The US Federal Reserve says it will begin to taper its massive stimulus program next month as it sees improvement in the local economy and the ailing job market.

The Fed will spend $US75 billion ($A84.52 billion) on bonds a month starting in January, down from the $US85 billion a month it has spent for a year in an effort to tamp down long-term interest rates to stimulate growth and jobs, the Federal Open Market Committee said after a two-day monetary policy meeting.

“In light of the cumulative progress toward maximum employment and the improvement in the outlook for labour market conditions, the Committee decided to modestly reduce the pace of its asset purchases,” the FOMC said in a statement.

Noting the federal government’s spending cuts since the start of the current asset-purchase program, the FOMC said it “sees the improvement in economic activity and labour market conditions over that period as consistent with growing underlying strength in the broader economy”.

In updates of its economic forecasts, the Fed projected gross domestic product growth between 2.8 per cent and 3.2 per cent, a tenth point wider than the 2.9-3.1 per cent range it projected in September.

It projected the unemployment rate, currently at 7.0 per cent, would fall to a range of 6.3-6.6 per cent by the end of next year, an improvement from the prior estimate of 6.4-6.8 per cent.

The Fed, as widely expected, held its key interest rate at 0-0.25 per cent where it has been for five years to support the recovery from recession.

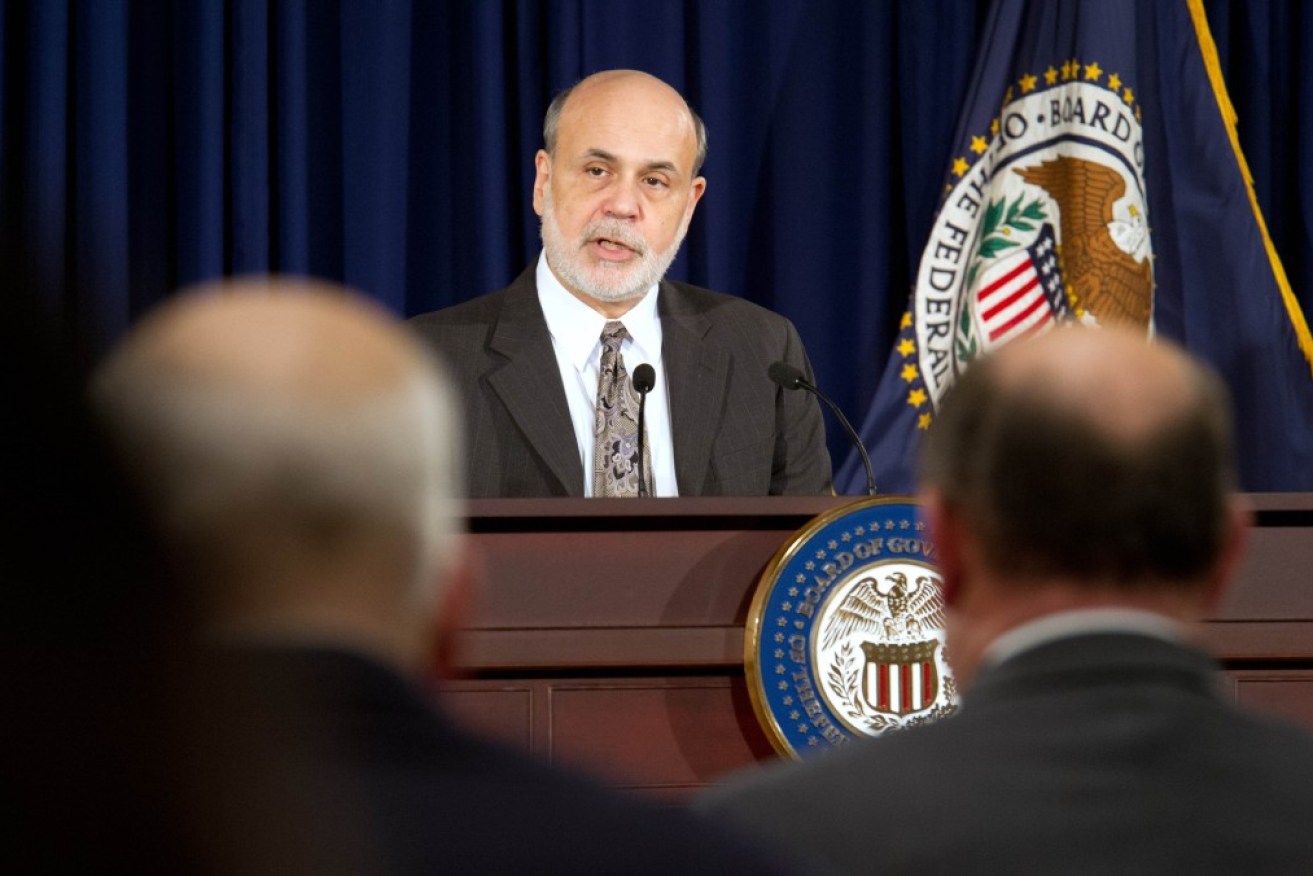

Chairman Ben Bernanke says the Federal Reserve’s decision today is a sign of progress and he expects the Fed to take “similar moderate steps” throughout next year to reduce the purchases further if the economy shows continued improvement.

Bernanke made the comments at a news conference after the Fed announced it would being to reduce its bond purchases.

Still, Bernanke cautioned that the Fed’s further reductions in the purchases remain dependent on data.

“When we are disappointed with the outcomes, we could skip a meeting or two; if things pick up, we could go faster,” he said.

He noted that the US economic recovery still remains far from complete and long-term unemployment remains a concern, he said.

Bernanke says the US economy’s slow recovery from the Great Recession has been subpar for several reasons, including the extensive damage from the housing bust and tight budgets at all levels of government.

But he also blamed the anaemic pace of the recovery on “some bad luck,” saying Europe’s debt troubles slowed the global economy at a critical time.

“Given all the things we have faced, it is not shocking that the recovery has been tepid,” he said during a news conference after the Fed’s two-day policy meeting.

He said the United States has still done better than many other countries.

Bernanke made the comments after the Fed announced it would begin to reduce its bond purchases by $US10 billion ($A11.27 billion) in January, signalling a stronger economy.

Meanwhile he says his expected successor, Janet Yellen, “fully supports” the Fed’s decision.

Bernanke said that he has made a practice of consulting with Yellen and that she was “consulted closely” before the Fed voted to reduce its bond purchases.

Yellen’s nomination as the next Fed chairman is expected to be confirmed soon by the Senate.

Bernanke’s term as chairman ends on Jan. 31.