Greyhound Racing SA ‘underpaid employees’ before receiving taxpayer jobs grant: claim

Several current and former Greyhound Racing SA employees say the organisation significantly underpaid them – despite receiving hundreds of thousands of taxpayer dollars last year to “protect local jobs”.

Photo: AAP

The group of employees – five former and one current – claims that GRSA owes them about $1.2 million in unpaid superannuation and entitlements.

The claims are made in a submission to the state parliamentary inquiry into wage theft in South Australia, published over the weekend.

Last year, the Marshall Government announced it would spend $4.85 million compensating South Australia’s greyhound, horse and harness racing industries for a tax imposed by its Labor predecessor “to protect local jobs”.

One of the former workers, Adam Jaworski, says he is owed about $300,000 in entitlements including superannuation because GRSA mis-categorised him as a contractor between 2003 and 2016.

He claims he should have been paid as an employee because he worked exclusively for the organisation over those 13 years and should have been paid entitlements including annual leave, long service leave and superannuation for the period.

Jaworski says GRSA agreed to make him an employee in July last year and later offered him a $25,000 settlement, but he rejected the offer.

He says GRSA dismissed him in October 2018 and later offered a larger settlement, $60,000, which he says he also rejected.

Jaworski told InDaily losing his job had caused financial and emotional hardship for his family, which is now relying on a single income from his partner.

He added that two other workers – who signed the submission to the parliamentary inquiry but their identities are redacted from the document – were dismissed in similar circumstances during the past two years.

“We … have bared the burden and costs for many years of underpayment and felt the adverse effects and uncertainty to our personal and financial lives,” the submission reads.

“While each of our matters are in various stages of mediation and litigation … some cases have been brought forward to the third parties: Australian Tax Office, South Australian Employment Tribunal and Fair Work Ombudsman.”

GRSA chairman Grantley Stevens told InDaily this morning that his organisation does not accept that the signatories to the submission were employees.

“GRSA does not accept that the parties to the submission were employees but rather were independent contractors,” said Stevens in a statement.

“They all held themselves out to be independent contractors and were compensated accordingly for their services.

“GRSA is dealing with various claims from the parties to the submission and cannot comment further at this stage.”

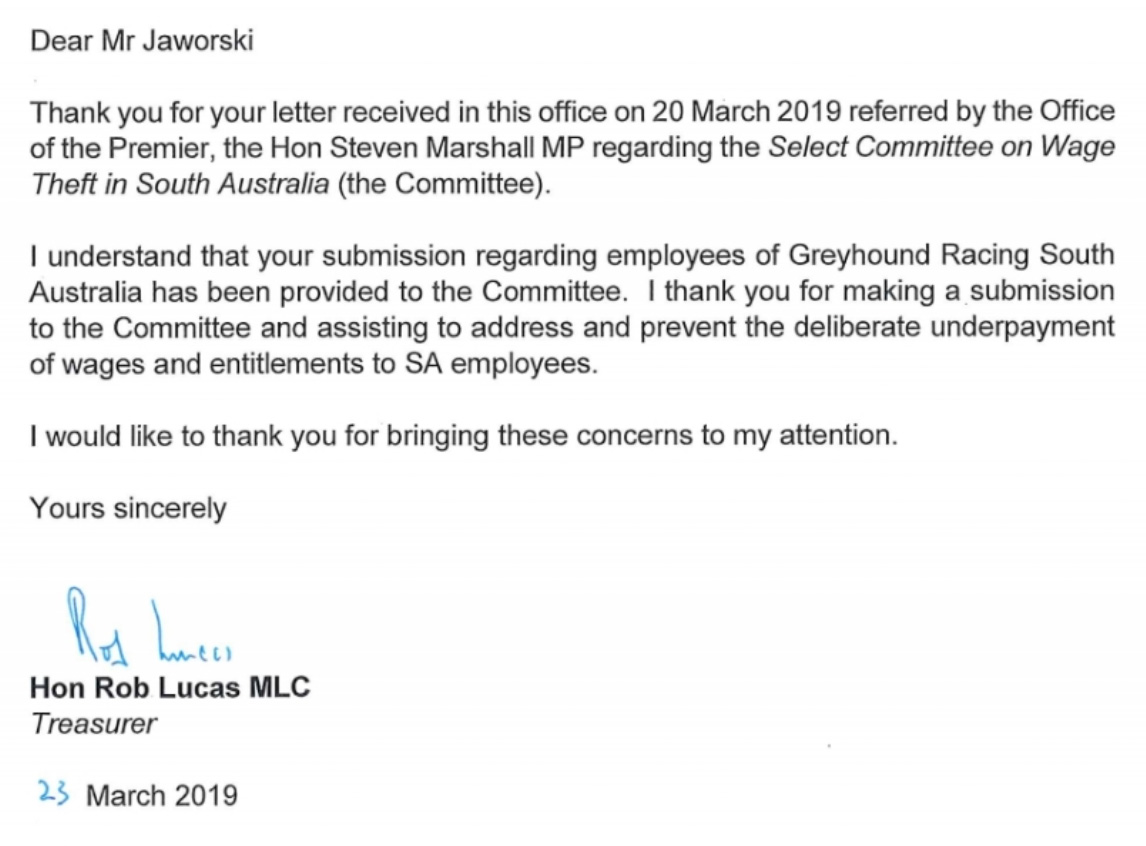

In a letter dated March this year Treasurer Rob Lucas thanked Jaworski and the other GRSA workers for raising the concerns.

In a letter to former Greyhound Racing SA employee Adam Jaworski, Treasurer Rob Lucas acknowledges the concerns about alleged underpayment.

In July last year, Minister for Sports and Recreation Corey Wingard announced that the Marshall Government would spend $4.85 million to protect local jobs in the racing industry and compensate it for the introduction of a betting operations tax by the former Weatherill Government.

The funding went to Racing SA, which distributed it between Greyhound Racing SA, Thoroughbred Racing SA and Harness Racing SA.

According to a report in The Advertiser last month, GRSA has returned its $269,000 share to Racing SA while it takes the other two organisations to Federal Court, arguing that it should have received a greater share and seeking “equitable compensation”.

Wingard argued last year that the betting operations tax had undermined the racing industry and threatened jobs.

“The state’s $400 million racing industry is enormously valuable to our economy and supports 3,600 South Australian jobs, from trainers and jockeys to all other support staff,” Wingard said at the time.

“They’ve reported significant revenue losses in the past year which could potentially result in job losses throughout the industry.

“That’s why the State Government is providing this assistance, to ensure the viability of an important industry that supports thousands of South Australian jobs.”

A spokesperson for Wingard told InDaily this morning it was inappropriate to comment because the GRSA employees’ submission was before the committee. Treasurer Rob Lucas for also approached for comment.

Want to comment?

Send us an email, making it clear which story you’re commenting on and including your full name (required for publication) and phone number (only for verification purposes). Please put “Reader views” in the subject.

We’ll publish the best comments in a regular “Reader Views” post. Your comments can be brief, or we can accept up to 350 words, or thereabouts.

InDaily has changed the way we receive comments. Go here for an explanation.