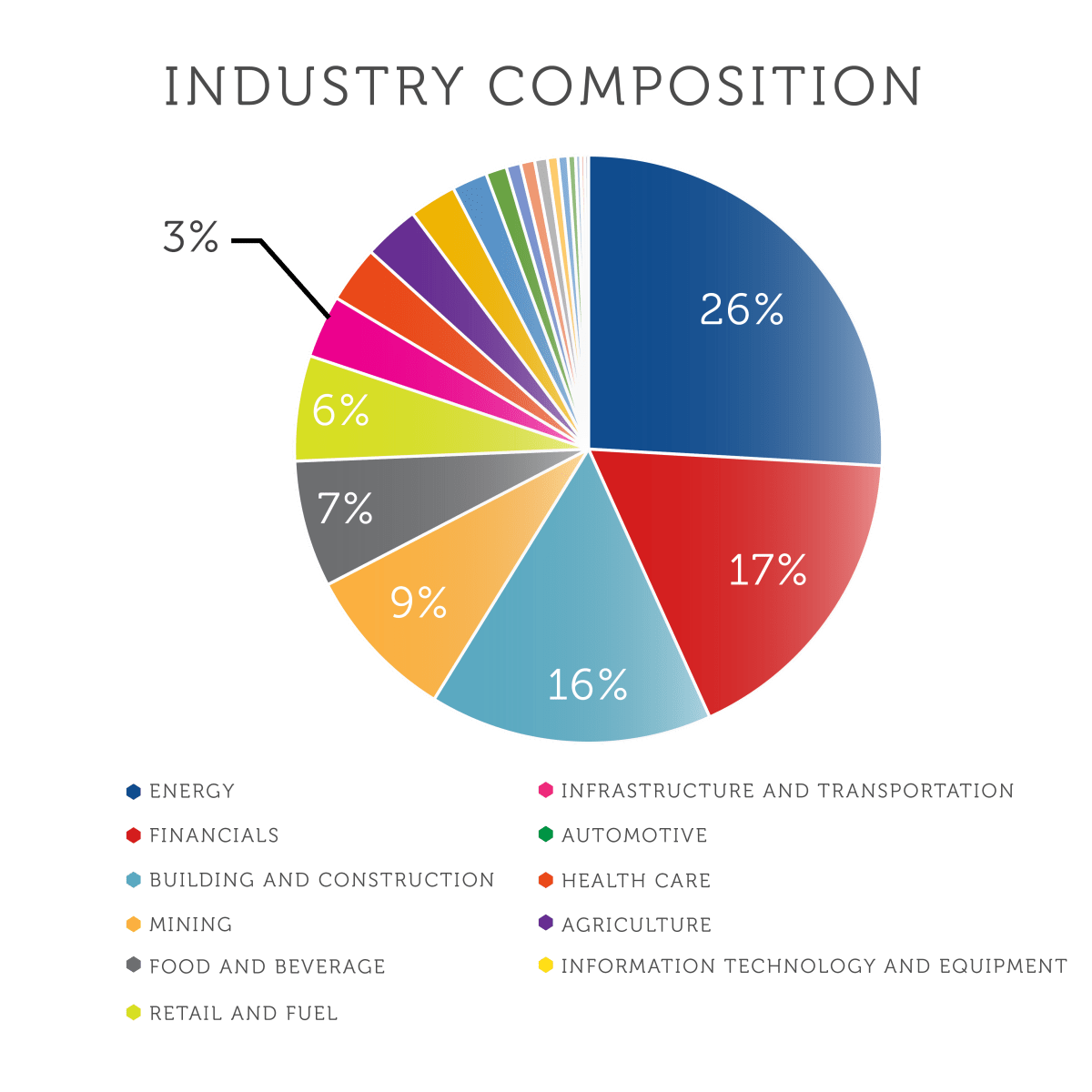

“With energy recovering strongly, SA’s largest industry in the Index increased its share of the SA pie, gaining 2.5 percentage points,” Dolling said.

“Metals and mining also gained a respectable 1.78 percentage points with the recovery in commodity prices. All other industry sectors remained roughly in line, with flat movement across the other major sectors (financials, building and construction, and retail).”

