Centrelink debt freeze causes Family Tax Benefit stress

A lack of transparency around how Centrelink’s Family Tax Benefit is balanced has seen some payments stalled, leaving welfare recipients stressed and confused about potential money owed amid the agency’s debt freeze imposed due to coronavirus.

Photo: AAP/Tracey Nearmy

The Family Tax Benefit is a two-part payment intended to help parents and carers who provide at least 35 per cent of a child’s care with the cost of child rearing.

Eligible recipients receive a fortnightly payment and a once-off lump sum at the end of each financial year based on the declared taxable income and caring responsibilities of each parent or carer.

The maximum 2019-20 payment is $766.50 for each eligible child.

But welfare advocate Kym Mercer told InDaily she’d been inundated with hundreds of questions since the beginning of the financial year from low-income earners who’d received messages from Centrelink advising their annual Family Tax Benefit had been frozen due to a potential debt.

She said welfare recipients were growing increasingly anxious as they were unable to dispute the potential debts with the Federal Government department.

“People who don’t owe money – because their taxable income is lower than the estimated income that they put in for their Family Tax Benefit in the first place – are receiving these messages that they possibly have a debt,” Mercer said.

“And they have no way of appealing that debt or checking if the information that has gone through is correct until Centrelink are allowed to do debts again.”

