Superannuation delivers strong returns for members over 2023

Much of the gain was made in the last couple of months of the year, with superannuation returns growing 3.1 per cent in November alone.

In a year that has seen sharemarket volatility, superannuation funds have performed remarkably well for 2023, boosting wealth for Australians.

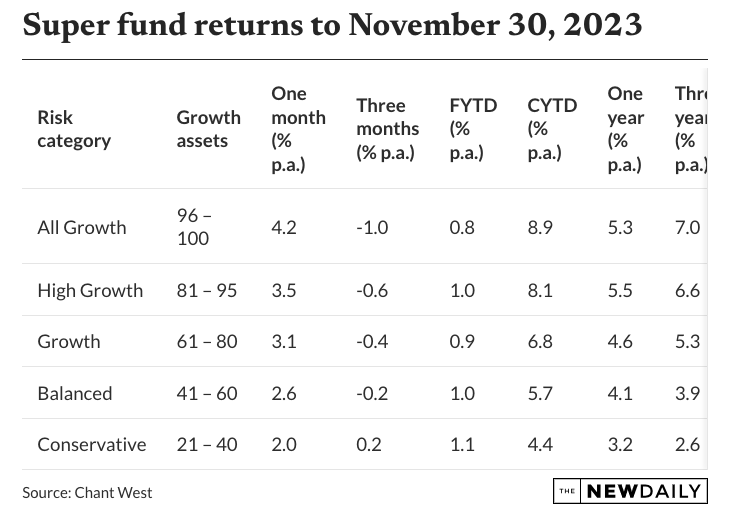

Chant West estimated on December 20 the average balanced or growth super fund with 61 to 81 per cent growth assets would finish up 8.8 per cent for the calendar year.

That more than makes up for the 4.3 per cent loss made by balanced funds last calendar year and helps build on the two annual double figure returns achieved since 2019.

Much of that gain was made in the last couple of months of the year, with superannuation returns growing 3.1 per cent for the month of November alone.

Chant West found that for the 11 months to November 30, growth funds returned 6.8 per cent.

Sharemarket drivers

Chant West research director Mano Mohankumar said strong sharemarkets were the main driver of the healthy super returns.

International shares were particularly strong performers with the allocation growing a staggering 22 per cent over the 11 months to November.

The tech sector was the strongest contributor, benefiting from advancements in AI, Chant West found.

Australian shares gained 9.5 per cent over the period.

During November, both shares and bond markets performed well, largely as a result of slowing inflation in the US and other regions, which further raised hope that interest rates may have reached their peak.

That reduction in inflation lead to Australian and international bonds returning 3 per cent and 3.2 per cent respectively as bond yields fell sharply. When bond yields fall the capital value of bonds actually rises.

“Over November, Australian shares surged 5.1 per cent, while international shares fared even better, returning 8.4 per cent in hedged terms,” Mohankumar said.

If December delivers the returns Chant West expects that an average balanced fund with $120,000 in it at the start of the year will grow to $130,560 while a fund with $50,000 in January 2023 will be worth $54,400 at year’s end.

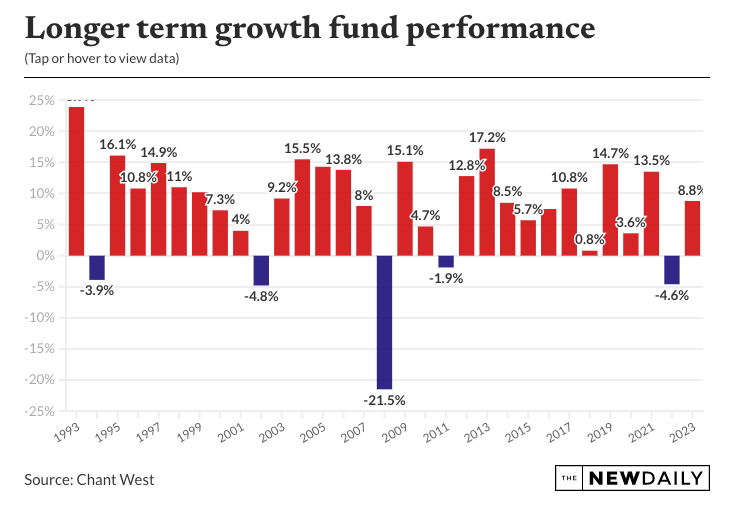

In the longer term superannuation has performed remarkable well, with the median growth fund returning 6.9 per cent and 7.6 per cent over 10 and 15 years.

