Off the boil: Rate rises begin to cool Adelaide’s hot house market

The Adelaide housing market is the nation’s strongest but is showing signs of a slowdown, with more than 50 suburbs decreasing in value in the past three months.

Image: Tom Aldahn/InDaily

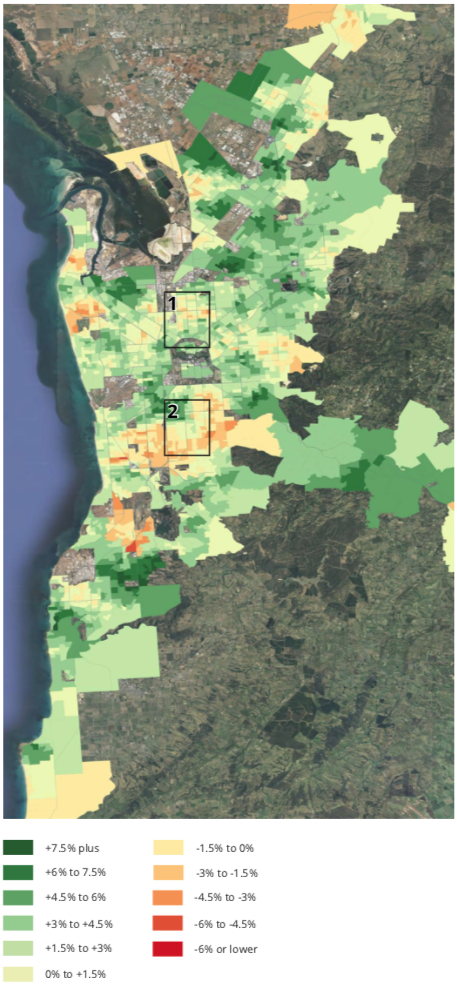

PointData analysis for the three months to June show that 59, or 16 per cent, of the 359 Adelaide suburbs it listed had a reduction in value in June as property market growth patterns begin to contradict the huge surge in prices experienced across the previous two years.

It follows interest rate rises in May and June – the first in more than a decade – with another expected next week as the Reserve Bank attempts to force down inflation.

“This change in the market comes at a time of broader change in South Australia, with two new governments, accelerating interest rates, and a change of seasons contributing to price shifts,” the Lay of the Land Winter Edition report says.

“While Adelaide’s residential market may be moving away from pandemic normalities, the geographical areas of ‘high’ performance have shifted substantially away from the previously dominant affluent areas, namely the city’s east and inner-south.

“The introduction of higher interest rates is tempering buyers’ maximum potential outlay, and reducing the pool of buyers.”

Courtesy PointData

Other property reports also released this morning show the Adelaide market slowing.

The PropTrack Home Price Index show Adelaide prices grew by just 0.42 per cent in June. However, the new peak is 42.2 per cent ahead of where prices were at the onset of the COVID-19 pandemic in March 2020.

Nationally, the PropTrack data shows property prices fell 0.25 per cent in June amid growth of 34.3 per cent since March 2020.

CoreLogic data showed overall Adelaide house values increasing by 1.3 per cent in June despite a national fall of 0.6 per cent.

However according to CoreLogic, Adelaide is the only capital city still recording a monthly growth rate above 1 per cent.

CoreLogic research director Tim Lawless said the national housing market’s sharp reduction in growth coincided with the May cash rate hike, surging inflation and low consumer sentiment.

“Considering inflation is likely to remain stubbornly high for some time, and interest rates are expected to rise substantially in response, it’s likely the rate of decline in housing values will continue to gather steam and become more widespread,” he said.

According to PointData’s Lay of the Land report, a snapshot of the past three months shows areas in “the middle ring southern suburbs” experiencing the greatest slowing.

“However, observed negative growth is not exclusive to these areas. Pockets around West Lakes, Magill and Peterhead are also beginning to turn, with much more moderate positive growth within their immediate surrounds,” the report said.

“Areas showing the first signs of negative growth are adjacent to some of Adelaide’s most affluent areas.

“These slightly more affordable options that were previously attainable by stretching ones finances are now drifting out of reach with the introduction of higher interest rates.”