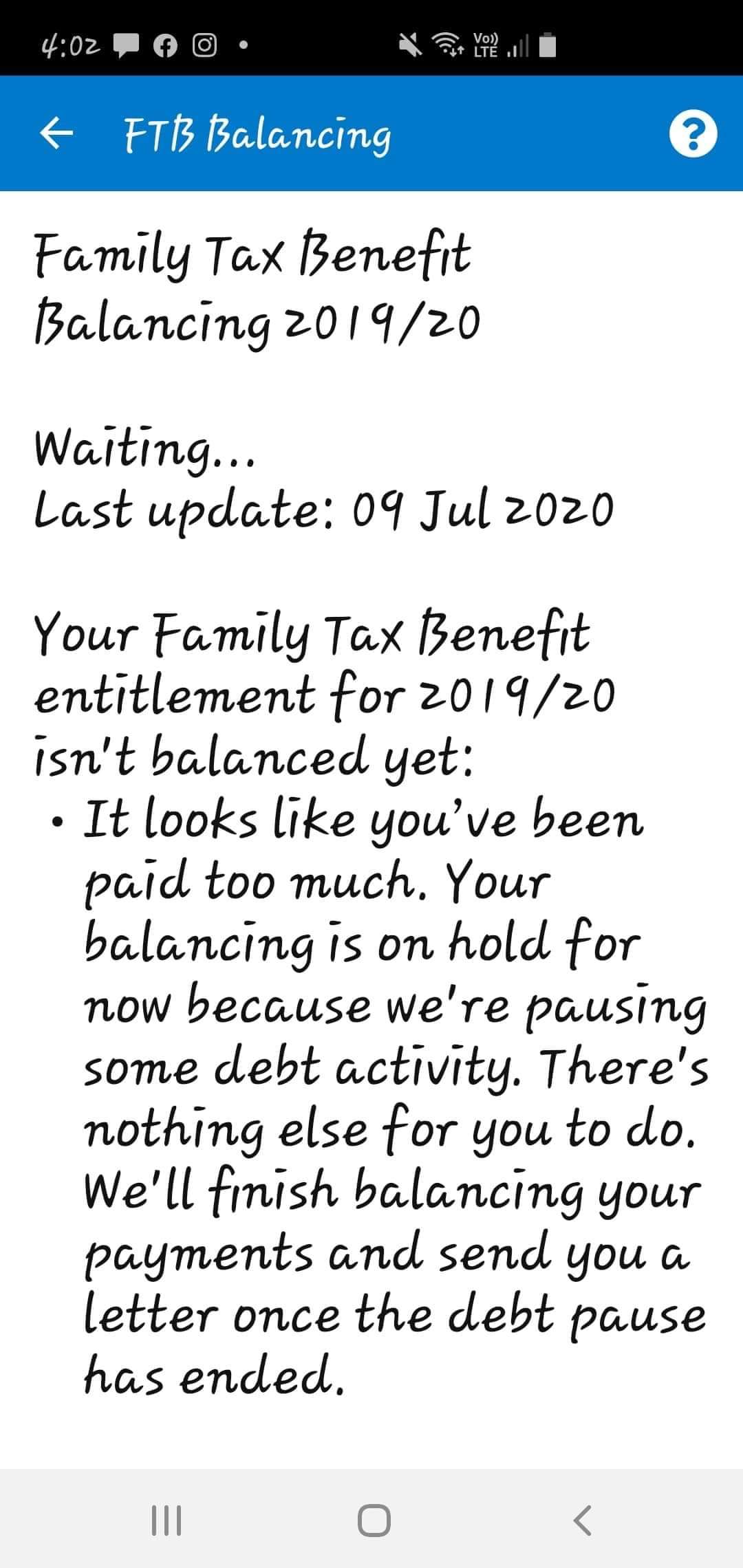

A Centrelink message sent to a welfare recipient advising their payment had been frozen.

In April, Federal Government Services Minister Stuart Robert announced the government would pause debt raising and recovery activity through Services Australia until October.

He said at the time the debt freeze was intended to help ease the financial pressure being felt as a result of the coronavirus pandemic.

A spokesperson for Services Australia said as a result of the debt pause, Family Tax Benefit recipients who were thought to have been paid too much throughout the year would have their annual payment frozen.

“If we think we’ve paid people too much during the year, based on what they told us they would earn compared to what they actually earned, we won’t finalise balancing their payments straightaway,” the spokesperson said.

“This is because we’ve paused a range of debt raising and recovery activities due to the coronavirus pandemic, so people can meet their immediate needs at this difficult time.

“If this happens, families can check their balancing status in the Express Plus Centrelink mobile app. They’ll be able to see that their balancing is on hold because we’re pausing some debt activity.”

As of July 1, welfare recipients began declaring their earnings with Centrelink in order to have their Family Tax Benefit entitlement balanced and receive a payment.

Services Australia general manager Hank Jongen said most families who had submitted their payment would receive a “top-up or no change when their balancing is complete”.

He said those families whose payments had been paused would not able to dispute a potential debt until the freeze was lifted, as no debt had been raised.

“There’s nothing else families need to do now. We’ll finish balancing their payments and write to them with the outcome once the pause has ended,” Jongen said.

“If a family is given an overpayment outcome, they will be able to ask for an explanation of the decision and request a review if they disagree.

“If families are in financial hardship, they should call 136 150 to discuss their circumstances and options with a staff member.”

Bec Bishop is among the low-income earners whose lump Family Tax Benefit has been frozen.

She told InDaily she was facing financial hardship and had phoned Centrelink on Tuesday morning to discuss what options were available to her.

She said she had already called Centrelink about the issue twice before.

“The first time I rang them they said they were waiting for my notice of assessment from the ATO office and once they received that they would start balancing,” Bishop said.

“When I rang up again, they said they were just checking for future debts and that the debts were on hold for the moment.

“This morning when I rang up, they said that because all of the debts are on hold until October, because of Covid-19, they can’t balance it until the end of October.

“Every time I ring up I get different stories from different people and it’s like, ‘what do I believe? Because I’m getting three or four different stories.”

Mercer said many families relied on the money and without it they had begun reducing their spending.

“People are going: ‘I’ve got to watch what I spend because I’ve got this amount of money, which I don’t know how much money that I might supposedly need to pay back to the government at some future time,’” she said.

“That can really put a stress on people and it also stops people spending, which is the whole reason for Centrelink suspending all debts and the ability to do debts at this time is to put more money into the economy – and you can’t put money back into the economy if you’re worried about money.”

Mercer said a lack of transparency around how Centrelink balanced people’s income was further exacerbating families’ stress.

“(Centrelink) don’t say anywhere on that letter what income they’ve used to get that debt: it doesn’t say what your estimate was for the year and it doesn’t say how much you’ve actually earned,” Mercer said.

“People are having to go blind and trust that Centrelink has got it right – and we know from past experiences that Centrelink don’t always get it right.

“During this time of uncertainty as people with people losing jobs … the last thing we need is people stressing over debt they may not even owe.”

Want to comment?

Send us an email, making it clear which story you’re commenting on and including your full name (required for publication) and phone number (only for verification purposes). Please put “Reader views” in the subject.

We’ll publish the best comments in a regular “Reader Views” post. Your comments can be brief, or we can accept up to 350 words, or thereabouts.