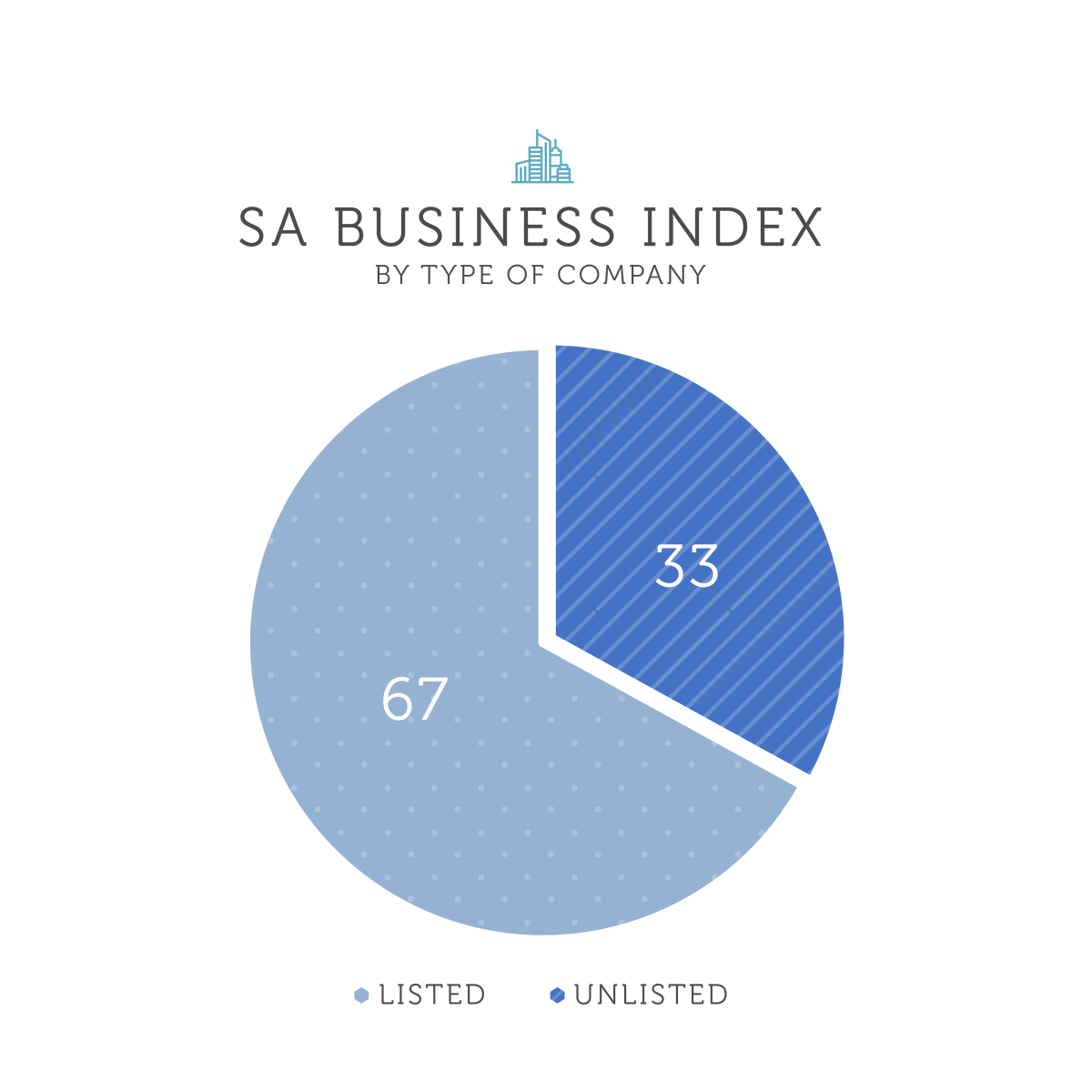

About two-thirds of the companies in the Index were listed companies, while the remainder were private.

Energy companies made up 26 per cent of the top 100, by revenue (see chart below), thanks in large part to the state’s number-one company, Santos, one of the world’s biggest oil and gas companies. The energy sector contributed more than $9 billion in market cap and revenue.

The next biggest industry was the financial sector, with 17 per cent of share, closely followed by building and construction (16 per cent), mining (9 per cent), food and beverage (7 per cent), retail and fuel (6 per cent), and infrastructure and transportation (3 per cent).

Dolling said the state had significant expertise in oil and gas.

“This looks to increase given the announcement by Beach Energy today that it will acquire Origin’s Lattice assets, with an enterprise value of over $1.5 billion.”

