Recent claims of a surge in house prices is misleading, says property market researcher SQM Research.

Capital city markets had their strongest winter since 2007, according to figures released on Monday by RP Data.

The RP Data numbers showed Sydney and Melbourne house prices lifted 5 per cent and 6.4 per cent respectively over the three months to the end of August with year-on-year growth of more than 16 per cent in Sydney and almost 12 per cent in Melbourne.

Adelaide home values recorded the strongest growth for the month, up 2.3 per cent since July, 1.5 per cent for the quarter and a year-on-year increase of 5.9 per cent.

The current median home price of $390,000, however, is little different to what it was several years ago.

By examining vendor sentiment and stock levels, SQM says “there is no further acceleration in market momentum beyond what is already in existence”.

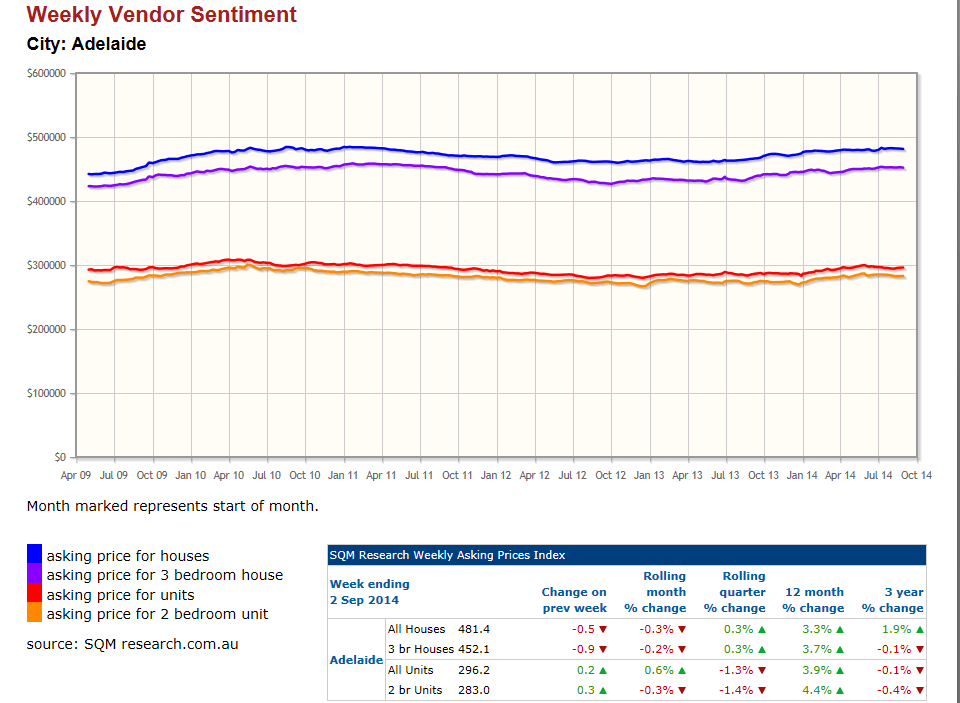

Further to this, SQM Research’s Asking Prices Index has revealed the only capital city to record monthly increases in vendor sentiment on both houses and units was Melbourne, with the remainder of the capital cities recording mixed results.

The index shows that asking prices for units in Adelaide has barely moved in the last five years and prices for houses have moved marginally in line with inflation.

Managing Director of SQM Research Louis Christopher said “while our competitors wish to grab headlines by stating one month the market is falling and will slow, then the next month reporting ‘the strongest growth since 2007’, we on the other hand, have been very consistent and accurate on our market observations”.

“It is clear for all to see that the market remains strong on the east coast of Australia, however the mining-exposed cities are by and large, having a downturn that will likely persist for some time yet.”

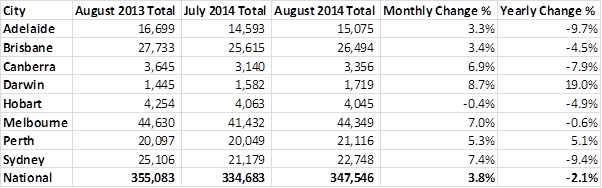

The stock levels in the Adelaide market have slumped since this time last year.

In August 2013 there were 16,699 properties listed – that’s dropped to 15,075.

The number of Australian residential property listings increased during August (in preparation for the spring selling season), perking up after a substantial dip in listings during July.

Nationally, the number of unsold properties on the market has been recorded at 347,646 for August 2014 – a 3.8% increase month-on-month and -2.1% decrease year-on-year.

“Of particular growing importance, is the narrowing difference in the yearly decrease of stock on market, where an ongoing trend has now become evident.

“Indeed we are not seeing the large drop in stock levels year on year, as we were at approximately this time last year, when the market (east coast predominantly) initially began to boom.”