Only for two short periods since 2002 – between 2010 and 2013 and 2009 and 2013 – were returns below the system target of CPI plus 3.5 per cent.

And losses have only occurred in five years since compulsory super commenced in 1992, with the largest being during the global financial crisis, as the chart above shows.

Since the introduction of compulsory super, the median growth fund has returned 7.8 per cent annually.

The annual CPI increase over the same period is 2.7 per cent, giving a real return of 5.1 per cent annually – well above the typical 3.5 per cent fund target and also well above the rate of inflation.

“Even looking at the past 20 years, which includes three major sharemarket downturns – the GFC in 2007-2009, COVID-19 in 2020 and high inflation and rising interest rates in 2022 – super funds have returned 7.2 per cent annually, which is still comfortably ahead of the typical objective,” Mohankumar said.

The outlook for 2024 is mixed, said Kirby Rappell, executive director of SuperRatings.

“We continue to believe that inflation will be a strong driver of markets in 2024, coupled with softening consumer demand; however, most members should remain reassured by super funds’ ability to navigate the range of market conditions we’ve seen over the past few years,” Rappell said.

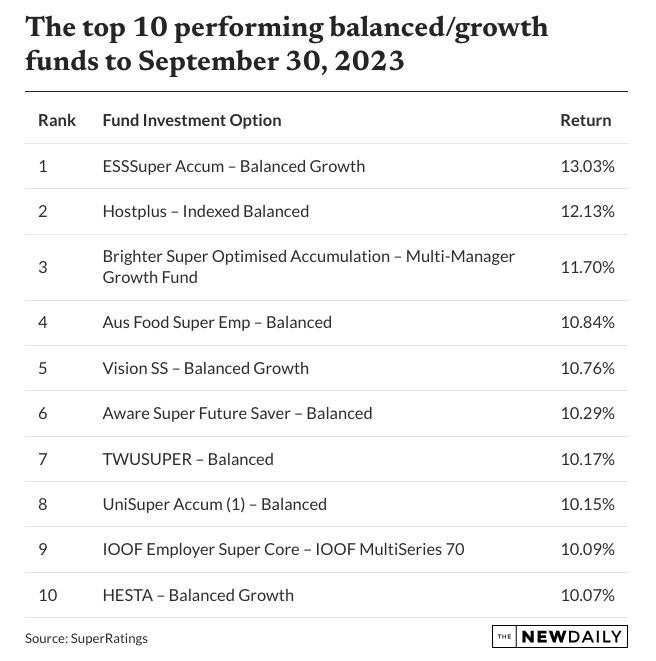

Returns for individual funds for the year are not yet available, but SuperRatings has listed the top 10 balanced fund performers to September 30.

The top performer was the Victorian energy and emergency service fund ESSSuper, which ticked over 13.03 per cent for the year for members.

All the top 10 returns were in double figures and all bar one fund – IOOF Employer Super – were not-for-profit funds.

Top performers over three years have been a similar group of funds but with Qantas Super, Australian Retirement Trust and Australian Super joining the list for top performers over three years.

To see how your fund went over time, use this interactive chart provided by SuperRatings.

The latest available figures from regulator APRA show that on June 30, 2023 the superannuation system totalled $3.54 billion of which $2.45 billion was in pooled funds and $876.4 billion in the self-managed sector.

The remainder was in defined benefit schemes.

This story first appeared in our sister publication The New Daily, which is owned by Industry Super Holdings