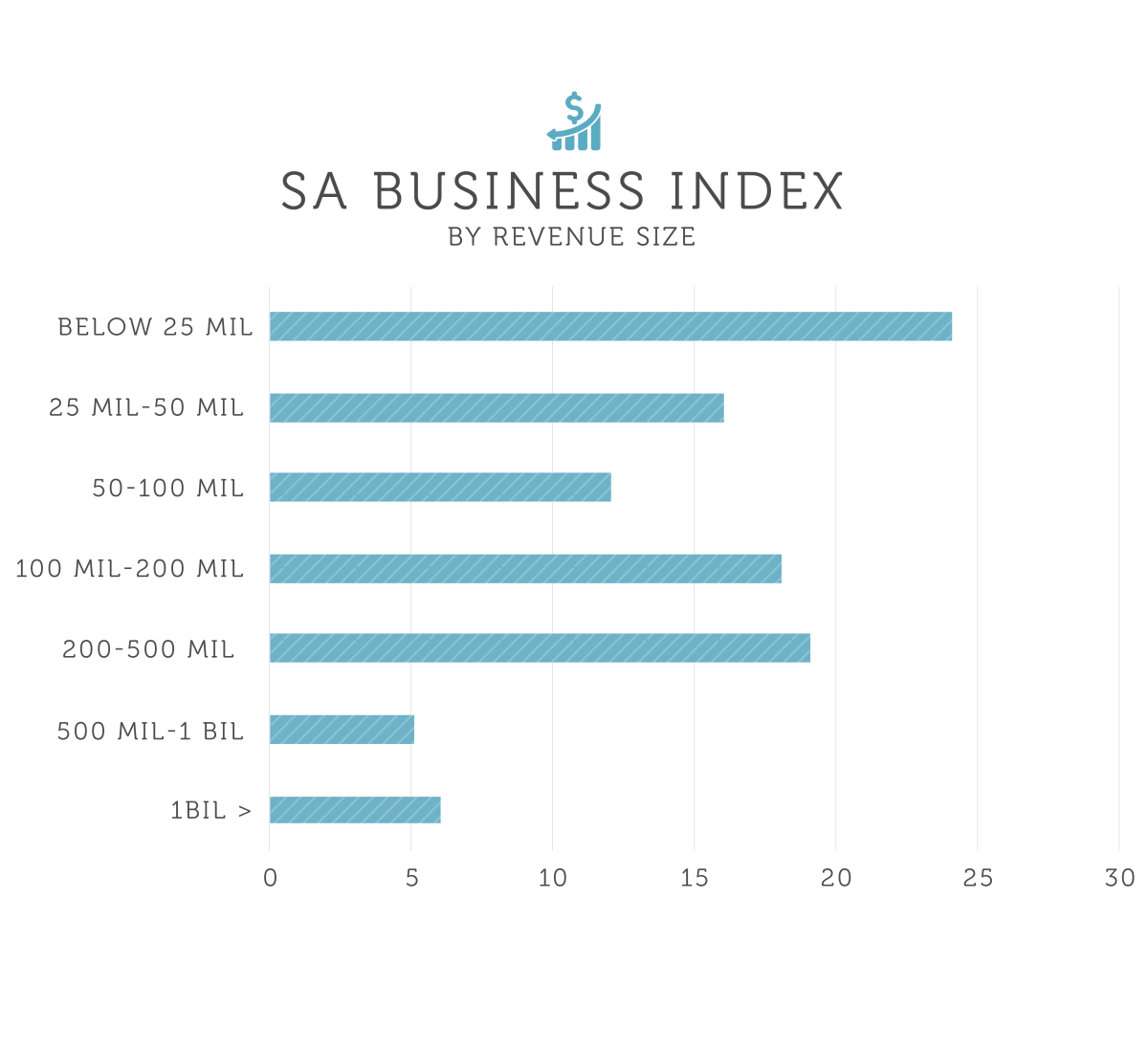

About a quarter of the list were companies with revenue below $25 million, with companies in the $200m-$500m range the next biggest segment (just under 20 per cent).

Eleven companies achieved revenue of more than $500 million.

Dolling said South Australia should aim to build on the high end of the Index.

“There is a clear benefit to having large corporate entities within the state,” he said. “The key message here is the more large entities we can attract and retain here, the higher the chance that more key decision-makers sit in South Australia. This leads to additional highly educated/high-paying jobs, as well as additional workflow in downstream services (accountants, lawyers, professionals, etc).

“The $500 million-plus companies provide high-end jobs that are critical to the future of SA – ensuring SA’s talent pool doesn’t leave the state and that high remuneration is spent within the state on goods and services here.”

Companies are considered eligible for the list if they have a South Australian head office, with an Adelaide share registry, or are SA operated, founded and majority-owned by South Australians. Qualifying companies can’t be government-run, agencies of government or a registered charity.

Companies are considered eligible for the list if they have a South Australian head office, with an Adelaide share registry, or are SA operated, founded and majority-owned by South Australians. Qualifying companies can’t be government-run, agencies of government or a registered charity.

Some private companies have requested revenue data not be made public.

For some companies – such as those involved in minerals exploration – revenue has little relevance, compared to market capitalisation. Where this is the case, it’s noted in the list.

South Australian Business Index: The full list

| 100 Landscape Construction Services Pty Ltd Sector: Building and construction Revenue 2017: $19m Last Year’s Ranking: Not ranked LCS Landscapes is a broad-based landscape construction company servicing public and private sectors, including work on playgrounds, streetscapes and other public spaces. |

| 99 Peter Cochrane Management Pty Ltd (Cochrane’s) Sector: Infrastructure and Transportation Revenue 2017: Not available Last Year’s Ranking: Not ranked Cochrane’s is an express logistics business, servicing South Australia, Mildura and Broken Hill. |

| 98 HMPS (Hot Melt Packaging Systems) Sector: Information technology and equipment Revenue 2017: Not available Last Year’s Ranking: Not ranked HMPS is an Australian company that specialises in the design, development and manufacturing of high quality machinery for packaging processes. |

| 97 Beerenberg Pty. Ltd. Sector: Food and Beverage Revenue 2017: Not available Last Year’s Ranking: 91 Beerenberg Farm is an Australian producer of jams, condiments, sauces and dressings, located in Hahndorf in the Adelaide Hills. |

| 96 Core Exploration Limited Sector: Mining Revenue 2017: Not relevant Last Year’s Ranking: Not ranked Core Exploration Ltd focuses on commercially robust base metal and uranium deposits in South Australia and the Northern Territory. |

| 95 Customs Agency Services Pty Ltd Sector: Infrastructure and Transportation Revenue 2017: Not available Last Year’s Ranking: 94 Customs Agency Services is an international freight forwarding and customs brokerage organisation. |

