Adelaide house sales take record dive

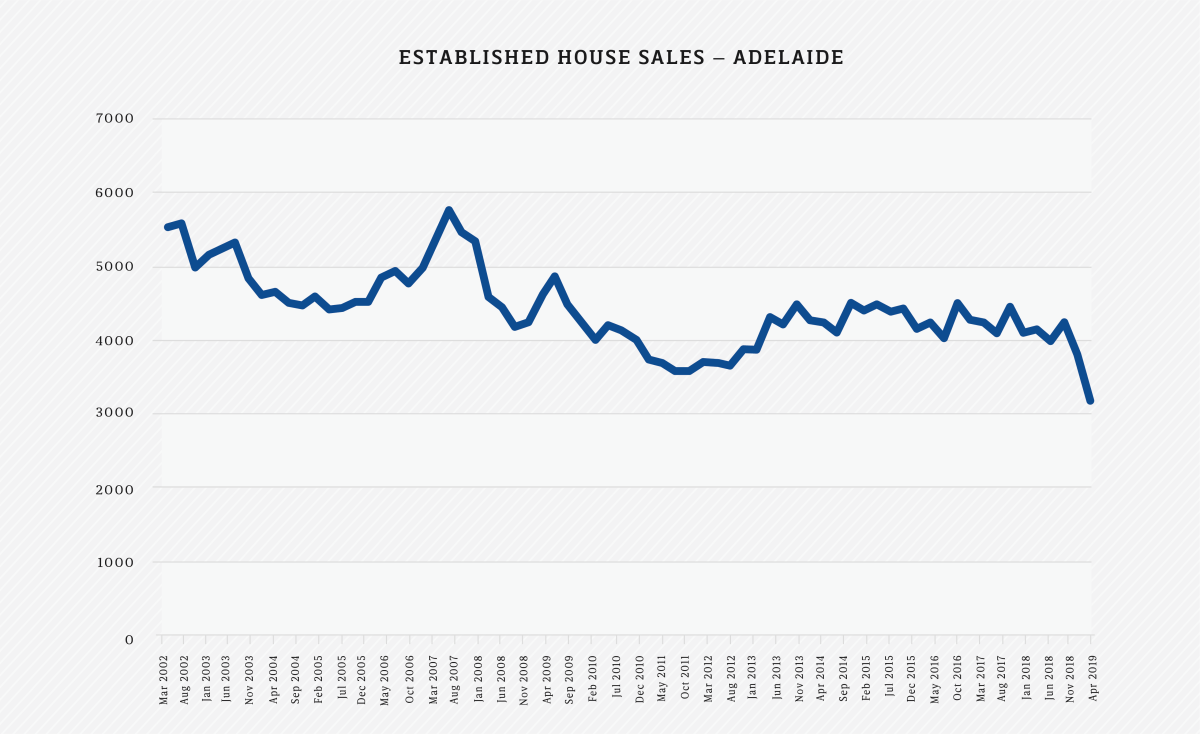

House sales in Adelaide have plunged to their lowest level in at least 17 years, with figures from the Australian Bureau of Statistics showing the sharpest decline on record.

Fewer established Adelaide dwellings were sold in the June quarter of this year than in any quarter since 2002, according to preliminary Australian Bureau of Statistics data released yesterday.

The available ABS data begins in 2002, with this week’s figures representing the steepest nine-month decline in housing sales – and lowest outright level – since then.

In total, 3168 established dwellings in Adelaide were sold in the three months to June – 636 fewer than in the March quarter.

And in the March quarter, 444 fewer houses were sold than in the quarter before that.

The ABS cautions that the June figure is “preliminary” and subject to change.

