SA’s biggest companies shed $20b in horror month

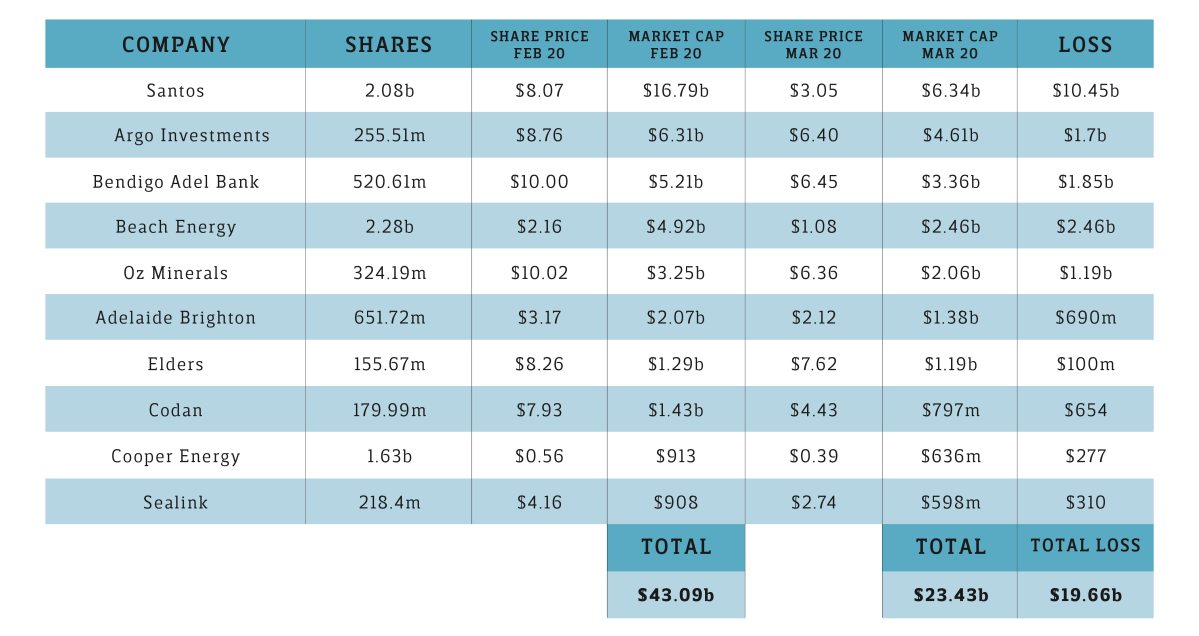

Almost $20 billion has been wiped off the value of the state’s 10 largest publicly listed companies in the past month.

Santos CEO Kevin Gallagher addresses the Santos Annual General Meeting in Adelaide last year. Photo: AAP / David Mariuz

The Australian stock market hit a record level on February 20 with South Australia’s largest companies reaching a combined market capitalisation of $43.09 billion. By Friday, March 20, the same 10 companies had a market capitalisation of $23.43 billion.

The shocking run has continued today with the Australian stock market down a further 7.5 per cent in morning trade.

The state’s biggest company, Santos, was also the biggest loser during the month with $10.45 billion coming off its value. Santos shares were priced at $8.07 on February 20 but were just $3.05 when the markets closed on Friday after falling to $2.75 on Thursday.

At noon today, Santos shares were down again to $2.80 at noon following the company’s announcement it will slash its 2020 capital spend by $550 million in a bid to counteract plunging oil prices and coronavirus.

The oil and gas giant will also defer its final investment decision (FID) on its offshore Barossa project, 300km north of Darwin and has announced a target 2020 free cash flow breakeven oil price of $25 per barrel.

Santos managing director and CEO Kevin Gallagher said the company was committed to supporting government and community efforts to limit the spread of the virus and had implemented a series of its own measured.

He said the financial measures undertaken would ensure Santos was well-positioned to survive in a lower oil price environment.

“Whilst the current oil price dynamic is challenging, the eventual recovery will create opportunities for companies positioned to act on them,” Gallagher said.

“The current environment is a time for discipline. In the short term, we will remain focused on the health and safety of our people and delivering our production target for 2020, whilst not compromising on safety or asset integrity.”

Fellow oil and gas company Beach Energy was also hit hard during the February 20 to March 20 period, halving its market capitalisation from $4.92 billion to $2.46 billion in the month while its share price fell from $2.16 to $1.08. The share price suffered another blow this morning, falling to $0.96 at noon.

Bendigo and Adelaide Bank had $1.85 billion wiped off to reduce its market cap $3.36 billion at Friday’s close with a share price of $6.45. That price continued to tumble this morning to $5.61 at noon, which is almost half the $10 February 20 share price.

The fall in values is not just a South Australian problem as companies Australia-wide fall victim to plummeting confidence.

Australian stocks dived more than 7.5 per cent this morning as borders close and businesses shut in efforts to slow the spread of the coronavirus pandemic.

The benchmark S&P/ASX200 tanked 367.2 points, or 7.62 per cent, to 4449.4 at 11.30am in panic selling across the board on a stream of negative COVID-19 news and profit warnings.

The All Ordinaries index plunged 378.5 points, or 7.8per cent, to 4475.8 as some businesses and state and territory borders closed with stricter measures to control the pandemic.

Retailer JB Hi-Fi has withdrawn guidance and fell 16.1 per cent to $23.14 although it reported a surge in sales as customers rush to secure products that will allow them to work from home.

Flight Centre was in a trading halt.

Federal parliament has announced a multibillion-dollar support package for businesses and households impacted by the pandemic.

However, analysts say the measures are not enough to prevent a recession.

Martin Petch, vice president of Moody’s Investors Service, said the measures would likely buffer, although not fully offset, the economic impact from coronavirus-related disruptions.

“Australia’s relatively strong fiscal position points to a limited impact of the economic downturn and the fiscal stimulus on the sovereign’s fiscal strength.”

ANZ said the measures will make an important difference – but will not offset the economic consequences of the pandemic.

“We maintain expectations of a mid-2020 recession,” it said in a note.

“The risk is that it could be deeper and longer than currently anticipated as shutdowns and border closures push economic growth down another notch.”

– with AAP