| 94 Axiom Properties Limited Sector: Real Estate Revenue 2017: $5m Last Year’s Ranking: 89 Axiom is a property development and investment business. |

| 93 Centrex Metals Limited Sector: Mining Revenue 2017: Not relevant Last Year’s Ranking: Not ranked Centrex Metals Limited has exploration licences covering an area of more than 2,000km2 of known iron ore deposits and prospects on Eyre Peninsula, South Australia. |

| 92 Hillgrove Resources Limited Sector: Mining Revenue 2017: $113m Last Year’s Ranking: Not ranked Hillgrove Resources Limited is an Australian mining company focused on developing its flagship Kanmantoo Copper Mine and associated regional exploration targets, located less than 55km from Adelaide. |

| 91 Korvest Limited Sector: Infrastructure and Transportation Revenue 2017: $45m Last Year’s Ranking: 84 Korvest is a supplier of cable and pipe supports, industrial access and safety systems, fastening solutions, and galvanising services. |

| 90 National Crime Check Sector: Information technology and equipment Revenue 2017: Not available Last Year’s Ranking: 92 National Crime Check is an innovative online web service application that enables the lodgement of police checks with most applications processed and dispatched in 1-2 business days. |

| 89 WGA Sector: Professional services Revenue 2017: $28m Last Year’s Ranking: 86 WGA (Wallbridge Gilbert Aztec) is a national engineering firm offering a wide range of consulting services including structural, civil, maritime, mechanical, geotechnical, heavy lifting, temporary works, project management, electrical and pressure vessels. |

| 88 IJF Australia Pty Ltd Sector: Other Revenue 2017: $40m Last Year’s Ranking: 85 For more than 50 years IJF Australia has specialised in office and residential fit-outs. |

| 87 GPA Engineering Pty Ltd Sector: Professional services Revenue 2017: Not available Last Year’s Ranking: 80 GPA is able to develop, engineer and implement industrial projects of any size, in oil and gas, water treatment and distribution, heavy metals and resources, manufacturing and electrical supply. |

| 86 Fyfe Pty Ltd Sector: Professional services Revenue 2017: $29m Last Year’s Ranking: 65 Fyfe is a well established land, resource and infrastructure development consultancy specialising in comprehensive engineering, environmental, planning and surveying services for land development, energy, mining and oil and gas industries across Australia. |

| 85 Prophecy International Holdings Limited Sector: Information technology and equipment Revenue 2017: $9m Last Year’s Ranking: 68 Prophecy International is a software company specialising in products for the financial and utilities markets. |

| 84 Pasture Genetics Sector: Agriculture Revenue 2017: $30m Last Year’s Ranking: Not ranked Pasture Genetics is one of the largest producers, marketers and suppliers of seed to Australian agriculture. |

| 83 Asian American Medical Group Limited Sector: Health Care Revenue 2017: $17m Last Year’s Ranking: Not ranked. AAMG was first established as a liver centre, formerly known as Asian Centre for Liver Diseases and Transplantation (ACLDT), but has expanded into broader health services. |

| 82 MYKRA Pty Ltd Sector: Building and Construction Revenue 2017: $32m Last Year’s Ranking: 87 Mykra provides construction and maintenance services to many government departments, individuals, builders and commercial organisations. |

| 81 Partek Industries Pty Ltd Sector: Building and construction Revenue 2017: $32m Last Year’s Ranking: 82 Partek provides a dedicated construction team to work closely with businesses, coordinating appropriate trades including directly employed staff as well as the specialist contractors. |

| 80 Trident Plastics Pty Ltd Sector: Other Revenue 2017: Not available Last Year’s Ranking: Not ranked Trident Plastics is the largest custom moulder in SA offering a full suite of services from concept development, product design, prototyping, mould making and product manufacture to a diverse range of clients. |

Hillgrove Resources’ Kanmantoo copper mine

| 79 Chem Supply Pty Ltd Sector: Other Revenue 2017: $23m Last Year’s Ranking: Not listed Chem-Supply Pty Ltd is an Australian owned manufacturer and supplier of laboratory and industrial specialty chemical products. |

| 78 Credit Union SA Sector: Financials Revenue 2017: $39m Last Year’s Ranking: 75 Credit Union SA is committed to supporting the financial future of those living in South Australia by providing a variety of financial products and services. |

| 77 Legend Corporation Limited Sector: Information technology and equipment Revenue 2017: $111m Last Year’s Ranking: 71 Legend Corporation Limited is an engineering solutions provider, operating in electrical, power, rail, mining, information technology, semiconductor, medical and defense industries. |

| 76 Growers Wine Group Sector: Food and Beverage Revenue 2017: Not available Last Year’s Ranking: Not listed Growers Wine Group is a business consortium of four local Riverland wine growers. The winery is strategically positioned on the eastern perimeter in the key grape growing region of the Riverland, South Australia. |

| 75 LBT Innovations Limited Sector: Health Care Revenue 2017: $5.9m Last Year’s Ranking: 88 Over the past decade, LBT Innovations has emerged as a groundbreaking designer of advanced automated solutions for the preparation and analysis of microbiology culture specimens, with significant benefits for busy clinical laboratories. |