Preliminary ABS data shows the lowest number of established dwelling sales in Adelaide since records began in 2002. Graphic: InDaily/Bension Siebert/Nicky Capurso

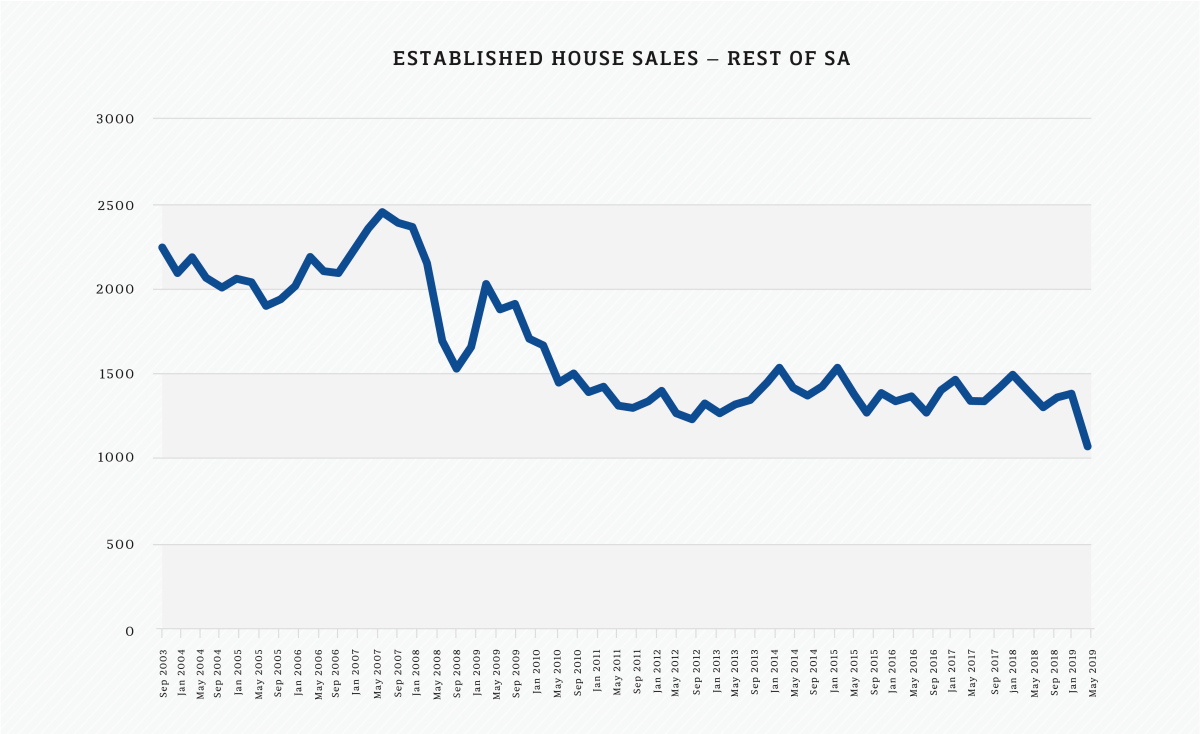

The figures show a similar story across the rest of South Australia.

Just 1086 established dwellings were sold outside of Adelaide in the June quarter, according to the latest figures.

Outside of Adelaide, sales have also slumped, according to the data.

