Claims of skyrocketing prostheses costs challenged

A medical industry body has challenged claims by Nick Xenophon Team senator Stirling Griff that the skyrocketing costs of prostheses are leading to high private insurance premiums.

Public and private hospitals can't be usefully compared, says the Medical Technology Association.

We agree with Senator Stirling Griff that Australians enrolled in private health insurance deserve a fair deal. They deserve good value for money. They deserve access to high quality treatment and to be protected against corrosive out of pocket costs.

The Prostheses List (PL) has delivered this in spades for years, and it is an essential part of the value in private health insurance. We also agree that the system can be improved for Australians now, and into the future.

However, there are a number of assertions in Senator Griff’s opinion piece of 30 March 2017 that need to be corrected to properly address reform models.

Despite recent claims by Senator Griff, medical devices are not growing in cost by 6-12% per year.*

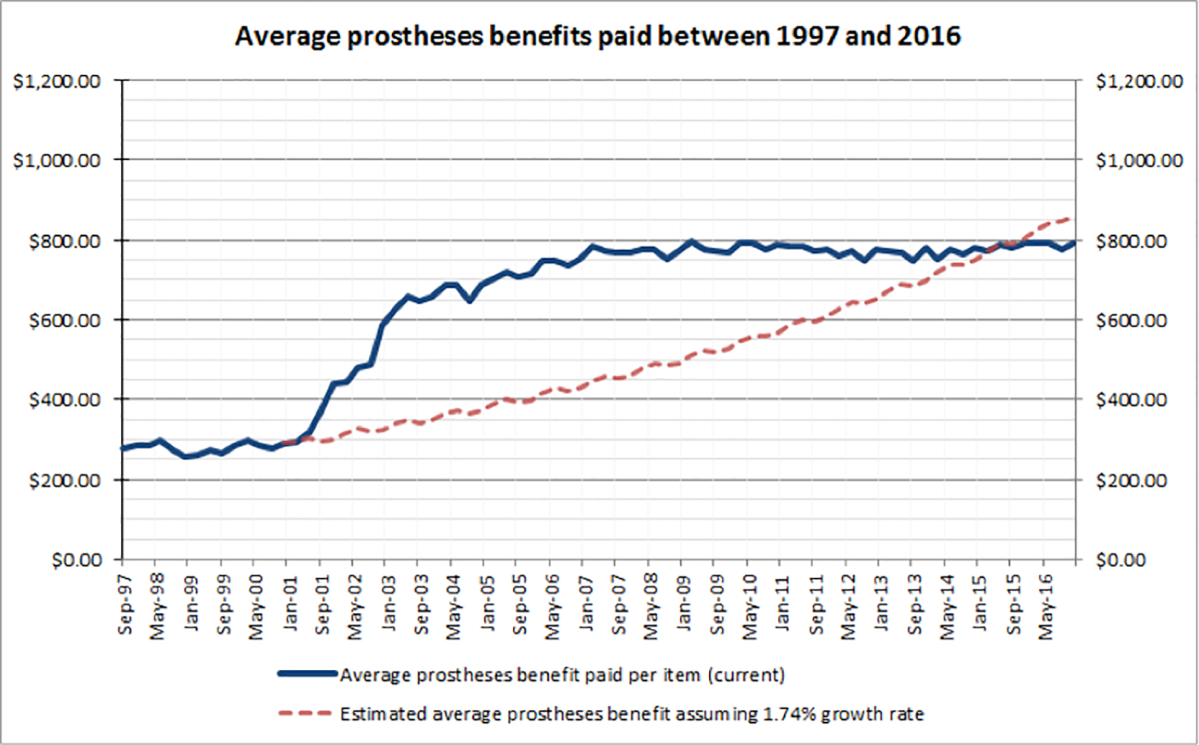

Growth has been zero over the past seven years and Australian Prudential Regulation Authority (APRA) data shows that the average benefit for a PL services has remained constant for a decade compared with the skyrocketing cost of health insurance premiums which have increased by 54.6% since 2009.

The reality is the increased use of medical devices is due to one simple fact – our ageing population.

As Australians get older, more and more of them each year require things like new hips, knees and pacemakers. While more is being spent on medical devices every year this is a function of increasing demand not increasing prices.

MTAA undertook an analysis of APRA data to look at what the average PL benefit would be today if the average inflation rate that applied in 1999 and 2000 had continued for 16 years – i.e. that the inflation in 2001 and 2005 had never occurred.

The actual average benefit level today is lower ($794) than it would have been had the pre-2001 inflation rate continued to apply ($860).

This means medical devices provide better value than they did 10 years ago. Meanwhile incremental improvements to technologies and no change to the benefit levels means patients are getting better technology based on 2005 prices.

For example, improvements to the battery technology for pacemakers since 2005 has delivered an estimated savings to the healthcare sector of around $900 million over 15 years.

The claims that between $500 million and $800 million can be saved if average prices were the same between private and public hospitals are flawed. It is based on an extremely small sample size that renders any statistically meaningful result null and void.

It ignores the fact that both private and public hospitals are in fact two different markets, and public hospitals, in particular, buy in bulk when many private hospitals can’t. This is known as economies of scale.

Not even the Department of Health supports this claim, describing it as akin to “putting up a wet finger in the air”. It is also important to reflect on other stakeholder inputs such as Shaun Gath the former CEO of the Private Health Insurance Administration Council who describes the $800 million as ‘insurer fantasy’.

The MTAA fully respects that Senator Griff has a strong commitment to healthcare issues and reform.

We welcomed the PL inquiry at the time as we welcome the inquiry he has launched into the private health insurance industry.

As Senator Griff notes, 70% of private health insurance payouts go to private hospitals – that’s approximately $14 billion per year. Medical service benefits represent 16% of these costs meanwhile medical devices represents 14%.

With premiums due to increase from April 1, what are health insurers doing to address the other 86% driving up costs?

Ian Burgess is CEO of the Medical Technology Association of Australia. The association represents manufacturers and suppliers of medical technology.

* Editor’s note: The figure in Griff’s opinion piece – which claimed a 6-12% total annual growth in the cost of medical devices – was sourced from evidence given to a parliamentary inquiry by Dr Rachel David, Chief Executive Officer, Private Healthcare Australia.