| 74 Micro-X Limited Sector: Health Care Revenue 2017: $659,000 Last Year’s Ranking: Not available Micro-X was founded in 2011 in Victoria by current Managing Director, Peter Rowland, to commercialise the miniaturisation benefits of CNT x-ray tubes in mobile radiography. |

| 73 Leigh Creek Energy Limited Sector: Energy Revenue 2017: Not meaningful Last Year’s Ranking: 93 Leigh Creek Energy Limited (LCK) is an ASX listed energy company focussed on developing its Leigh Creek Energy Project (LCEP), located 550km north of the capital city of Adelaide in the state of South Australia. |

| 72 The Co-op Sector: Agriculture Revenue 2017: $57m Last Year’s Ranking: Not listed The Co-op is the largest and longest standing consumer co-operative in Australia. It has 18,100 members that currently own the Barossa Shopping Centre of 24 tenancies. It also operates six businesses within the centre (including a Foodland, Mitre 10 and Betta Home Living). |

| 71 Guidera O’Connor Pty Ltd Sector: Building and construction Revenue 2017: Not available Last Year’s Ranking: 72 Guidera O’Connor Pty Ltd (GO) is a private Australian-owned company providing design and construction services to the Australian water industry. |

| 70 Angove’s Pty Ltd Sector: Food and Beverage Revenue 2017: $59 million Last Year’s Ranking: Not listed Founded in 1886, Angove Family Winemakers is a 5th generation, family-owned winery with a dedication to creating premium wines from across South Australia’s best regions with a focus on McLaren Vale and organic wines. |

| 69 Stonewall Resources Limited Sector: Mining Revenue 2017: Not meaningful Last Year’s Ranking: Not listed. Stonewall Resources is reawakening a giant goldfield in South Africa’s Eastern Goldfields, where South Africa’s gold mining industry began almost 130 years ago. |

| 68 CCW Co-operative Limited Sector: Agriculture Revenue 2017: $63m Last Year’s Ranking: 73 Located in the Riverland of South Australia, CCW Co-operative Limited has almost 600 grower members and a grape supply base close to 200,000 tonnes of winegrapes, making it the largest grape supply co-operative in Australia. |

| 67 Boart Longyear Limited Sector: Mining Revenue 2017: $857m Last Year’s Ranking: 45 Boart Longyear is the world’s leading provider of drilling services, drilling equipment and performance tooling for mining and drilling companies. It also has a substantial presence in aftermarket parts and service, energy, mine dewatering, oil sands exploration, production drilling, and down-hole instrumentation. |

| 66 Maughan Thiem Automotive Pty Ltd Sector: Automotive Revenue 2017: $136m Last Year’s Ranking: 70 Maughan Thiem is a family-owned and operated car dealership with over 100 years of experience in the automotive industry. |

| 65 AE Haigh Pty Ltd Sector: Food and Beverage Revenue 2017: $59m Last Year’s Ranking: 69 Haigh’s Chocolates is a loved brand that creates quality Australian-made chocolates in Adelaide. |

| 64 Sundance Energy Australia Limited Sector: Energy Revenue 2017: $89m Last Year’s Ranking: 28 Sundance Energy Australia Ltd. (ASX: SEA) is a US onshore oil and gas company focused on the acquisition and development of large, repeatable resource plays. |

| 63 O’Connor Services Sector: Building and construction Revenue 2017: Not available Last Year’s Ranking: Not listed O’Connors is an industry leading South Australian, privately owned, mechanical services provider. |

| 62 Havilah Resources NL Sector: Mining Revenue 2017: $13m Last Year’s Ranking: Not listed Havilah Resources NL engages in the exploration of gold, base metals, and other mineral deposits in Australia. |

| 61 Data Action Pty Ltd Sector: Information technology and equipment Revenue 2017: $42m Last Year’s Ranking: 66 Leading software and services providing Digital Banking and Core Banking solutions based on the latest technologies and industry requirements. |

| 60 Duxton Water Limited Sector: Agriculture Revenue 2017: $843,000 Last Year’s Ranking: 63 Duxton Water Limited presents an opportunity to invest Australian Water Entitlements – a key production input into a number of agricultural industries. |

Simon, John and Alister Haigh are third- and fourth-generation owners of South Australian family business Haigh’s Chocolates. Photo: supplied

| 59 Clean Seas Tuna Limited Sector: Agriculture Revenue 2017: $36m Last Year’s Ranking: 77 Clean Seas is Australia’s only commercial producer of Kingfish and a pioneer in the country’s emerging aquaculture industry. |

| 58 L H Perry & Sons Pty Limited Sector: Energy Revenue 2017: $107m Last Year’s Ranking: 62 Independent, family-owned fuel distribution company founded in 1949. Perrys is a distributor of Mobil fuel and lubricants through its bulk deliveries as well as BP fuel and lubricants through its service station and reseller sites. |

| 57 Finsbury Green Pty Ltd Sector: Printing Revenue 2017: $79m Last Year’s Ranking: Not ranked Finsbury Green is a leading Australian company in the business of print, managed services and logistics. |

| 56 Flinders Port Holdings Pty Limited Sector: Infrastructure and Transportation Revenue 2017: $206m Last Year’s Ranking: 60 Leading privately-owned port operator with seven ports in South Australia also offering hydrographic survey services. |