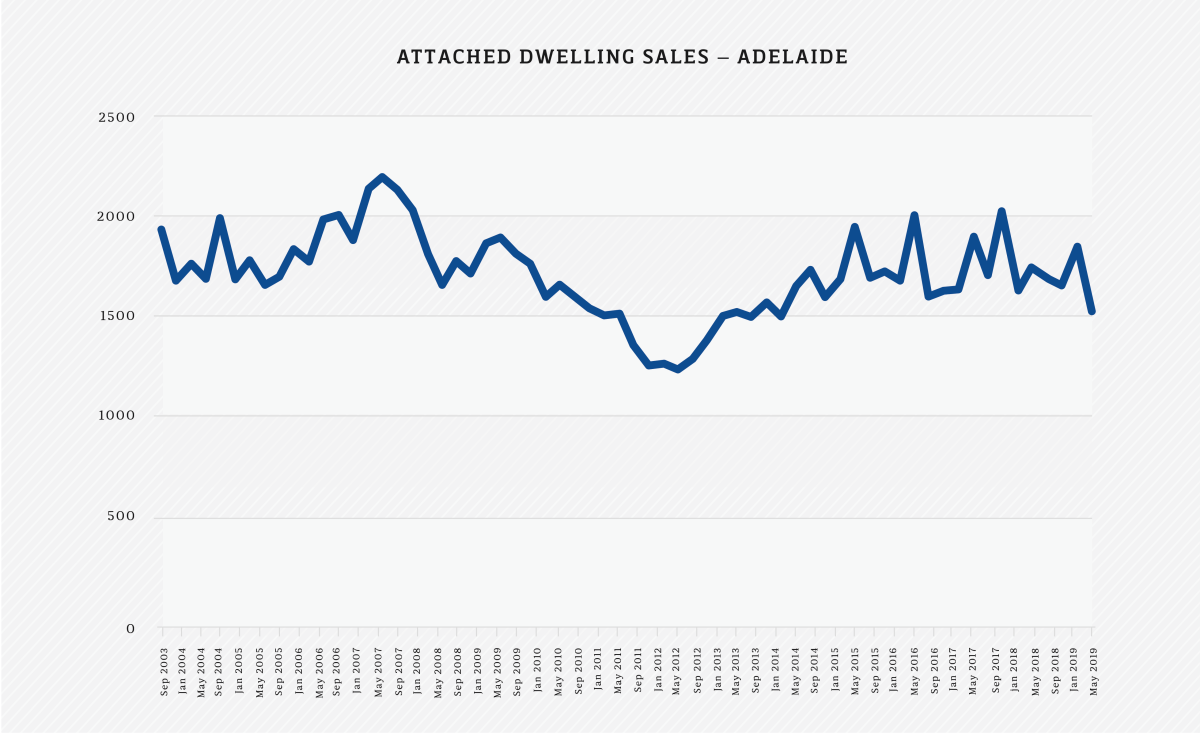

The drop-off in sales is less dire for the attached dwellings (units and apartments) market in Adelaide than in the market for houses.

But the June quarter still saw the lowest number of attached dwellings sales since March 2014.

Latest ABS figures show attached dwelling sales at the lowest level in five years.

