First home buyers squeezed out of hot SA property market

A combination of rising house prices and an influx of investors to the market is squeezing out first home buyers in South Australia, according to figures released today by the Real Estate Institute of Australia.

The Housing Affordability Report found that while the number of first home buyers across Australia decreased in all states and territories by 12.6 per cent in the September quarter, South Australia recorded the largest quarterly decrease in the number of loans to first home buyers at 21.6 per cent.

The average loan to first home buyers in SA grew to $361,680, an increase of 2.9 per cent over the quarter and 14.1 per cent over the past year. The average loan to all borrowers in SA rose by almost $10,000 to $410,628.

REIA President Adrian Kelly said the figures showed a worsening affordability situation in South Australia, particularly for first home buyers.

“As we attempt to start adjusting to the new COVID normal, buyer and investor interest shows little signs of being satiated and the combination of rising real estate prices and a return of investors to the market is putting the squeeze on South Australians trying to buy their first home,” he said.

According to REIA, the total number of loans granted in South Australia was 7405 in the September quarter. This was a decrease of 11.7 per cent compared to the June quarter.

However, it was an increase of 9 per cent over the past year compared to the 6795 loans in the September quarter in 2020.

The number of loans to first home buyers in South Australia decreased to 2179, representing about 29 per cent of all loans.

A year ago, first home buyers made up 33.5 per cent of the SA market.

This was a decrease of 21.6 per cent over the quarter and a fall of 4.3 per cent over the past year.

Source: REIA Housing Affordability Report September 2021

“Over the past 12 months, the number of first home buyers increased in New South Wales, Victoria, Western Australia and the Australian Capital Territory but declined in Queensland, South Australia, Tasmania and the Northern Territory,” Kelly said.

“Nationally, we saw a fall in the number of first home buyers to 37,782 for the quarter with only 5.8 per cent of these coming from South Australia.

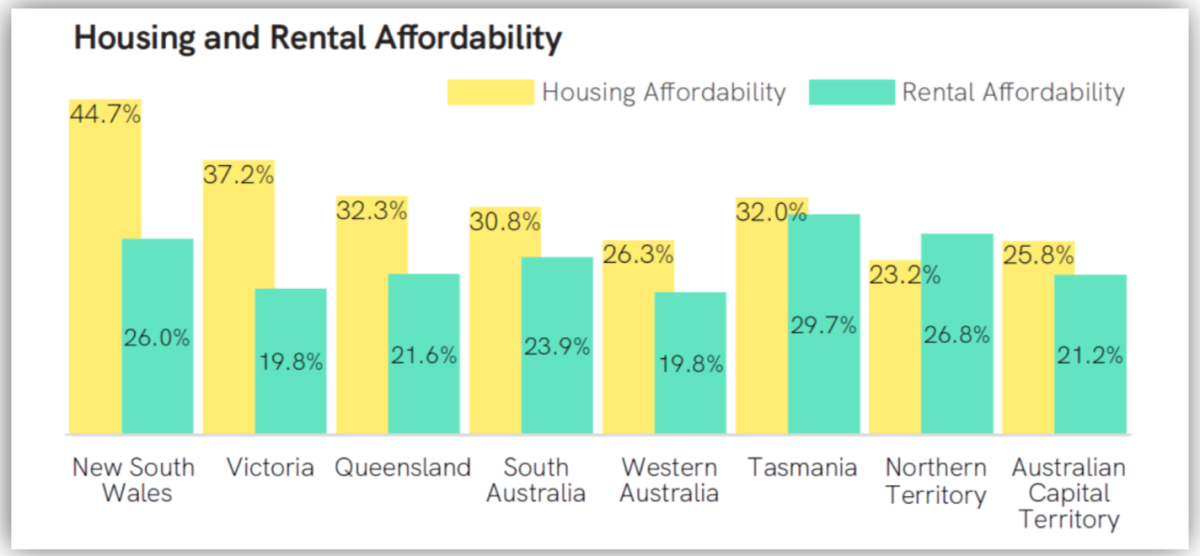

In terms of housing affordability, the proportion of family income needed in South Australia to meet loan repayments increased 0.3 per cent for the quarter to 30.8 per cent. This was up from 29 per cent 12 months ago.

Nationally, the REIA figure rose to 36.2 per cent while the least affordable state continues to be New South Wales where 44.7 per cent of family income is needed to meet loan repayments.

For rentals, 23.9 per cent of family income is needed to meet median rent repayments in South Australia, also a quarterly rise of 0.3 per cent.

REIA is not due to release its September quarter capital city median price data until next week.

However, CoreLogic figures released last week show median house prices in Adelaide were up 6.5 per cent in the September quarter to $558,179, a 12-month increase of 21.4 per cent.

Nationally, the median house price is $698,170, up 22.2 per cent in the past year.