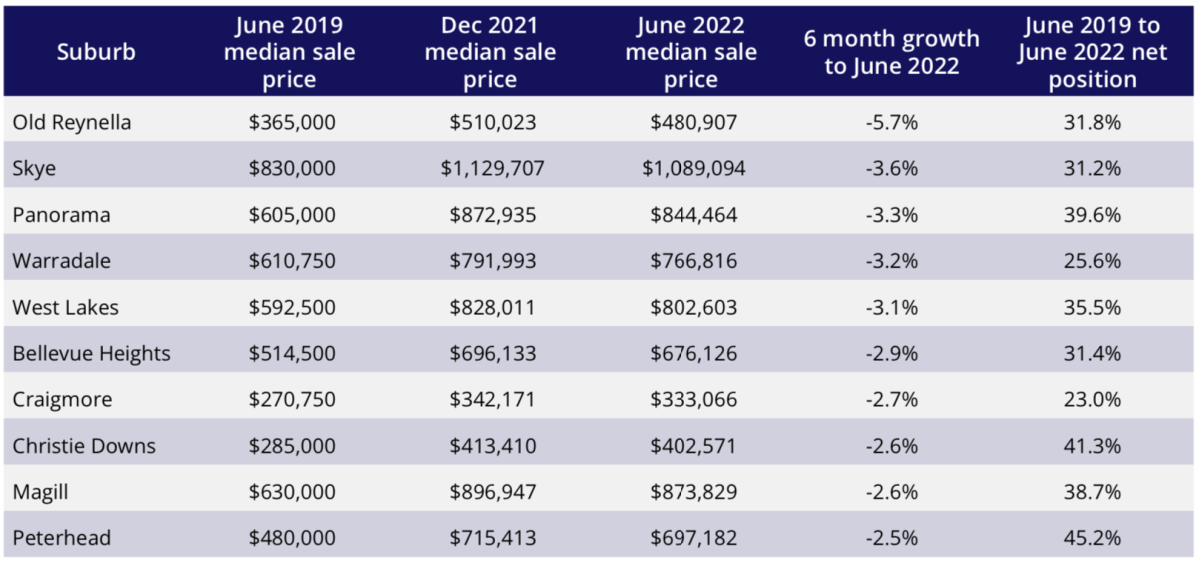

The six-month snapshot shows homes in the southern suburb of Old Reynella have lost the most ground, losing 5.7 per cent. However, its current median value of $480,907 is still up 31.8 per cent over the past three years.

The report said it was highly unlikely a price slump would reduce values to levels similar to before the pandemic.

“The broader context of median sale prices in the last three years show that while prices are no longer as high as they were six months ago, the net position in all cases listed indicates incredible asset growth upwards of 20 per cent, with Peterhead nearing 50 per cent.

“Given how unprecedented the growth observed over the past two years has been, it would take a significant collapse of property values to fall to what they were prior to the pandemic.

“Instead, this shift towards negative growth is more appropriately labelled a ‘correction’.”

Courtesy PointData

PointData calculates property price trends by applying rolling medians for SA1 regions to smooth out short-term fluctuations. SA1 statistical areas can contain as few as 200 houses.

While 69 per cent of Adelaide properties continued to sustain double-digit growth in the six months to June, the figure is down on the 88 per cent in the six months to February 2022.

Previous Lay of the Land reports, which are released quarterly, have generally shown blue-ribbon suburbs in Adelaide’s east performing strongest.

But the recent May and June interest rate rises appear to have put those suburbs out of reach.

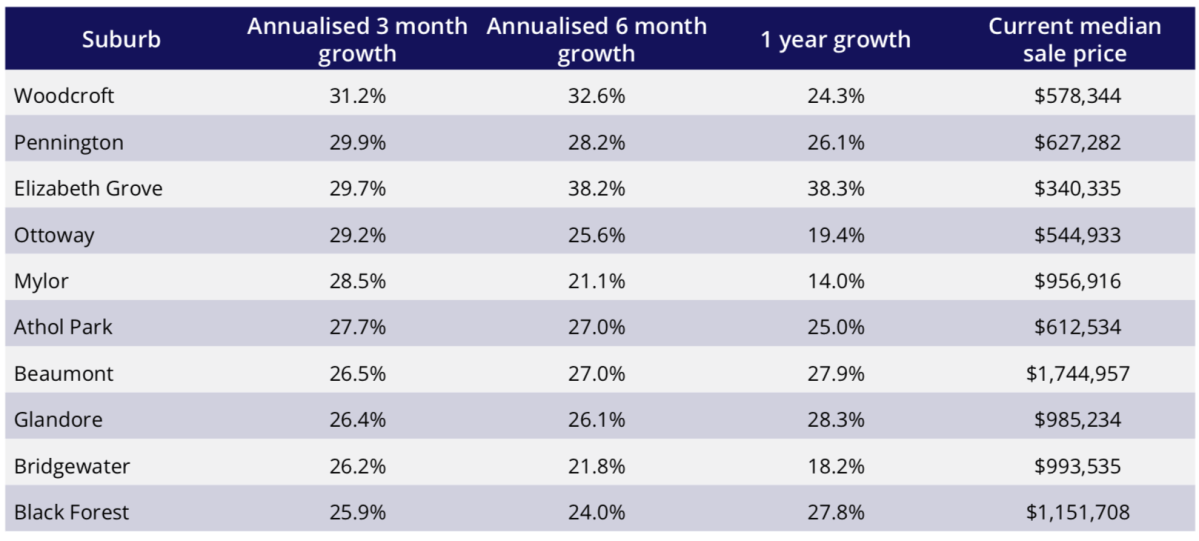

The suburbs that have performed best in the past three and six months have tended to be in areas that are more in line with or below the Greater Adelaide median sale price of $680,000.

The southern suburb of Woodcroft sits atop the list, with growth exceeding 20 per cent in all three metrics.

Courtesy PointData

The Lay of the Land report said Glandore and Black Forest’s inclusion indicated strong growth was being achieved across numerous price points in the south.

“It is a similar story for the tight cluster of suburbs to the city’s north-west of Pennington, Ottoway and Athol Park which all exceeded 27 per cent annualised growth over the past three months.”

“Elizabeth Grove stands out as the lone northern suburb, with the one-year growth actually exceeding the three months annualised growth.”

“Beaumont retains its spot from the previous edition, and is the only eastern suburb. However, its $1.7 million median price tag ensures that it is out of reach for many.”