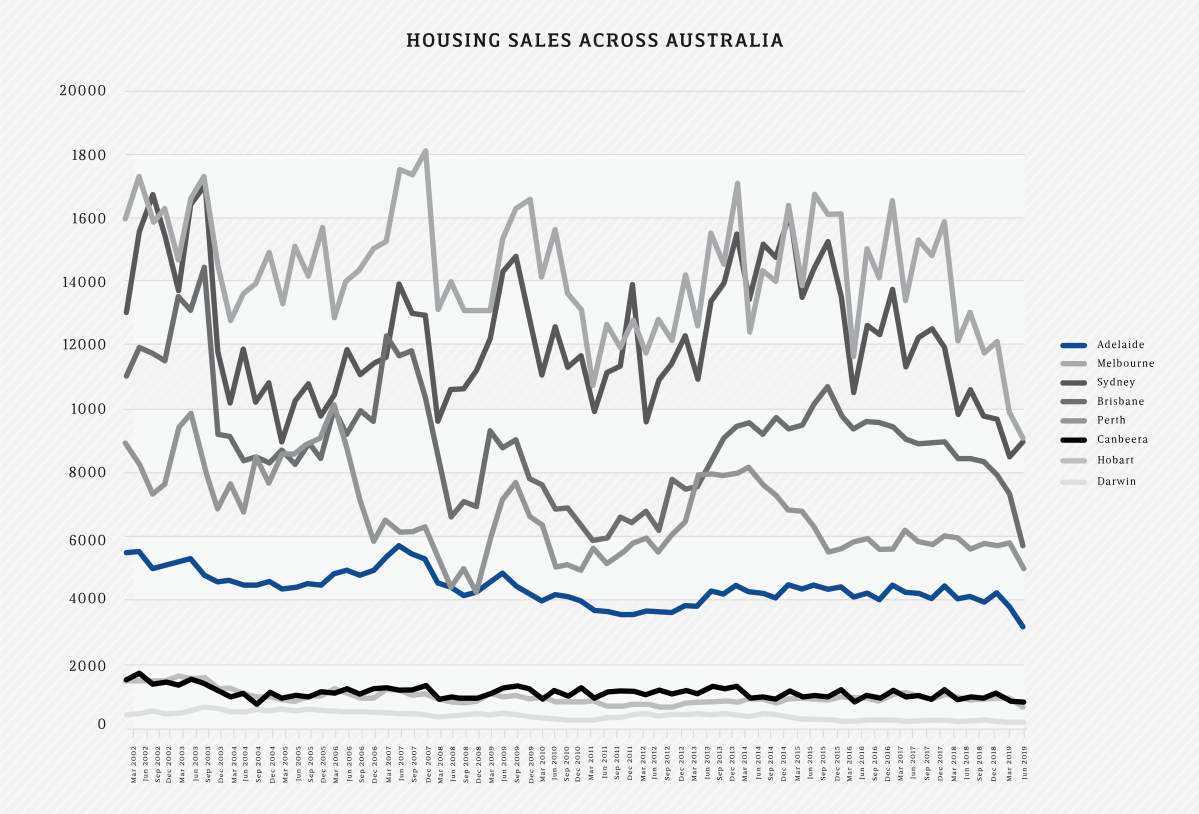

Adelaide is not alone.

The decline in housing sales here is in line with a slump across most Australian capital cities since about December 2017.

ABS figures show housing sales have declined across the country.

Treasurer Rob Lucas argued that South Australian figures are consistent with a national housing downturn and that the State Government was doing what it can to support the sector.

“Those June figures show very significant falls for each capital city,” he told InDaily.

That’s true for all capital cities except Sydney, which saw a slight uptick in the June quarter.

It is a signal of slow down in the whole economy, and likely to be higher unemployment on the horizon.

The Marshall Government’s second budget contained a $105 million housing stimulus package.

“The State Government took action … with its housing improvement package,” Lucas said.

However, Opposition Treasury spokesperson Stephen Mullighan told InDaily the figures were new evidence of poor economic management.

“This is just the latest evidence South Australia’s economy is struggling under the Marshall Liberal Government,” he said.

“The unemployment rate is the highest in Australia, State Final Demand has declined for two consecutive quarters and retail spending is falling.

“(Premier) Steven Marshall’s cuts, closures and privatisations are hurting South Australia, and his hikes to fees, charges and taxes are making a bad situation worse.”

He also argued the Government’s handling of the controversy over its land tax aggregation changes has “led to an investment strike and has further dented confidence in South Australia’s economy”.

But Lucas said 16,000 homeowners would benefit from the changes.

Executive director of the SA Centre for Economic Studies at Adelaide University Michael O’Neill told InDaily the figures point to a national economic slowdown.

“SA is really in the middle of the pack,” he said.

“This is not (a) slow population growth-induced effect, it is a signal of slow down in the whole economy, and likely to be higher unemployment on the horizon.

“All points to national economy slowdown and why RBA Governor wants to see (the Federal Government) increase and accelerate fiscal spending in preference to a budget surplus.”

Housing Industry Association Chief Economist Tim Reardon told InDaily homeowners were holding onto their nest egg amid lower prices.

“That trend is consistent across the county as we have seen house prices come down,” he said.

Reardon said the Australian housing market was still feeling the effects of the federal election.

This year’s poll was particularly significant for the housing market because of the focus on Labor’s negative gearing policies, he said, adding that people often hold off on major life decisions during national elections.

He said he expected the market to rebound slightly as the effect wears off.

“We’d expect those transfers to pick up a little bit across the country,” he said.