| 55 Academy Services Pty Ltd Sector: Commercial services Revenue 2017: $56m Last Year’s Ranking: 46 Academy Services is widely recognised as one of Australia’s leading providers of commercial cleaning and associated property services. |

| 54 SAGE Group Holdings Ltd Sector: Other Revenue 2017: $72m Last Year’s Ranking: 64 SAGE Group Holdings Ltd, together with its subsidiaries, provides electrical engineering and automation services in Australia. |

| 53 Kangaroo Island Plantation Timbers Limited Sector: Agriculture Revenue 2017: Not relevant Last Year’s Ranking: 74 Kangaroo Island Plantation Timbers is Australia’s only listed timber company. It manages a wholly-owned portfolio of hardwood and softwood forestry plantations on Kangaroo Island, South Australia. |

| 52 Galipo Sector: Food and Beverage Revenue 2017: $92m Last Year’s Ranking: Not ranked Galipo Foods is a one stop shop for the food service industry with more than 6500 different products & a fleet of 42 trucks servicing South Australia. |

| 51 Beston Global Food Company Limited Sector: Agriculture Revenue 2017: $25m Last Year’s Ranking: 34 Beston Global Food Company Limited (BGFC) says it is out to change the emerging global imbalance between food demand and supply around the globe. It exports dairy products, meat, seafood and spring water. |

| 50 Samuel Smith & Son Pty Limited Sector: Food and Beverage Revenue 2017: $147m Last Year’s Ranking: 56 Samuel Smith & Son is a well respected, family-owned wine merchant established in 1923, servicing the liquor industry of Australia with a blue chip portfolio of national and international wines, spirits and premium ales. |

| 49 Thomson Geer Sector: Professional services Revenue 2017: $130m Last Year’s Ranking: 52 Large corporate law firm with 90 partners working across ASX clients, major global foreign corporations government enterprises and private corporations with offices in Adelaide, Sydney, Melbourne and Brisbane. |

| 48 Nova Aerospace Pty Ltd Sector: Professional services Revenue 2017: $104m Last Year’s Ranking: 59 Founded in 2000, Nova Aerospace is a private professional services firm operating in the areas of defence, energy and utilities, communications and transportation. |

| 47 Australian Outdoor Living Sector: Housing Revenue 2017: Not available Last Year’s Ranking: 47 Founded in 2005, Australian Outdoor Living’s range of products now includes outdoor blinds, roller shutters, artificial grass, pergolas, verandahs, carports, timber decking, fibreglass pools, concrete pools, spas and swim spas. |

| 46 MGA and Whittles Group of Companies Sector: Financial Revenue 2017: $106m Last Year’s Ranking: 57 The group has been providing risk advice and a general insurance broking service for over 35 years. Whittles provide professional and experienced strata and community title management. |

| 45 Arrowcrest Group Pty Ltd Sector: Automotive Revenue 2017: $216m Last Year’s Ranking: 49 Arrowcrest is the parent company of ROH Wheels, John Shearer, Unicast, Tristar, NonFerral, Kockums Industries and Brownbuilt. |

| 44 Spend-less Shoes Pty Ltd Sector: Retail and Fuel Revenue 2017: Not available Last Year’s Ranking: Not ranked Spend-less Shoes is an Australian-owned and operated footwear retailer. |

| 43 Police Health Ltd Sector: Financials Revenue 2017: $112m Last Year’s Ranking: 55 Australia’s only private health insurer run by police for police offering comprehensive health insurance to 50,000 members across the policing community in Australia. |

| 42 A Noble & Son Limited Sector: Other Revenue 2017: $58m Last Year’s Ranking: 37 Nobles is a specialist provider of lifting & rigging equipment, technical services & engineering design. |

| 41 Discovery Parks Holdings Pty Limited Sector: Travel and accommodation Revenue 2017: $118m Last Year’s Ranking: 48 Discovery Parks has more than 60 holiday parks around the country, with a head office based in Adelaide. |

| 40 Alice Car Centre Pty Ltd Sector: Automotive Revenue 2017: $241m Last Year’s Ranking: 44 A entity of Peter Kittle Motor Company, which runs a series of motor dealerships. |

A Flinders Ports crane in operation.

| 39* Ellex Medical Lasers Limited Sector: Health Care Revenue 2017: $71.6m Last Year’s Ranking: 38 Ellex Medical Lasers is an Australia-based company that is engaged in the business of designing, manufacturing and marketing a line of lasers used by ophthalmologists. |

| 39 Australian Vintage Limited Sector: Food and Beverage Revenue 2017: $226m Last Year’s Ranking: 43 Leading Australian wine company with a fully-integrated wine business model including vineyards, boutique and bulk wine production, packaging, marketing and distribution. One of the largest vineyard owners and managers in Australia, crushing approximately 10% of total Australian annual production. |

| 38 Iron Road Limited Sector: Mining Revenue 2017: Not relevant Last Year’s Ranking: 61 Iron Road’s vision is to become a trusted and reliable supplier of premium iron concentrates to the Asian marketplace. |

