Ask the Expert: How super affects the age pension and what to do about it

Financial adviser Craig Sankey answers your superannuation and other finance questions each week, and today tackles pension problems.

Photo: Getty

Question 1

I am 71 and on a full age pension and my wife works part-time. She is 66 years old and wants to retire when she turns 67 in April. She has 560k in her super. Will she be eligible for a full age pension when she retires or will her super balance affect her pension? What is the asset limit or cut-off point for a full pension as a couple? Should we be spending some of this super to reduce her assets before she retires? Also, will her assets have an impact on my full pension? Thanks

Once your partner hits age pension age her super will count as an asset.

And once you are both age pension age all your assets will be combined, and you will be assessed by Centrelink together, with the end result being you will receive the same age pension payment.

Whether your pension is affected will be dependent on your total level of assets.

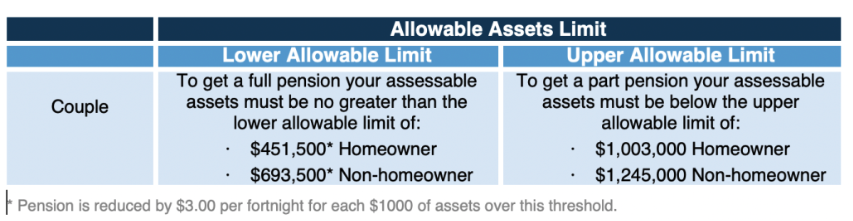

Note that if you own your home, it does NOT get included as an asset. However, non-homeowners can have a little more in assets before their age pension is affected. Please see the table below for these figures.

Your partner can start spending some of her super, and as she does your part age pension will increase.

However, you should only spend the money on things that are useful or enjoyable, I would never suggest just frittering the money away.

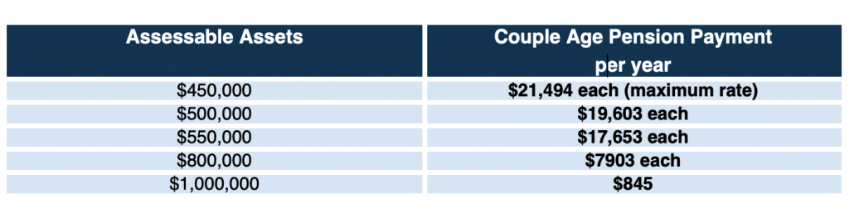

The table below gives examples of the level of annual age pension that would be payable for each member of a couple at a given level of assessable assets, provided the income test does not intervene.

The below examples assume you are homeowners.

Question 2

I turn 75 in Nov 2029, so have six years to do some non-concessional contributions to my super fund. I have about $500k in my super (all concessional contributions). I am thinking of transferring $450k from my super to start a pension. To increase the tax-free portion, I intend to withdraw $35k each year from 2023-2026, each time re-contributing the cash into my accumulation super. Finally, withdraw $95k in each of 2027 and 2028 when I turn 74, again re-contribute to my super. I have now done a total of $330k non-concessional contributions.

- Can I now amalgamate my accumulation super with my pension phase super before I turn 75?

- Can a 65-year-old make a $110k non-concessional contribution every year into their super until they turn 75, assuming their balance is still below $1.4 million? Or is there a lifetime cap of $330k for non-concessional contributions?

Yes, you can combine your pension and super at any time before 75, or even after 75.

You will need to roll back the pension into your super and then commence a new pension with the amalgamated funds.

Your current super fund would currently be made up of 100 per cent ‘taxable component’. This is because concessional contributions and all earnings of super go into the taxable component.

If your main goal is to maximise the ‘tax-free component’ (I assume to reduce future tax payable for your beneficiaries), then you may want to consider opening a separate superannuation accumulation account to make your non-concessional (after-tax) contributions.

In that way, you will be able to take a future lump sum withdrawal from your existing super account, which is 100 per cent taxable until that is exhausted.

When withdrawing from super, it’s done proportionally from the tax free and taxable component. For example, if your super has 80 per cent taxable and 20 per cent tax-free component, then the withdrawal will be made up of the same components.

To the second part of your question, yes, a 65-year-old can make non-concessional (after-tax) contributions to super of $110,000 each year until they turn 75, so long as their balance is below the required total super balance cap.

They can also bring forward future years to make a one-off $330,000 contribution, but they then could not contribute for another three years.

Note that the superannuation contribution caps are indexed by AWOTE (Average Weekly Ordinary Time Earnings) and there is a high chance they will be indexed up next financial year.

Question 3

My wife and I recently qualified for a small part pension as we have a reasonable sum in our superannuation schemes. As this amount varies with the fund’s performance, does Centrelink monitor the amount and possibly cut off or increase our pensions?

Centrelink normally updates its valuation of these types of assets twice a year.

Then it will increase, decrease or stop your age pension payment based on the updated valuation.

Note that if you draw down and spend a sizeable amount, or your balance falls due to market movements, you can be proactive and update your balances earlier with Centrelink, which may result in a higher payment.

Craig Sankey is a licensed financial adviser and head of Technical Services & Advice Enablement at Industry Fund Services

Disclaimer: The responses provided are general in nature, and while they are prompted by the questions asked, they have been prepared without taking into consideration all your objectives, financial situation or needs.

Before relying on any of the information, please ensure that you consider the appropriateness of the information for your objectives, financial situation or needs. To the extent that it is permitted by law, no responsibility for errors or omissions is accepted by IFS and its representatives.

This column also appears in our sister publication The New Daily, which is owned by Industry Super Holdings.