Adelaide’s the fifth-best city … pity about jobs and power prices

Latest data suggests the worst may be over for South Australia’s economy, but a major ongoing problem that will continue to discourage new business investment is the cost of electricity, writes Richard Blandy.

SA's economy is blowing in the wind.

First, the good news. The Economist Intelligence Unit has again rated Adelaide the world’s fifth most liveable city (equal with Calgary in Canada). Melbourne was top, Perth was seventh and Sydney finished eleventh.

We ranked equal top in education and health care, equal fourth in stability and infrastructure, and fifth in culture and environment.

The other top 10 cities were Vienna, Vancouver, Toronto, Auckland, Helsinki and Hamburg.

Notice that each city’s economy was not ranked.

There you have it: Adelaide is a wonderful place to live, with a lousy economy.

The latest evidence on South Australia’s economy arrived in the monthly employment and unemployment figures released by the Australian Bureau of Statistics last Thursday. Some commentators thought that the figures showed a startling improvement, based on the large change in the volatile, seasonally-adjusted figures.

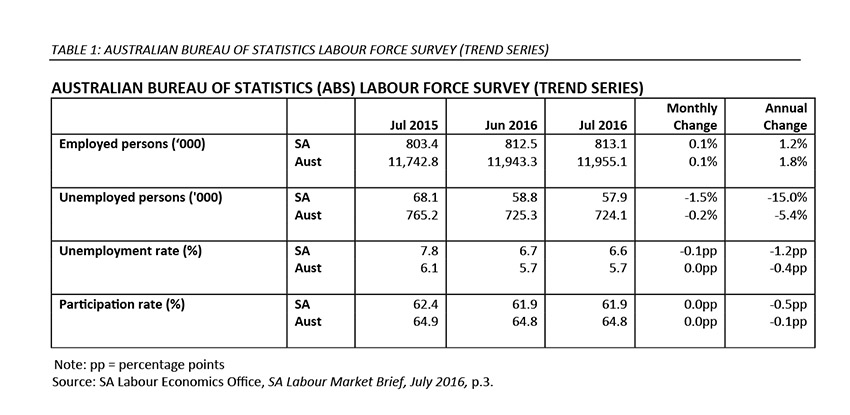

As usual, I prefer to look at the less volatile trend figures, shown in the below.

Looking at these less-volatile trend figures, South Australian employment grew by 1.2 per cent over the past 12 months (compared with growth nationally of 1.8 per cent) and the number of unemployed people fell by 15 per cent over the same period. The unemployment rate has fallen by 1.2 per cent, about 40 per cent of which can be attributed to people stopping looking for work (shown by the fall in the participation rate).

All of the increase in South Australian employment over the last year was in part-time jobs. In fact, full-time jobs fell by 1000, continuing their slide over the past five years: in July 2011, there were 542,700 full-time jobs in South Australia; in July 2016, there are only 523,600 – a fall of 19,000 full-time jobs.

Total employment in South Australia has increased by fewer than 3000 over the same five-year period. Hence, we have seen a very large replacement of full-time jobs by part-time jobs over the past few years.

Looking at other Australian Bureau of Statistics data, quarterly retail turnover increased in the year to June 2016 by 2.4 per cent in South Australia, compared with 2.0 per cent nationally. Over the last five years, retail turnover increased by 1.6 per cent pa in South Australia and by 2.8 per cent pa, nationally.

Private new capital expenditure fell in the year up to March 2016 by 11.4 per cent in South Australia, compared with 14.4 per cent nationally. Over the last five years, private new capital expenditure fell by 1.9 per cent pa in South Australia, but rose fractionally nationally.

Building approvals rose in the year up to June 2016 by 26.5 per cent in South Australia, compared with a fall nationally of 7.0 per cent. Over the last five years, building approvals rose by 3.8 per cent pa in South Australia and by 6.5 per cent pa nationally.

Taking all these figures together, one forms the impression that the worst may be over for South Australia, at least in the context of Australia’s economic performance. We still have a lousy economy, but hopefully it may be bottoming out and not deteriorating further.

However, a major problem that will continue for years is the cost of electricity in South Australia.

It would significantly help the economy if we could get our electricity prices under control. According to data from the Australian Energy Regulator, South Australia is facing wholesale electricity prices that are roughly double those of other states for at least the next two years. This is a disincentive for new business investment in South Australia, particularly in businesses where electricity is a significant cost.

The cause of very high electricity prices in South Australia is the very high penetration of intermittent renewable energy, particularly wind. This form of energy generation has to be backed up by electricity generated by variable gas-powered turbines. More than 60 per cent of South Australia’s electricity is generated by gas turbines. It has to be, because dependence on wind energy drives dependence on gas.

A high price of electricity makes it more profitable to find solutions. This is how innovation works.

The price of gas heavily affects the price of electricity in South Australia, because of our dependence on wind (and wind’s associated back-up gas turbines).

Hence, moves by Energy Ministers last Friday to try to reduce the price of gas will help South Australia more than any other state because we have easily the greatest dependence on wind energy (and, therefore, on associated gas-turbine energy).

Privatisation has nothing to do with the price and reliability of energy in South Australia. Electricity was privatised in Victoria ahead of it being privatised in South Australia, and Victoria’s electricity price is far below South Australia’s.

The closure of Port Augusta’s coal-fired, base-load power stations was driven by the low price of electricity (and high volume of renewable energy) when the wind was blowing (not too fast) and the sun was shining in South Australia. Being base-load plants, Port Augusta’s power stations had to produce continuously to achieve low costs. They could not do so in the face of the huge, wind-fuelled electricity resource in South Australia.

The only answer to South Australia’s predicament (other than a drop in the price of gas) is to have more interconnection to interstate coal-fired, base-load power stations (nuclear being unavailable).

Denmark is able to have a high penetration of renewable energy generation because it is able to rely on adequate interconnection with France’s nuclear power, among other interconnection arrangements. Interconnection with coal-powered generators interstate as part of the answer to South Australia’s electricity problems is ironic, given that the South Australian Government’s policy is to reduce reliance on coal-powered electricity.

What happens when coal-powered base-load generation is shut down in Victoria and New South Wales is unknown. Batteries or elevated sea-water dams to store power are obviously too expensive as yet to be solutions.

We will stagger along, with expensive gas turbine technology kicking in when the wind fails and at night. This is why electricity costs so much in South Australia: basically, capacity has to be doubled to provide a reliable source that kicks in when the intermittent source becomes unavailable.

A sleeper issue is the cost of the transmission and distribution network. As more and more households and businesses install their own renewable energy systems (largely rooftop solar), the average cost of transmitting and distributing power to the remaining industrial and household consumers must rise. Should not households and businesses with roof-top solar have to pay a transmission and distribution charge based on their overall consumption like consumers who do not have roof-top solar?

South Australians are now going to be faced with very expensive electricity for the immediate future. This is part of the process of innovation and change that the State Government has embarked on. A high price of electricity makes it more profitable to find solutions. This is how innovation works.

At some time in the future, innovative processes will be found that significantly reduce the cost of generating electricity from renewable energy systems, allowing economies that invest in such innovations to expand rapidly. The resulting high profitability of these innovations will lead to their widespread adoption.

The South Australian Government forgot to tell us that before the innovations that deliver cheap, renewable-energy-based electricity are discovered, the cost of electricity has to be high enough to create the incentive for those innovations to be tried, enabling the winning ones to be discovered.

Richard Blandy is an Adjunct Professor in the Business School at the University of South Australia and a weekly contributor to InDaily.