| 37 Phil Hoffman Travel Sector: Travel and accommodation Revenue 2017: Not Available Last Year’s Ranking: 36 Travel agency established in 1990, now with 10 locations in South Australia servicing business and private travel, cruising and luxury tours. |

| 36 Leader Computers Pty Ltd Sector: Information technology and equipment Revenue 2017: $147m Last Year’s Ranking: Not listed. Leader Computers Pty Ltd is a manufacturer & distributor of high quality Information Communications Technology (ICT) products. They manufacture Leader branded PC’s, Notebooks, Tablets, & Intel white box series. They also distribute a huge range of IT products and peripherals. |

| 35 Civil & Allied Technical Construction Pty Ltd Sector: Building and construction Revenue 2017: Not Available Last Year’s Ranking: 54 CATCON is a well-established, resource based company which delivers and manages power, mining, water and general infrastructure projects for national and international clients. |

| 34 ResourceCo Sector: Waste Disposal Revenue 2017: $156m Last Year’s Ranking: 39 Founded in 1993, the waste services company provides recycling, soil and waste management services, and produces alternative fuels. |

| 33 Clearlight Investments Pty Limited Sector: Food and Beverage Revenue 2017: $312m Last Year’s Ranking: 31 Trading as San Remo, the company has offices and distribution centres in all main capital cities throughout Australia and New Zealand, and exports to 35 countries throughout the world. San Remo’s manufacturing site in Adelaide combines the traditional Italian pasta-making knowledge with modern technology. |

| 32 Weeks Group Pty Ltd Sector: Building and construction Revenue 2017: $157m Last Year’s Ranking: 33 Building company offering a range of homes to customers in South Australia and Victoria. |

| 31 Rivergum Homes Sector: Building and construction Revenue 2017: $158m Last Year’s Ranking: 31 A building company servicing property markets in South Australia and Queensland |

| 30 Mossop Group Pty Ltd Sector: Building and construction Revenue 2017: $159m Last Year’s Ranking: 42 Significant South Australian-based construction + interiors company, directly employing around 100 people and providing jobs to numerous contractors. |

| 29 Detmold Holdings Pty Ltd Sector: Packaging Revenue 2017: $409m Last Year’s Ranking: 29 The Detmold Group is a leading manufacturer of paper and board-based packaging products for a diverse range of customers. |

| 28 Hickinbotham Group of Companies Sector: Building and construction Revenue 2017: Not Available Last Year’s Ranking: 25 Established in 1954, the company has built 20,000 homes and more than 50 community estates. |

| 27 Bionomics Limited Sector: Biotechnology Revenue 2017: $19m Last Year’s Ranking: 27 Biopharmaceutical company dedicated to making better treatments for cancer, central nervous system disorders such as anxiety, depression and Alzheimer’s Disease. |

| 26 Sarah Group Sector: Building and construction Revenue 2017: $234m Last Year’s Ranking: 32 Established in 1961, the group comprises Sarah Constructions, a commercial construction contractor, and Hindmarsh Plumbing, a commercial plumbing, maintenance and water treatment contractor. |

| 25 Community CPS Australia Limited Sector: Financials Revenue 2017: $238m Last Year’s Ranking: 23 A fully customer-owned bank, bringing together a number of community financial organisations under a united brand. Provides banking services, community investments, grants and sponsorships. |

| 24 McMahon Services Australia Pty Ltd Sector: Building and construction Revenue 2017: $260m Last Year’s Ranking: 24 McMahon Services is a privately-owned industrial, construction and environmental services provider established in 1990. |

| 23 Ahrens Group Pty Ltd Sector: Building and construction Revenue 2017: $289m Last Year’s Ranking: 19 National full-service construction, engineering and mining services company, delivering a complete range of project services and solutions from design, steel fabrication and procurement through to construction and project delivery. |

| 22 Terramin Australia Limited Sector: Mining Revenue 2017: Not relevant Last Year’s Ranking: 26 Terramin is a base and precious metal development company with advanced zinc and gold projects in Algeria and South Australia |

| 21 Drakes Supermarkets Pty Ltd Sector: Food and Beverage Revenue 2017: $1.1b Last Year’s Ranking: 22 Drakes Supermarkets is the largest independent grocery retailer in Australia and specialises in supermarket retailing. Operating in over 50 stores across South Australia and Queensland, the company now has an annual turnover in excess of $1 billion and employs more than 5500 staff nationally. |

| 20 Badge Group Holdings Pty Ltd Sector: Building and construction Revenue 2017: $377m Last Year’s Ranking: 18 Privately-owned construction group delivering commercial projects across Australia from offices in Adelaide, Brisbane, Maroochydore and Perth, with more than three decades of experience across a diverse range of sectors. |

| 19 Codan Limited Sector: Information technology and equipment Revenue 2017: $226m Last Year’s Ranking: 20 Provides technology solutions for communications, safety, security and productivity problems in the harshest environments on earth. |

| 18 Taplin Group of Companies Sector: Real Estate Revenue 2017: Not Available Last Year’s Ranking: 67 Taplin Real Estate is a household name in South Australia and has a long association with the real estate industry. Their main focus is selling and property management in residential and commercial. |

