South Australia’s economy is steady, but in need of a “spark” to move it forward, a leading economist says.

Labour market and retail turnover data for the last six months shows SA is “treading water but not going backwards”, SA Centre for Economic Studies (SACES) executive director Michael O’Neil says.

“It’s not all doom and gloom; we are, however, looking for the spark to energise investment in the private sector, boost growth, boost employment and incomes,” he said.

“With no major infrastructure projects in the offing, we do need a spark to drive private sector investment and hence growth.”

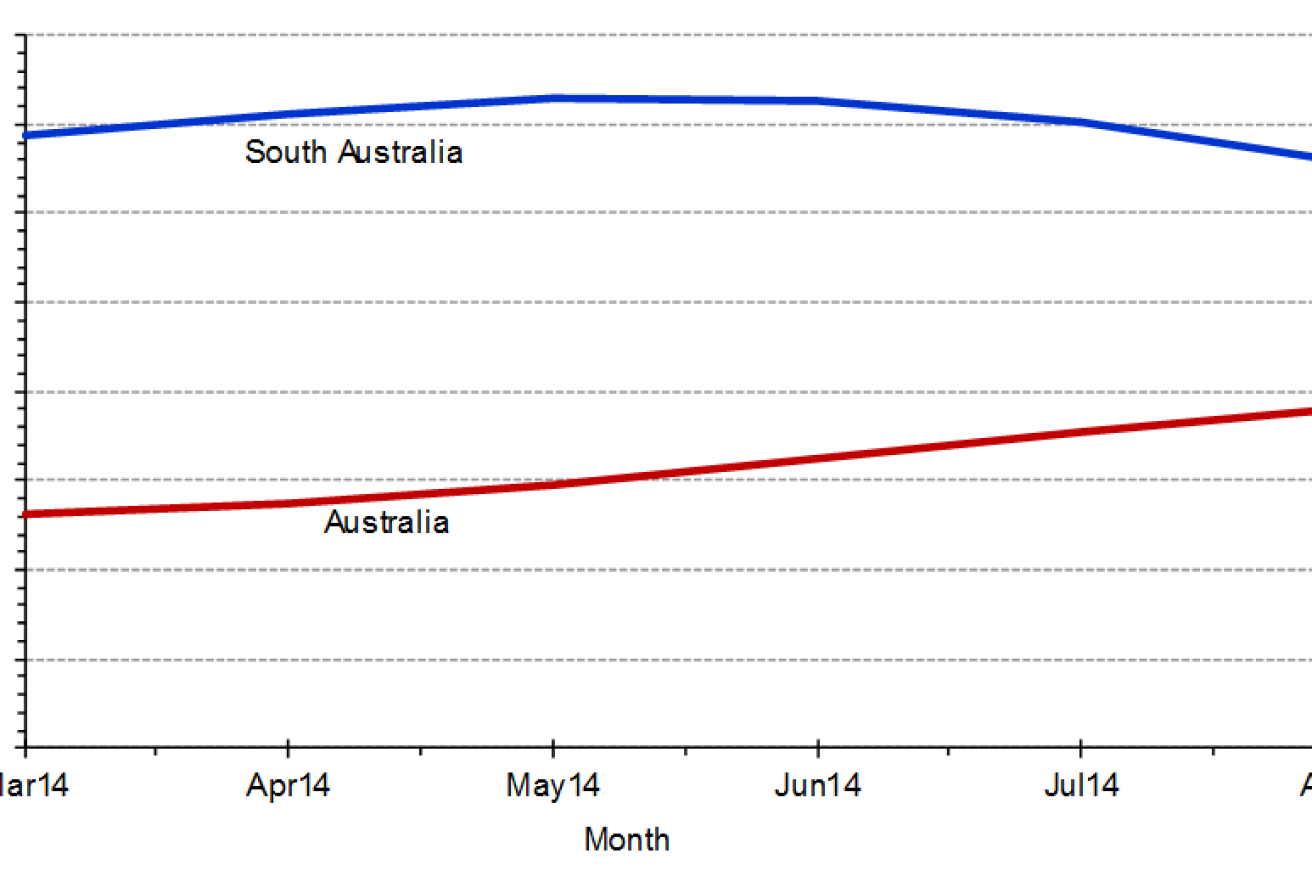

The SACES analysis shows South Australia’s trend unemployment rate over the six months to August 2014 has been above that of Australia, averaging 6.8 per cent.

Australia’s trend unemployment rate averaged 6.0 per cent in the six months to August 2014.

Analysis released overnight by the International Monetary Fund expects Australia will have the worst jobless rate in the Asia-Pacific region bar the Philippines, over the next two years.

The IMF is predicting a rate of 6.2 per cent in 2014 and 6.1 per cent for 2015.

Only the Philippines is higher in the region, with respective rates of 6.9 and 6.8 per cent.

More broadly, the IMF has made a modest upgrade to Australia’s growth forecasts in its latest World Economic Outlook, released in Washington on Tuesday, compared with those made in April.

The IMF expects Australia to grow by 2.8 per cent in 2014 and 2.9 per cent in 2015, but still below its long-term average of about 3.25 per cent and a level needed to help lift employment.

It sees a pick-up in exports offsetting waning mining investment.

However, it has nudged down its last forecast for world growth to 3.3 per cent in 2014 and to 3.8 per cent in 2015.

The IMF’s economic counsellor Olivier Blanchard describes the world economy being in the middle of a balancing act.

On one hand, countries must address the legacies of the global financial crisis, ranging from debt overhangs to high unemployment.

“On the other, they face a cloudy future,” Blanchard says in the report.

“Potential growth rates are being revised downward, and these worsened prospects are in turn affecting confidence, demand and growth today.”

He sees three key risks to the outlook.

The long period of low interest rates does pose risks, such as increased household indebtedness – it ranks Australia in this category.

Geopolitical risks have also become more relevant, although he notes the effects of the Ukraine crisis have so far not spread, and the turmoil in the Middle East has yet to have much impact on energy prices.

“But clearly, this could change in the future, with major implications for the world economy,” Blanchard said.

Finally, he says, the tentative recovery in the euro area could stall, although this is not the IMF’s baseline case.

– with AAP