| 17 Sealink Travel Group Limited Sector: Infrastructure and Transportation Revenue 2017: $200m Last Year’s Ranking: 12 Tourism and transport company with more than 900 staff and six million customers annually. |

| 16 Kilbirnie Investments Pty Ltd (CMV Group) Sector: Automotive Revenue 2017: $1b Last Year’s Ranking: 14 Established in 1934, now with substantial operations in automotive dealerships and horticulture predominately in South Australia and Victoria, employing more than 1200 staff with annual turnover in excess of $1B. |

| 15 Accolade Wines Holdings Australia Pty Limited Sector: Food and Beverage Revenue 2017: $529m Last Year’s Ranking: 15 Number-one wine company in Australia and the UK by volume, and the fifth-largest wine company in the world, producing some of the world’s best-known brands. |

| 14 Royal Automobile Association of SA Inc Sector: Automotive Revenue 2017: $464m Last Year’s Ranking: 16 Established in 1903 to serve the motoring-related needs of South Australians. Provider of insurance, security, travel, finance, motoring and road safety products and services. |

| 13 Cooper Energy Limited Sector: Energy Revenue 2017: $35m Last Year’s Ranking: 41 Has offices and distribution centres in all main capital cities throughout Australia and New Zealand, and exports to 35 countries throughout the world. San Remo’s manufacturing site in Adelaide combines the traditional Italian pasta-making knowledge with modern technology. |

| 12 Coopers Brewery Limited Sector: Food and Beverage Revenue 2017: $254m Last Year’s Ranking: 11 Established in 1862, sole major brewer 100% owned by Australians, with more than 5% of the Australian beer market. |

| 11 Elders Limited Sector: Agriculture Revenue 2017: $1.6b Last Year’s Ranking: 31 Rural services provider offering finance, livestock and wool marketing, farm merchandise, agronomy, property and auction sales. |

| 10 People’s Choice Credit Union Sector: Financials Revenue 2017: $241m Last Year’s Ranking: 10One of Australia’s largest credit unions with 348,000 members across Australia and branches in South Australia, Northern Territory, Victoria, Western Australia and Australian Capital Territory. Created through the merger of Australian Central and Savings & Loans in December 2009. |

| 9 Thomas Foods Sector: Food and Beverage Revenue 2017: $1.4b Last Year’s Ranking: 9 Established in 1988, Thomas Foods International now has annual revenue well in excess of $1 billion, and is Australia’s largest 100% family-owned meat-processing company. |

| 8 Adelaide Airport Sector: Infrastructure and Transportation Revenue 2017: $210m Last Year’s Ranking: 8 Fourth-largest domestic airport and sixth-largest international airport in Australia, aviation gateway to South Australia processing more than 7.7 million passengers annually. Parafield Airport is South Australia’s premier general aviation airport and is a major world-standard international training airport. |

| 7 Mayne Pharma Group Limited Sector: Health Care Revenue 2017: $504m Last Year’s Ranking: 4 ASX-listed specialty pharmaceutical company focused on applying its drug delivery expertise to commercialise branded and generic pharmaceuticals. Mayne Pharma also provides contract development and manufacturing services to more than 125 clients worldwide. |

| 6 Beach Energy Limited Sector: Energy Revenue 2017: $649m Last Year’s Ranking: 7 Formed in 1961 and listed on the Australian Securities Exchange in 1962, Beach Energy is an oil and gas exploration and production company headquartered in Adelaide. Beach has a core focus on the resource-rich Cooper Basin with gross acreage of over 69,000 km2. |

| 5 Peregrine Corporation Sector: Retail and Fuel Revenue 2017: $2.1b Last Year’s Ranking: 6 Founded in 1984 when Fred Shahin, an accomplished auditor for the United Nations, immigrated to Australia, Peregrine’s retail operations include convenience and petroleum retailing; franchising; giftware and tobacco retailing; property and more. |

| 4 OZ Minerals Limited Sector: Mining Revenue 2017: $823m Last Year’s Ranking: 5 Copper-focused international company based in South Australia with a copper-gold-silver mine at Prominent Hill and developing one of Australia’s largest copper-gold resources at Carrapateena. Australia’s third-largest copper producer, OZ Minerals was formed in 2008 by the merger of two Australian non-ferrous metals mining businesses – Oxiana and Zinifex. |

| 3 Adelaide Brighton Limited Sector: Building and construction Revenue 2017: $1.4b Last Year’s Ranking: 3 One of Australia’s leading integrated construction materials and lime producers, established in 1882, now with approximately 1400 employees and operations in every state and territory in Australia |

| 2 Argo Investments Limited Sector: Financials Revenue 2017: $229m Last Year’s Ranking: 2 Established in 1946, Argo has a market capitalisation as at June 30, 2016, of $5.0 billion, placing it in the top 100 companies listed on the Australian Securities Exchange. |

| 1 Santos Limited Sector: Energy Revenue 2017: $3.5b Last Year’s Ranking: 1 Leading oil and gas producer, supplying Australian and Asian customers with a portfolio of high-quality liquefied natural gas (LNG), pipeline gas and oil assets. |

* Due to oversight, Ellex Medical Lasers Limited is placed in the joint position of 39 on the countdown.